Among the several cards currently being offered by American Express, Gold card is one of the best cards to get for several reasons that we will see in this article.

One fundamental difference between this card and other cards from Amex or any other card issuers is that Gold card is a ‘charge card’ and not a credit card. What that means is this card has no ‘pre-set spending’ limit offering you a higher purchasing power. No ‘pre-set limit’ does not mean your spending power is unlimited. How much you can swipe this card for would depend on your financials, spend pattern, credit record and account history. The only other charge card available in the country is the Amex Platinum charge card.

Also, for charge cards, you need to pay entire amount in full by the due date which means there is no concept of a minimum amount due with the charge cards and you can’t use charge cards for EMI purchases.

Let’s see the card features and benefits in detail and figure out whether this card deserves a place in your wallet or not.

Overview

Just like the Amex MRCC credit card, this card lets you rack up reward points that can be used for redemption against vouchers under the Amex Gold collection. For someone who is looking for their 1st Amex card, Gold card could be a great way to join the Amex world. Using the link given below, you can get additional bonus points (make sure to spend Rs. 5000 in the first 90 days of card membership to get bonus points).

[Apply through the link above to get additional 2000 4000 Bonus points + limited edition playing cards]

| Type | Charge Card |

| Reward Rate | up to 5% |

| Best for | Voucher Redemption (Taj, Shoppers Stop, Tata Cliq, Amazon) via Amex Gold collection |

| USP | No pre-set spending limit, Monthly Bonus Rewards, Amex Reward Multiplier |

Design

Even though the card is of plastic, it looks amazing and premium compared to other plastic cards. The gold color really makes it stand out in the ocean of other generic design credit cards out there.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 1000 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | 4000 Points (Applicable only for paid cards & on spending Rs. 10000 within 90 days of Card membership) |

| Renewal Fee | Rs. 4500 + 18% GST |

| Renewal Fee Waiver | N/A |

| Renewal Benefit | 5000 points (only for 1st renewal) |

Joining benefit is applicable only after paying the joining fee and spending Rs. 10000 within 90 days of Card Membership. Similarly, 5000 points on card renewal will get credited post realization of the renewal fee. Points should get credited to your account after 90 days, post the card renewal month, which will be visible in your Amex account via AMEX app or website.

Tip: You can call the customer care team in the last month of card anniversary year to discuss retention offers.

Other Charges

Supplementary Card

One can get upto 2 supplementary cards for free post which the standard supplementary card fee (1500 + 18% GST) will be applicable.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%)

Fuel Purchases

Not only you get 1 reward point for every Rs. 50 spent on fuel purchase, you will even get surcharge fee waiver as well if you use card at HPCL fuel pumps. For others, surcharge fee will vary based on which fuel pump you go to.

- HPCL: 0% fee for transactions less than Rs. 5000 and 1% fee otherwise

- BPCL & IOCL: 1% fee subject to a minimum of Rs. 10 + applicable taxes

- Rest: 2.5% fee subject to a minimum of Rs. 10 + applicable taxes

Rent Payments

There is no additional fee charged on rent payments but unfortunately Amex cards are not accepted at any of the portals which allow for rent payments via credit cards.

EMI Fees

Since this is a charge card, it does not support EMI payment option.

Benefits

Reward Points

The base reward rate for Gold card is 1 reward point per Rs. 50.

| Spend Category | Reward | Reward Rate (Taj Voucher) | Reward Rate (Marriott Bonvoy) |

| Regular Spends | 1 point on every Rs. 50 spent | 1% | 2% |

| Reward Points Expiry | Never | – | – |

| Redemption Fee | Nil | – | – |

| Exclusions | Insurance, Cash Withdrawals, Cash Transactions | – | – |

Good thing about this card is that you get points for spends on utilities (electricity, water and gas bills) and fuel too unlike the Amex MRCC card.

- Utilities: 1 point on every Rs. 50 spent (electricity, water and gas bills) capped at 10000 points in a calendar month.

- Fuel: 1 point on every Rs. 50 spent capped at 5000 points in a calendar month.

The reward rate is pretty low if we just look at regular spends but there are ways to boost the reward rate much higher which we will see next.

Tip: For insurance payments, you can purchase gift cards on amazon and use those to pay your insurance premium.

Monthly Rewards

Using monthly reward feature we can boost the reward earn rate as depicted below –

| SPEND CRITERIA | REWARD |

|---|---|

| Min. 6 transactions of INR 1000 in a calendar month | 1000 Points |

What that means is if you do 6 transactions of at least Rs. 1000 each in a calendar moth, then you would be awarded 1000 bonus points. So, just by spending Rs. 6000 each month you can rack up 1000 + 120 (6000/50) = 1120 points.

