AMEX is one of major players in the credit card industry and are known for their top-notch customer service and some of the best rewards available. One of the cards that they offer in India is the MRCC card. Although it is an entry level credit card based on the hierarchy of their credit card portfolio, this is still a very good card as it can get you close to ~6% reward rate. Let’s get into details of why this card should be worth looking into.

Overview

As you can guess from the name itself, this is a rewards credit card which means on spends done via this card, reward points are earned which can be either used for redemption against vouchers under the Amex Gold collection or can be transferred to Airline or Hospitality partners. There are other options as well to redeem these rewards but those aren’t as lucrative.

This card rewards handsomely and that too without worrying about how or where to spend. Using the link given below, you can get additional bonus points (make sure to spend Rs. 5000 in the first 90 days of card membership to get bonus points).

[Apply through the link above to get the card for Rs. 1000 + 18% GST free for 1st year + 2000 Bonus points + limited edition playing cards]

| Type | Entry-Level Credit Card |

| Reward Rate | upto 6% |

| Best for | Voucher Redemption (Taj, Shoppers Stop, Tata Cliq, Amazon) via Amex Gold collection |

| USP | Monthly Bonus Rewards |

Design

The card looks decent in a slight golden color (it is a gold series card along with AMEX Gold credit card) and has same background image of AMEX logo like all other AMEX cards. The digits of the card number are embossed so that does gives it a slight premium feel.

Fees & Charges

Joining & Renewal Fee

| Joining Fee | Rs. 1000 + 18% GST (Free if applied using this link) |

| Joining Fee Waiver | N/A |

| Joining Benefit | 4000 Points (Applicable only for paid cards & on spending Rs. 15000 within 90 days of Card membership) |

| Renewal Fee | Rs. 4500 + 18% GST (Reduced to Rs. 1500 + 18% GST if applied using above link) |

| Renewal Fee Waiver | 100% waived off if total spends exceed Rs. 1.5 lakh; 50% waived off if total spends exceed Rs. 90000 |

| Renewal Benefit | 5000 points (applicable only on 1st year card renewal for cards issued with Renewal Fee of Rs. 4500) |

Joining benefit is applicable only after paying the joining fee and spending Rs. 15000 within 90 days of Card Membership. Similarly, 5000 points on card renewal will get credited post realization of the renewal fee. Points should get credited to your account after 90 days, post the card renewal month, which will be visible in your Amex account via AMEX app or website.

Tip: Even if the spend criteria to get renewal fee waiver is not met, you can call the customer care team in the last month of card anniversary year to discuss retention offers.

Other Charges

Supplementary Card

One can get upto 2 supplementary cards for free post which the standard supplementary card fee (1500 + 18% GST) will be applicable.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%)

Fuel Purchases

Fuel purchase transactions are not eligible for earning reward points but one can at least get surcharge fee waiver if purchase is done at HPCL fuel pumps. Surcharge fee will vary based on which fuel pump you go to.

- HPCL: 0% fee for transactions less than Rs. 5000 and 1% fee otherwise

- BPCL & IOCL: 1% fee subject to a minimum of Rs. 10 + applicable taxes

- Rest: 2.5% fee subject to a minimum of Rs. 10 + applicable taxes

Rent Payments

There is no additional fee charged on rent payments but unfortunately Amex cards are not accepted at any of the portals which allow for rent payments via credit cards.

EMI Fees

On all Amex cards which have EMI purchase option, a processing fee of Rs. 199 + 18% GST is levied on all EMI transaction(s) converted at Point of Sale online or in-store.

For transactions that are converted to EMI post purchase, an additional one-time processing fee of 2% plus applicable taxes is charged. Any foreclosure or early payment will be subject to a 3% fee of the outstanding balance along with applicable taxes.

Benefits

Reward Points

The base reward rate for MRCC card is 1 reward point per Rs. 50.

| Spend Category | Reward | Reward Rate (Taj Voucher) | Reward Rate (Marriott Bonvoy) |

| Regular Spends | 1 point on every Rs. 50 spent | 1% | 2% |

| Reward Points Expiry | Never | – | – |

| Redemption Fee | Nil | – | – |

| Exclusions | Insurance, Cash Withdrawals, Fuel, Utilities (electricity, water and gas bills), Cash Transactions and EMI conversion at Point of Sale | – | – |

With MRCC card, some of the crucial categories like Utilities, Fuel and Insurance are excluded. If you plan to use the card primarily for fuel and utilities, you may instead have a look at the Amex Gold Charge Card.

The reward rate is pretty low if we just look at regular spends but there are ways to boost the reward rate much higher which we will see next.

