Axis Bank Privilege card sits somewhere in between the entry level credit cards and super premium credit cards. This segment of premium cards is for those who have already been using a credit card and want to expand their arsenal of cards to get a taste of other benefits once can get out of using credit cards.

Back when Axis had not launched many other super premium credit cards, Privilege Credit Card used to be the one of their best offerings but even now this card would be a good companion for many credit card users who want to earn rewards and keep things simple. Let’s talk about the benefits and features of this card in detail.

Overview

As mentioned earlier, this card is targeted for those who want a simple rewarding credit card that will help them earn decent rewards without too many complications. This card is similar to other Axis cashback cards in terms of rewards rate but instead of cashback you earn reward points that can be used for Brand voucher redemptions.

| Type | Semi-Premium Rewards Credit Card |

| Reward Rate | ~2% |

| Best for | Multi-brand Voucher redemption |

Design

The card has a clean design with a graphic of an ancient key on the front on a black background. It is issued on the Visa Signature network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 1500 + 18% GST |

| Joining Fee Waiver | First year free only for Axis Priority A/C customers |

| Joining Benefit | 12500 Edge reward points on PAID cards (redeemable for vouchers worth Rs. 5000) 6250 Edge reward points on FREE cards (redeemable for vouchers worth Rs. 2500) |

| Renewal Fee | Rs. 1500 + 18% GST |

| Renewal Benefit | 3000 Edge Reward points |

| Renewal Fee Waiver | waived off on annual spends greater than Rs. 2.5 lakh; Rent transactions (MCC 6513) and wallet load transactions (MCC 6540) aren’t eligible for annual fee waiver |

There are two version of this card but expect for the joining fee & benefit everything else is the same. Those who have a Priority Account banking relationship with Axis bank can get this card for free in first year and are given 6250 Edge Reward Points. Points may take up to 10 working days from the date of the 1st transaction to reflect in the card holder’s EDGE REWARDS account. You get two broad choices when it comes to the redemption of these points which we will in the Benefits section later.

Note: For the joining benefit points (free & paid version), customer needs to do a transaction of any amount within first 30 days of the card setup.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%) which means it is not a good option to use it for foreign trips as you would end up paying 1.87% extra (4.13% – 2% cashback).

Fuel Purchases

There is no cashback on fuel purchases but you do get 1% fuel surcharge waiver across all petrol pumps in India as long as transactions are between Rs. 400 – Rs. 4000, exclusive of GST and other charges.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

There is a capping of Rs. 400 per statement cycle for surcharge waiver per credit card account which is more than enough.

Rent Payments

No reward points on rent payments plus a charge of 1% of the transaction value + GST capped at Rs. 1500 per transaction is levied. Also, all the portals for rent payments take their own convenience fee which means use of this card for rent payments is not a good idea.

EMI Fees

For EMI transactions, a one-time processing fee of 1.5% or Rs. 250 whichever is higher is charged on the date of conversion.

Benefits

Reward Points

The earn rate is very simple and straightforward. For every Rs. 1 lakh spend you can earn 5000 reward points.

Tip: You may as well use Axis Privilege Card on gift cards using Axis Grab Deals portals to earn 5X/10X rewards.

| Regular Spends (Domestic & International) | 10 points for every Rs. 200 |

| Reward Point Expiry | Never |

| Redemption Fee | NIL |

| Exclusions | Insurance, Rent, Fuel, Education Services, Utilities, Government Institutions, EMI transactions |

Note: EMI transactions are not mentioned in the exclusions but it would be safe to assume that no points would get credited for them as is the case with other Axis credit cards.

Redemption

For points redemption, you get two options –

- Edge Rewards Catalogue Vouchers which gives 20p/point value (1% reward rate)

