Most of us have faced this issue of lower credit limit at least once. A lower credit limit restricts our purchasing power as well as is not good for credit score as it increases the credit utilization ratio.

A way to circumvent (read hack) lower credit limit is to make advance payment on the credit card and then use the card for making the required transaction. This is not ideal as instead of using your credit card like a proper credit card you are essentially using it as prepaid card/debit card. Here we will see 6 ways to increase the credit card limit:

Show increase in income

The time we apply for the card we may get a lower credit limit but if it has been a while and you have been earning more now then you can call your bank and request for limit enhancement and submit your latest salary slips or ITR proof to support your request.

Show better limits on other cards

Most of the times banks issue us credit cards on ‘card-on-card’ basis i.e. they ask us if we have an existing credit card of some other bank or not. If you do hold a credit card of other bank with a high limit then use that for your advantage and request for a good limit of the new card.

Show your reduced liabilities

Banks are always apprehensive to give higher limit to those who are already holding other loans so in case you have recently been able to pay off your loan then you can forward the loan closure papers to bank and ask for limit enhancement.

Try to upgrade the card

As a general rule of thumb the more premium the credit card is the higher the credit limit would be. Ask the bank if you are eligible for an upgrade to a more premium credit card with the bank. If you are eligible, request for a limit enhancement along with credit card upgrade.

Spend more on your Card

Banks love customers who spend more and pay bills on time. Spend a lot on your card for 3-4 months and then ask customer care team for limit enhancement. The waiting period may vary from bank to bank as some banks have a policy to not entertain limit enhancement requests before 6 months.

Use the card for foreign trips

Banks love people who travel abroad. That’s because they earn a lot on foreign currency markup fees. This should help you with limit enhancement.

My personal experience

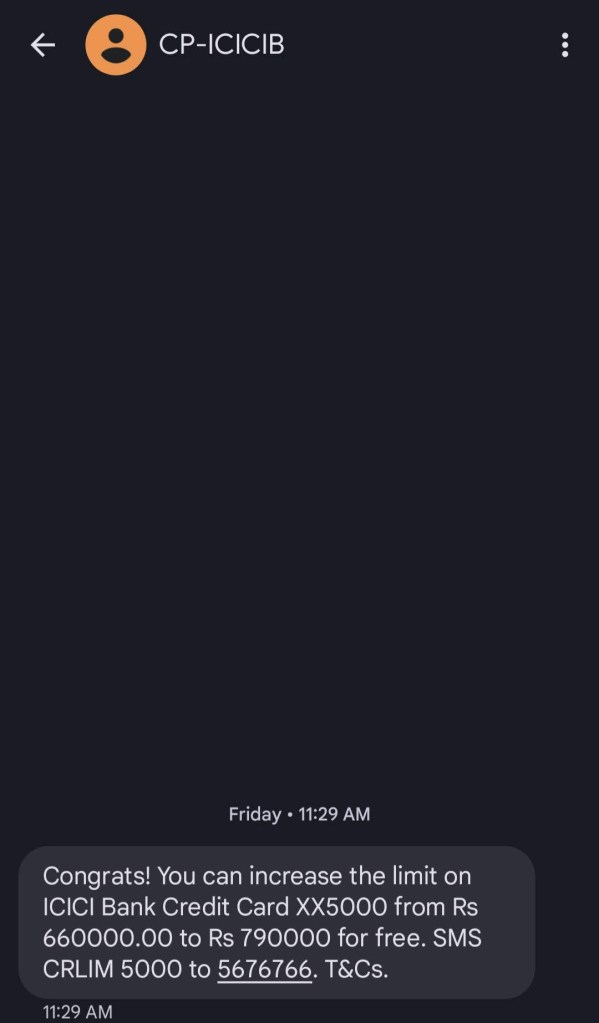

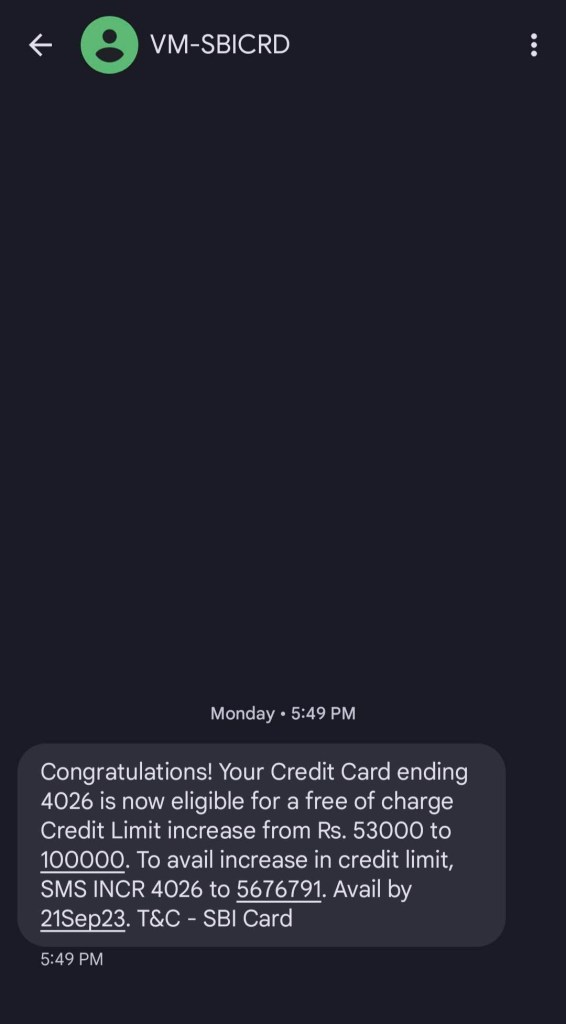

I have been able to get some limit enhancement offer on regular basis as I have tried some of these techniques. Sometimes bank themselves extend limit enhancement offers if they feel your card usage has been good. Below are the offers I got on my ICICI Amazon Pay and SBI Cashback credit card.

What are your thoughts about the ways to improve the credit limit? Feel free to share your views in the comment section below.