Tip: For insurance & utilities payments, you can purchase gift cards on amazon and use those to pay your bills.

Note: EMI transactions done from online shopping websites like Amazon or Flipkart etc. and at Merchant’s terminal e.g. a Chip and PIN transaction at Croma retail store etc. are ineligible. But all EMI transactions through Amex SafeKey and on all EMI conversions done post purchase are still eligible for reward points.

Monthly Rewards

Using monthly reward feature we can boost the reward earn rate as depicted below –

| SPEND CRITERIA | REWARD |

|---|---|

| min. 4 transactions of at least Rs. 1500 in a calendar month | 1000 Points |

| spending at least 20000 in a calendar month | 1000 Points |

What that means is if you do 4 transactions of at least Rs. 1500 each in a calendar moth, then you would be awarded 1000 bonus points. So, just by spending Rs. 6000 each month you can rack up 1000 + 120 (6000/50) = 1120 points. And if you achieved spend threshold of Rs. 20000 in a calendar month then you get a total of 1000 + 1000 + 400 (20000/50) = 2400 points.

Note: The bonus MR points on reaching 20K spend milestone is only applicable if you have enrolled for it which can be done here.

On spending Rs. 20000 every month you can get a total of 28800 points against spend of Rs. 2.4 lakh (entire fee also gets waived) which translates to 12% reward rate if redeemed for Travel partners transfer.

Tip: If doing 4 transactions of Rs. 1500 each every month is difficult for you, you may also load your wallets like Paytm or Amazon or simply split your spends into multiples of 1500 to get there faster.

Reward Multiplier

To boost the reward rate even more, one can use the Amex Reward Multiplier. Most credit cards issuers have some sort of rewards portal which helps to get extra points if user does transaction via that portal. In case of Amex, one can accrue additional reward points by using the Amex Reward Multiplier option.

Instead of the base reward rate of 1X (1 point per Rs. 50), you can get 2X rewards on the Reward Multiplier with MRCC card i.e. 2 points per Rs. 50 which is a good way to boost the reward earn rate. If you spend Rs. 6000 each month you can rack up 1000 + 240 (6000/50 * 2) = 1240 points.

While this is not so lucrative as the Amex Gold card with 5X rewards, it’s still decent enough to get little beyond the regular rewards.

Detailed T&C for reward multiplier are available here.

Reward Redemption

There are various reward point redemption options but the best one among them is to either go for Gold collection redemption OR to transfer points to airline or hotels loyalty programs. Here is the exhaustive list of redemption options and the value you could get for that-

