One of the best card for travel benefits in the country is hands down the Amex Platinum Travel credit card. The cards gives you great rewards and is one of the most sought after cards from Amex in India. You can earn a handsome reward, get amazing offers from time to time from Amex, enjoy the best in class customer service and much more. All of this at a fee that won’t break the bank and would feel like a great bargain as you would get multifold returns for that every year.

Let’s see the card features and benefits in detail and understand why this card should be in your wallet without a doubt.

Overview

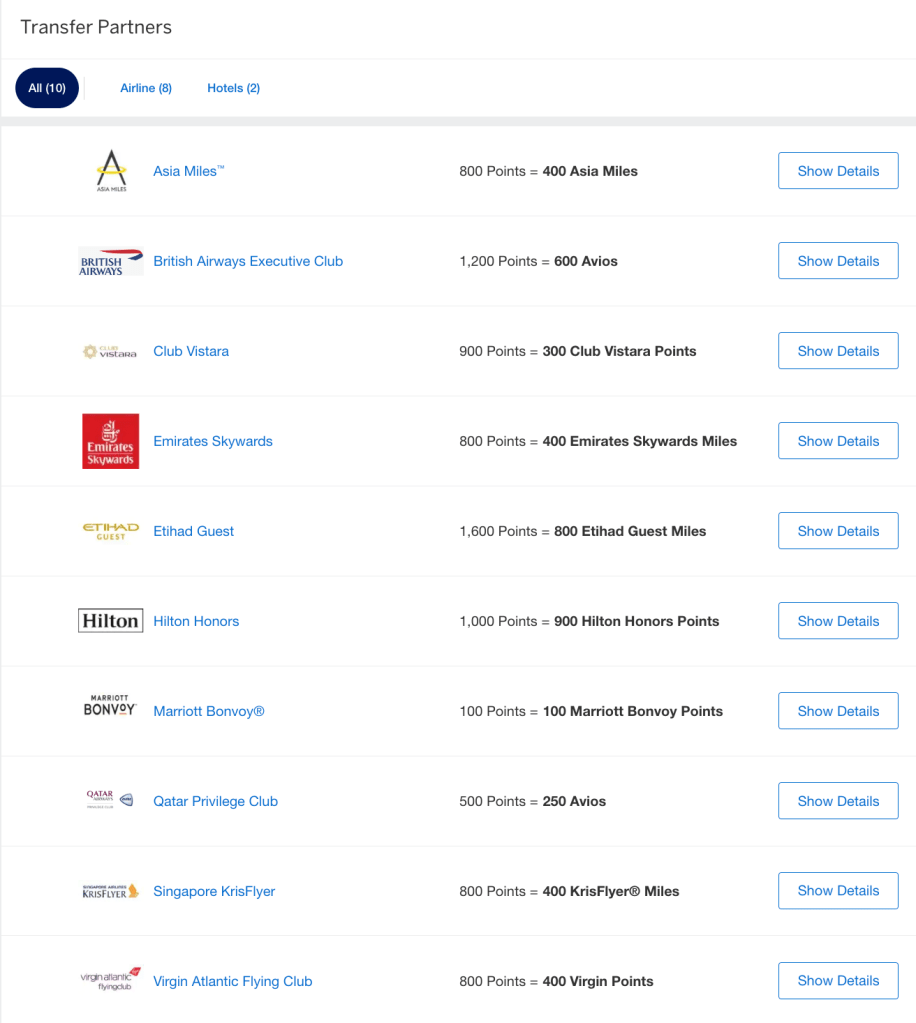

This is a premium level credit card through which you can earn reward points that can be used to earn Taj hotel stay vouchers as well as you can transfer those points to more than a dozen travel partners of American Express like Marriott, Hilton, British Airways, Vistara, Qatar to name a few. The reward rate is also mouth watering but one needs to be a bit mindful of how to use the points to get the max. value out of it.