On spending Rs. 6000 every month you can get a total of 13440 points against spend of Rs. 72000 which translates to 18% reward rate if redeemed for Travel partners transfer. But you won’t get any fee waiver (4500 + GST) on such low spends so accounting for that the reward rate comes down to 11%.

Tip: If doing 6 transactions of Rs. 1000 each every month is difficult for you, you may also load your wallets like Paytm or Amazon.

Reward Multiplier

To boost the reward rate even more, one can use the Amex Reward Multiplier. Most credit cards issuers have some sort of rewards portal which helps to get extra points if user does transaction via that portal. In case of Amex, one can accrue additional reward points by using the Amex Reward Multiplier option.

Instead of the base reward rate of 1X (1 point per Rs. 50), you can get 5X rewards on the Reward Multiplier with Gold card i.e. 5 reward points per Rs. 50 which is a great way to boost the reward earn rate. If you spend Rs. 6000 each month you can rack up 1000 + 600 (6000/50 * 5) = 1600 points.

Detailed T&C for reward multiplier are available here.

Reward Redemption

There are various reward point redemption options but the best one among them is to either go for Gold collection redemption OR to transfer points to airline or hotels loyalty programs. Here is the exhaustive list of redemption options and the value you could get for that-

- Pay with points while shopping in store or online: 25p/point

- Purchase Insta vouchers: 25p/point

- Use points to offset any purchases made on card: 25p/point

- Travel bookings (flights & hotels) using Amex Travel portal: 30p/point

- Redeem for gift cards under 18K & 24K Gold collection: 33p – 58p/point

- Experiences (Newly launched) Redeem points for Adventure, Stay or Dining

- Transfer points to Airlines & Hotel loyalty programmes: 50p – Rs. 1/point

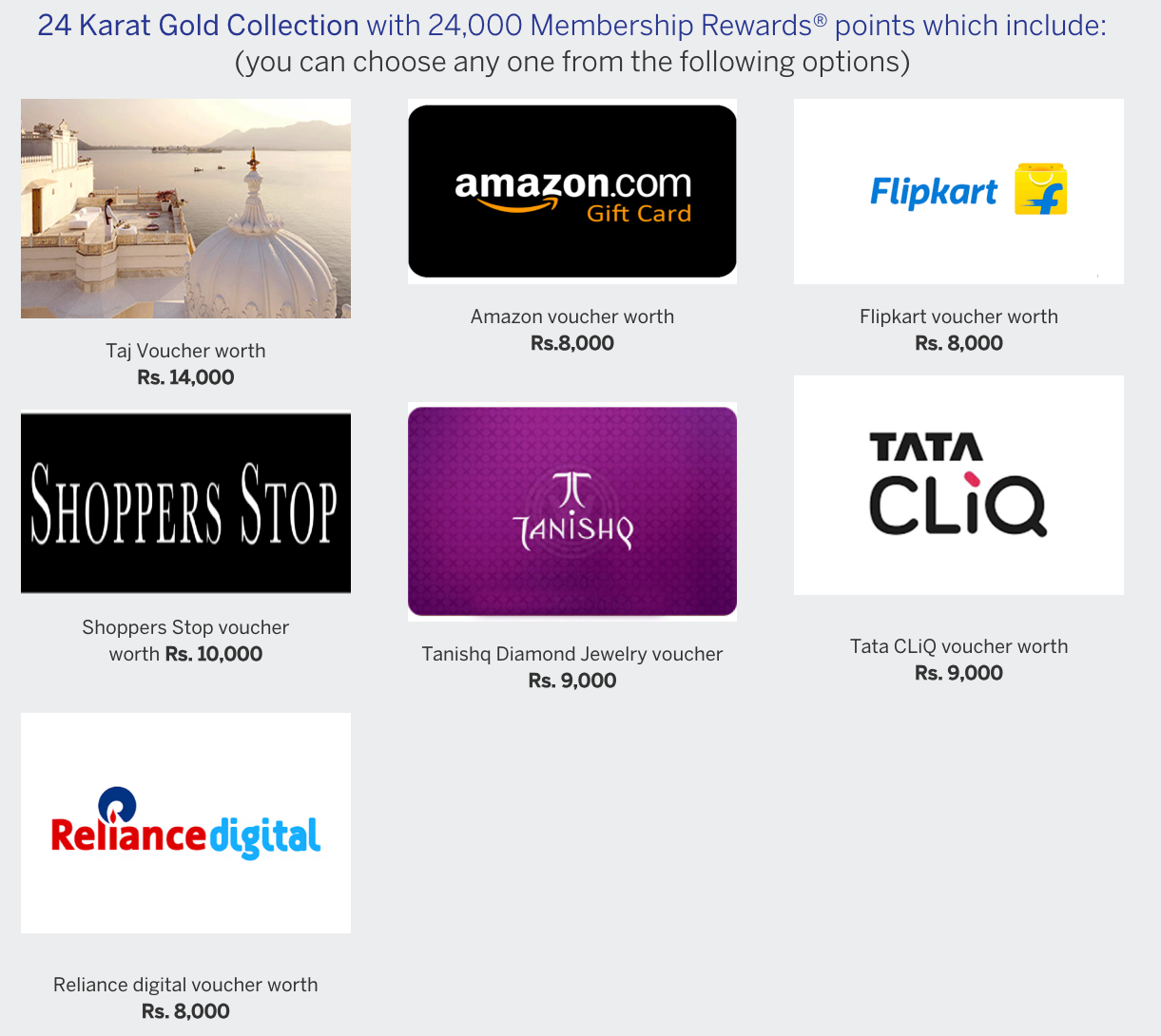

Under Gold collection, you can redeem your points for different brand vouchers as shown below. You need to have points in multiple of 18000 or 24000 to redeem for vouchers under this option. You get highest value per point with the Taj Voucher option 58p per point for 24K points.

| Brand | Voucher value for 18K points | Points value for 18K points | Voucher Value for 24K points | Points value for 24K points |

| Taj Voucher | 9000 | 50p | 14000 | 58p |

| Shoppers Stop | 7000 | 39p | 10000 | 42p |

| Tanishq | – | – | 9000 | 37p |

| Tata Cliq | 7000 | 9000 | 37p | |

| Myntra | 7000 | 39p | – | – |

| Amazon, Flipkart | 6000 | 33p | 8000 | 33p |

| Reliance Digital | 6000 | 33p | 8000 | 33p |

If none of the brands under Gold collection suit your needs then you can use points to transfer them to various partners and utilize for travel or stay bookings. I have been using the points to transfer to Marriott Bonvoy for booking rooms for my vacations and it has been an amazing experience so far always.

Travel Benefits