- Pay with points while shopping in store or online: 25p/point

- Purchase Insta vouchers: 25p/point

- Use points to offset any purchases made on card: 25p/point

- Travel bookings (flights & hotels) using Amex Travel portal: 30p/point

- Redeem for gift cards under 18K & 24K Gold collection: 33p – 58p/point

- Experiences (Newly launched) Redeem points for Adventure, Stay or Dining

- Transfer points to Airlines & Hotel loyalty programmes: 50p – Rs. 1/point

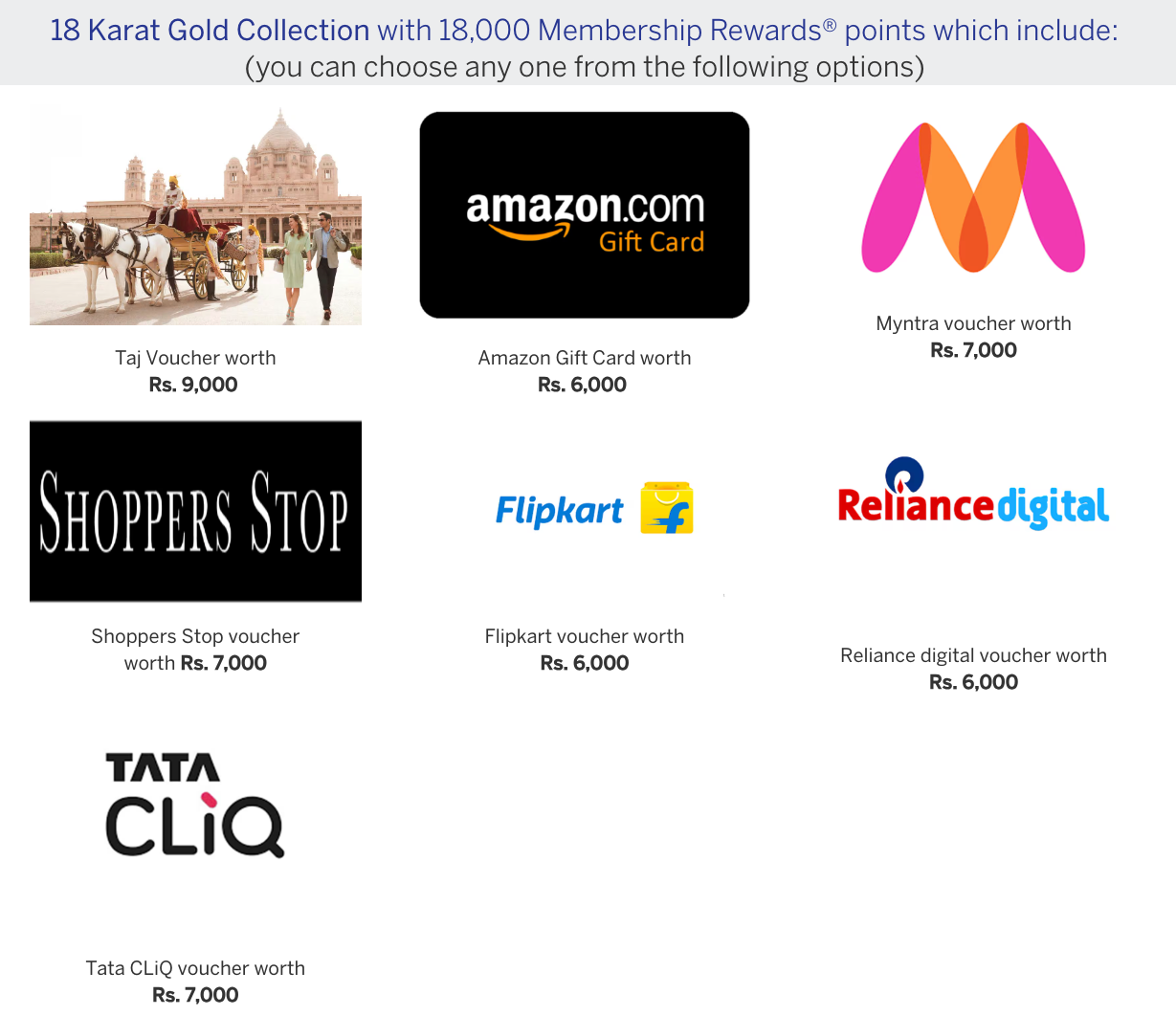

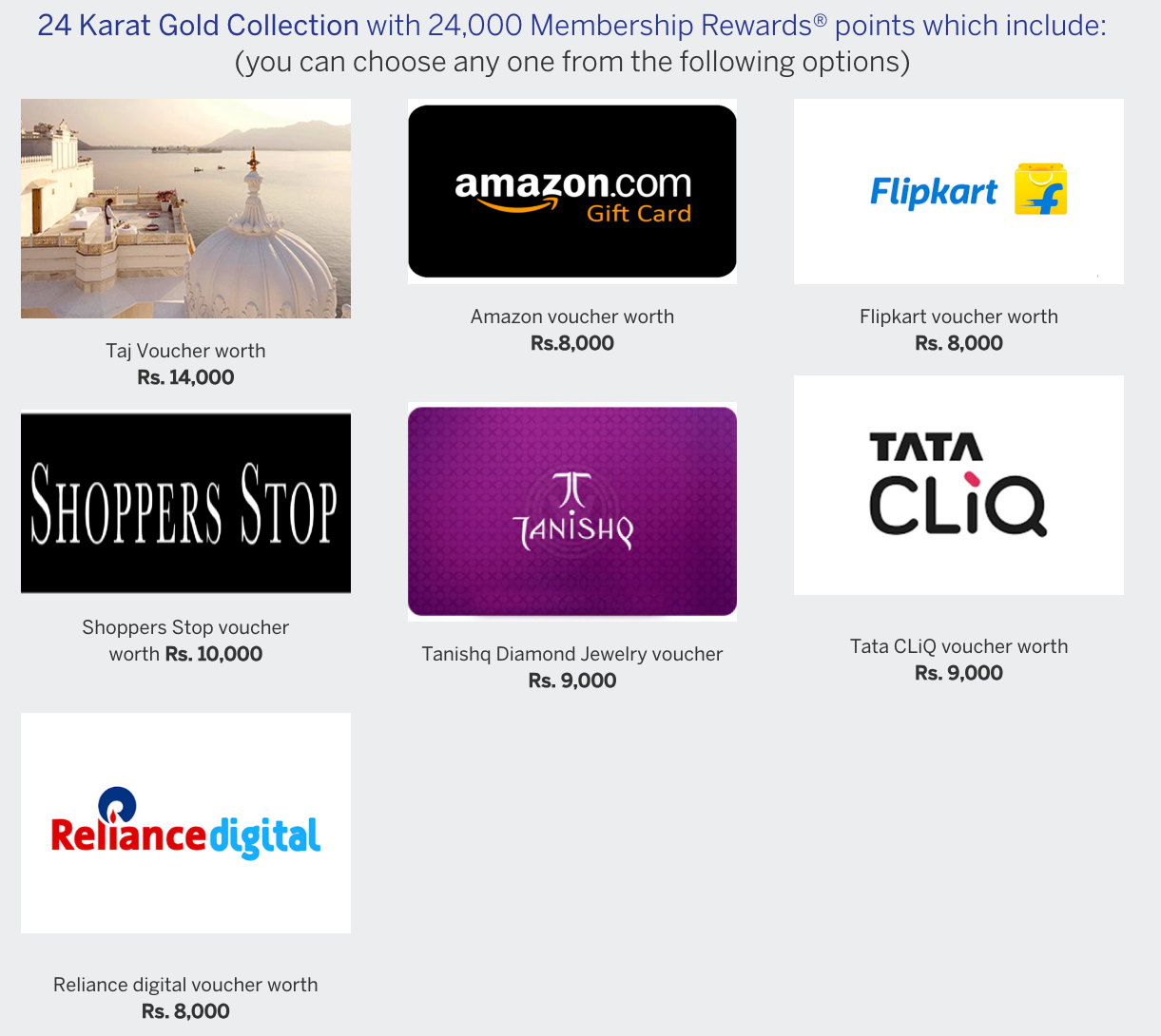

Under Gold collection, you can redeem your points for different brand vouchers as shown below. You need to have points in multiple of 18000 or 24000 to redeem for vouchers under this option. You get highest value per point with the Taj Voucher option 58p per point for 24K points.

| Brand | Voucher value for 18Kpoints | Points value for 18K points | Voucher Value for 24Kpoints | Points value for 24K points |

| Taj Voucher | 9000 | 50p | 14000 | 58p |

| Shoppers Stop | 7000 | 39p | 10000 | 42p |

| Tanishq | – | – | 9000 | 37p |

| Tata Cliq | 7000 | 9000 | 37p | |

| Myntra | 7000 | 39p | – | – |

| Amazon, Flipkart | 6000 | 33p | 8000 | 33p |

| Reliance Digital | 6000 | 33p | 8000 | 33p |

If none of the brands under Gold collection suit your needs then you can use points to transfer them to various partners and utilize for travel or stay bookings. I have been using the points to transfer to Marriott Bonvoy for booking rooms for my vacations and it has been an amazing experience so far always.

Also note that the MR points earned on MRCC can be pooled with other Amex Gold charge card so you can get closer to 24K or 18K Gold collection redemptions faster.

Travel Benefits

Airport Lounge Access

This card doesn’t offer complimentary Airport Lounge access.

Dining Benefits