[Apply through the link above to get this card for Rs. 3500 + 18% GST free for first year + 2000 Bonus points + limited edition playing cards]

| Type | Premium Rewards Credit Card for Travel |

| Reward Rate | 5 – 10% |

| Best for | Taj Vouchers, Travel (Hotels & Airlines) Redemptions |

Design

The card comes in plastic but don’t mistake that for it being a cheap looking card. It surely gives premium vibe with its classy design in silver color, embossed card digits and clean look. This is a card that you surely can flaunt when hanging out with your family, friends or colleagues.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 3500 + 18% GST (Free if applied using this link) |

| Joining Fee Waiver | N/A |

| Joining Benefit | 10000 points (Applicable only for paid cards & on spending Rs. 15000 within 90 days of Card membership) |

| Renewal Fee | Rs. 5000 + 18% GST |

| Renewal Fee Waiver | N/A |

| Renewal Benefit | N/A |

The joining benefit for paid cards of 10000 points can be either redeemed for Flipkart voucher worth Rs. 3000 or do a travel booking at Amex Travel Online portal to get 3000 off using pay with points option. I would prefer to use it for Flipkart voucher as travel booking via Amex portal would can’t be done with card discounts like you can on MMT or Yatra.

Joining benefit is decent enough as it covers ~75% of the fees but as the limited time offer is going on one can take advantage of that.

Tip: You can call the customer care team in the last month of card anniversary year to discuss retention offers.

Other Charges

Supplementary Card

One can get upto 2 supplementary cards for free post which the standard supplementary card fee (1500 + 18% GST) will be applicable.

If you are lucky, you might get offer to get brand vouchers worth 500 or so on applying for a supplementary card. If you get 2 supplementary cards, that would help you get back ~17% of joining fee.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%)

Fuel Purchases

There are no reward points on fuel purchase but you will get surcharge fee waiver only if you use card at HPCL fuel pumps. Surcharge fee will vary based on which fuel pump you go to.

- HPCL: 0% fee for transactions less than Rs. 5000 and 1% fee otherwise

- BPCL & IOCL: 1% fee subject to a minimum of Rs. 10 + applicable taxes

- Rest: 2.5% fee subject to a minimum of Rs. 10 + applicable taxes

Rent Payments

There is no additional fee charged on rent payments but unfortunately Amex cards are not accepted at any of the portals which allow for rent payments via credit cards.

EMI Fees

On all Amex cards which have EMI purchase option, a processing fee of Rs. 199 + 18% GST is levied on all EMI transaction(s) converted at Point of Sale online or in-store.

For transactions that are converted to EMI post purchase, an additional one-time processing fee of 2% plus applicable taxes is charged. Any foreclosure or early payment will be subject to a 3% fee of the outstanding balance along with applicable taxes.

Benefits

Reward Points

| Regular Spends | 1 point on every Rs. 50 spent |

| Reward Points Expiry | Never |

| Redemption Fee | Nil |

| Exclusions | Insurance, Fuel & Utilities |

The value of reward points earned on American Express Platinum Travel Credit Card is great when it is utilized for Marriott transfers (or) Taj voucher redemptions, as other options are not attractive enough.

- 1 point redeemed for Flipkart voucher or booking using Amex Travel Online portal gives 30p value

- 1 point redeemed for Taj voucher gives 50p value

- 1 point redeemed for Marriott or Other Partner Transfers can give 50p – 100p value

Also note that the points earned on plat travel can’t be pooled with other Amex cards, so you can’t redeem them for Gold (or) Platinum rewards collection, an option that comes with Amex Gold charge card, MRCC credit card & Amex Platinum charge card.

The reward rate on regular spends is not that attractive but taking the milestone benefits into consideration, the picture is completely different and beautiful 🙂

Milestone Benefits

| SPEND MILESTONE | BENEFIT | VALUE |

|---|---|---|

| 1.9 lakhs | 7500 Threshold Membership Rewards points + 7500 Bonus Membership Rewards points | Rs. 7500 |

| 4 lakhs | 10000 Threshold Membership Rewards points + 15000 Bonus Membership Rewards points + Taj Experiences E-Gift Card worth Rs. 10000 | Rs. 22500 |

Note: For getting the Bonus MR points, one needs to contact Amex customer care via helpline (1800 419 2122) or via chat and request to credit the Bonus MR points.