Airport Lounge Access

This card doesn’t offer complimentary Airport Lounge access.

Dining Benefits

There are certain benefits for dining enthusiasts which can be discovered on Amex website. Plus, if you want to look for restaurants in your city where Amex card can get you discounts, visit this link.

Other Benefits

Intelligence from Gold

With Amex charge cards, there is no pre-set limit which means you can use the card for large purchases as well as long as your spending pattern, financials, credit record and account history are deemed good enough by Amex to approve those purchases. But ‘no pre-set limit’ does not mean your spending is unlimited. If you anticipate making an exceptionally large purchase, you can call Amex customer care in advance to know about your ‘purchase power’.

Gold Card Benefits Catalogue

Under the ‘MORE TO YOUR GOLD‘ options for Gold card, there are even more offerings for those who are interested in luxury hotels, dining and shopping options.

- The Gold Gourmet: 50% off for up to 10 guests at The Lodhi. Offer valid until 15 December 2024.

- Food Delivery: Up to 25% off on order ins from The Lodhi, Taj Qmin and More.

- Grand Getaways: Up to 25% discounts on certain luxury hotel brands

Best way to use this card

- Take advantage of Monthly rewards to get 1000 bonus points

- Use Amex Reward Multiplier benefit to get 5X points

- AMEX offers (communicated via email or website)

- Gold collection redemption catalogue

How to apply

Amex lets you hold maximum of 1 Charge Card & 2 Credit cards at any point in time. The best way to apply is online by visiting the Amex website. Using the link given below, you can get additional bonus points (make sure to spend Rs. 5000 in the first 90 days of card membership to get bonus points).

[Apply through the link above to get additional 2000 4000 Bonus points + limited edition playing cards]

Verdict

With a reward rate that can skyrocket up to ~6% on a snazzy charge card with a joining fee that won’t break the bank, American Express Gold Charge Card is the real deal!

Not only will you strut around town with a card so beautiful it turns heads, but you’ll also have a credit limit that can handle any unexpected splurges that come your way. Also, getting reward points on even the fuel and utility expenses is a cherry on top of this already delicious cake.

And let’s not forget about the customer support. Amex is second to none when it comes to customer support and ready to save the day whenever you need them. Trust me, this card is a total must-have for anyone with a sense of style and a desire for the best.

Incase if you wish to have EMI facility and prefer more rewards, you may go for the Amex Membership Rewards Credit Card which is quite similar to this card and is issued as “First Year Free” for a limited period.

What are your thoughts about the American Express Gold Charge Card? Feel free to share your views in the comment section below.