There are certain benefits for dining enthusiasts which can be discovered on Amex website. Plus, if you want to look for restaurants in your city where Amex card can get you discounts, visit this link.

Other Benefits

MRCC Card Benefits Catalogue

Amex keeps running various offers on travel, dining, retail and health categories. To find it all in one place, check out this link.

Best way to use this card

- Take advantage of Monthly rewards to get 2000 bonus points

- Use Amex Reward Multiplier benefit to get 2X points

- AMEX offers (communicated via email or website)

- Gold collection redemption catalogue

How to apply

Amex lets you hold maximum of 1 Charge Card & 2 Credit cards at any point in time.

The best way to apply is online by visiting the Amex website. The best way to apply is online by visiting the Amex website. Using the link given below, you can get additional bonus points (make sure to spend Rs. 5000 in the first 90 days of card membership to get bonus points).

[Apply through the link above to get the card for Rs. 1000 + 18% GST free for 1st year + 2000 Bonus points + limited edition playing cards]

Verdict

MRCC is the best card to begin with for anyone new to credit cards or if you want to have an AMEX card. This card will get you a good reward rate of ~7% if you are able to spend is strategically to get the monthly bonus reward points.

While MRCC is ideally suitable for ~2L or so spends, If your spends are in the range of 4 Lakhs or above, you must check out the Amex Platinum Travel Credit Card which is one of the best travel credit cards in the country.

Overall, this card certainly deserves to be part of your wallet as you get more than decent rewards and great customer service.

What are your thoughts about the American Express Membership Rewards Credit Card? Feel free to share your views in the comment section below.