Don’t get confused with Threshold MR points and Bonus MR points; it is the same thing but for some weird reason Amex has configured the benefits this way. Now let’s relook at the total value you get on Rs. 4 lakh milestone-

- Points for regular spends (1 point for every Rs. 50) = 400000/50 = 8000 points

- Points for Milestone spends on reaching 4 lakh = 15000 + 25000 = 40000 points

- Cumulative value (considering 50p/point) = 24000 + 10000 (Taj voucher) = 34000

The reward rate comes out to be ~8.5% (34000/400000* 100) which is simply amazing. And if you transfer points to Marriott Bonvoy & use it wisely (booking at non-peak time) the reward rate can even go beyond 10% easily.

Due to renewal fee, if not waived, the reward rate takes a hit of ~1.5% but it is still better than majority of the cards out there)

Note: For the usage of Taj Experiences E-Gift Card, one needs to ensure that the rate used to make the booking is a non-member rate otherwise they may not accept the E-Gift card as per the policy.

Reward Redemption

There are various reward point redemption options but the best one among them is to either transfer points to airline or hotels loyalty programs. Here is the exhaustive list of redemption options and the value you could get for that-

- Pay with points while shopping in store or online: 25p/point

- Purchase Insta vouchers: 25p/point

- Use points to offset any purchases made on card: 25p/point

- Travel bookings (flights & hotels) using Amex Travel portal: 30p/point

- Experiences (Newly launched) Redeem points for Adventure, Stay or Dining

- Transfer points to Airlines & Hotel loyalty programmes: 50p – Rs. 1/point

Travel Benefits

Airport Lounge Access

Since this is a card focused on travel benefits, it comes with generous Airport lounge access option too.

| ACCESS TYPE | VIA | ACCESS LIMIT |

|---|---|---|

| Domestic | Amex Platinum Travel Card | 8 (2/qtr) |

| International | Priority Pass | Paid Access |

Here is the list of the domestic airport lounges that are covered under this card. Amex Platinum Travel card comes with ‘complimentary’ membership to Priority Pass for international lounge access but you don’t get any complimentary “access” with it. Each visit will cost you $35 per cardmember/guest.

Dining Benefits

There are certain benefits for dining enthusiasts which can be discovered on Amex website. Plus, if you want to look for restaurants in your city where Amex card can get you discounts, visit this link.

Other Benefits

Reward Multiplier

Most credit cards issuers have some sort of rewards portal which helps to get extra points if user does transaction via that portal. In case of Amex, one can accrue additional reward points by using the Amex Reward Multiplier option.

You can get 3X rewards on the Reward Multiplier with Platinum Travel card i.e. 3 reward points per Rs. 50 which is a great way to boost the reward earn rate. There are a lot of brands & portals which are part of the Reward Multiplier program like Apple, Flipkart, Myntra, Croma, Tanishq to name a few. One could purchase gift cards as well on this portal.

Detailed T&C for reward multiplier are available here.

Best way to use this card

- Spend upto 4 lakh to get 28000 points + Taj e-Voucher worth 10000

- Use Amex Reward Multiplier to boost reward rate even higher

- AMEX offers (communicated via email or website)

- Redeem points for Taj vouchers or other travel partners

How to apply

Amex lets you hold maximum of 1 Charge Card & 2 Credit cards at any point in time.

The best way to apply is online by visiting the Amex website. Using the link given below, you can get additional 2000 bonus points (make sure to spend Rs. 5000 in the first 90 days of card membership to get referral bonus points).

[Apply through the link above to get this card for Rs. 3500 + 18% GST free for first year + additional 2000 Bonus points + limited edition playing cards]

Verdict

With a reward rate that can skyrocket beyond 10% on a premium credit card with a joining fee that won’t break the bank, American Express Platinum Travel credit card is a must-have card.

Amex cards have had the acceptance issue at limited offline merchants but other than that at any big retail outlets, online websites, premium restaurants & hotels there won’t be any such issue.

And let’s not forget about the customer support. Amex is second to none when it comes to customer support and ready to save the day whenever you need them. Trust me, this card is a total must-have for anyone with a sense of style and a desire for the best.

If you don’t need a premium card or your usage is not that high, you can opt for the Amex Membership Rewards Credit Card and is issued as “First Year Free” for a limited period.

What are your thoughts about the American Express Platinum Travel Credit Card? Feel free to share your views in the comment section below.