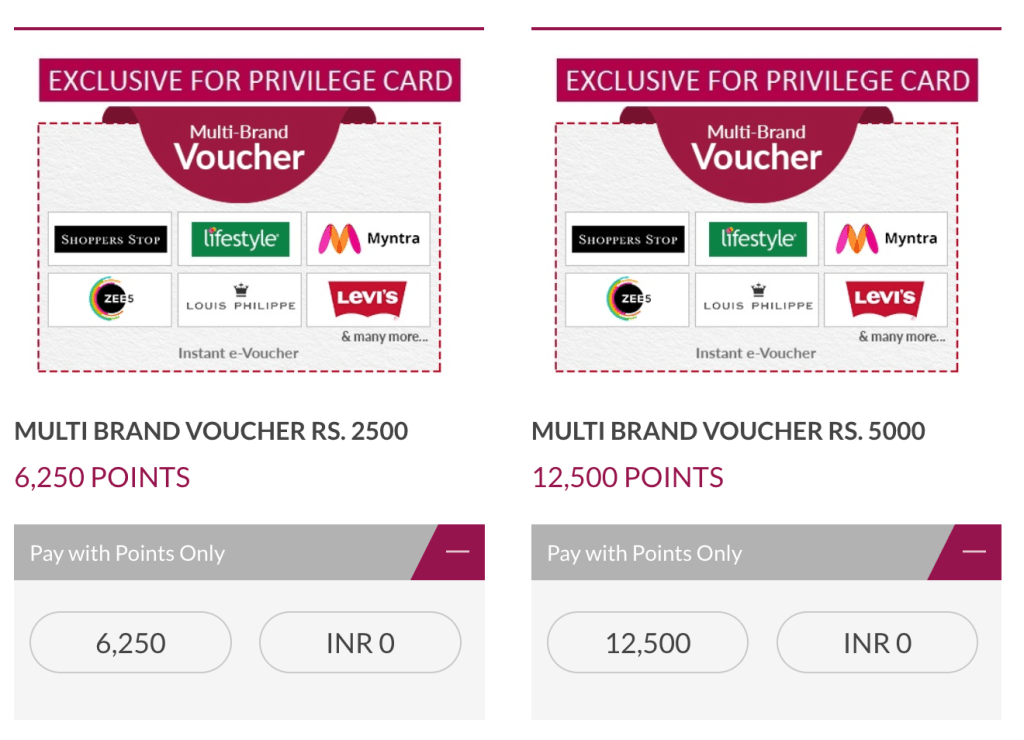

- Multi-Brand Vouchers which gives 40p/point value (2% reward rate)

Follow below steps for redeeming points against Multi-Brand vouchers (works only if you have points in multiple of 6250)

- Use Edge Rewards portal or on Axis Bank Mobile app under EDGE REWARDS section to redeem points to get Multi Brand voucher code. Search using keyword ‘Multi’ to get the below options.

- Then the voucher cods has to be used on GYFTR page for Privilege card to get the brand voucher you want.

Milestone Benefits

On reaching the annual spend target of Rs. 2.5 lakh, the Edge Reward points get converted to Multi Brand Vouchers so you get double the value of 40p/point instead of the usual 20p/point.

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Domestic Lounge (Primary) | Visa / Mastercard | 2 per quarter |

| International Lounge | N/A | N/A |

With this card, you get 2 complimentary domestic airport lounge access per quarter (equates to 8 visits a year) which is a great value for regular flyers.

List of eligible airport lounges can be checked here. The coverage is good as you get all metro and few non-metro cities too.

Dining Benefits

There are no special dining benefits just for this card but as part of Axis Dining Delight you can get upto 25% off upto Rs. 800 at restaurants by using EazyDiner to pay the bill.

- Offer: 25% off upto Rs. 800

- Min. Transaction: Rs. 2500

- Usage limit: Once a month per customer on EazyDiner

More details on Axis Bank Dining Delight program are available here.

Best way to use this card

- Buy gift cards using Gift Edge portal to get 5X/10X points

- Spend Rs. 2.5 lakh to get renewal fee waiver & Multi-brand voucher redemption option

- Avail airport lounge access

How to apply

With Axis you can hold up a maximum of three cards. You can apply either on Axis bank website or at your nearest Axis bank branch. If you already hold an Axis card, then the credit limit they issue might be combined for this card and your existing one given that your existing card is non-premium category card.

Verdict

The Axis Privilege Credit Card is a pretty cool credit card for folks who like getting shopping vouchers instead of a cashback card and with the option to redeem those rewards for Multi brand vouchers the value you get is also pretty good. It’s a great choice if you enjoy treating yourself with some retail therapy!

What are your thoughts about the Axis Privilege Credit Card? Feel free to share your views in the comment section below.