HDFC and Tata have come up with a co-branded credit card that could be a game changer as this card gives great rewards when used on the Tata Neu app (super app of Tata group). All the brands under the Tata umbrella i.e. Taj, Croma, BigBasket, Tata Cliq, 1mg, Tanishq, Air India Express (rebranded Air Asia) etc. are part of this super app so you can imagine why this card could be like a jack of all trades sort of card.

The rewards that one gets on using Tata Neu app gets boosted by 2% – 5% when you use this card which we will see in this article. Let’s see the card features and benefits in detail and figure out whether this card deserves a place in your wallet or not.

Overview

Tata Neu HDFC credit card is a rewards credit card with rewards up to 10% on Tata Neu app. It comes in two variants – Plus (entry-level rewards card) & Infinity (mid-level rewards card).

| Type | Rewards Credit Card |

| Reward Rate | 2% (Plus variant); 5% (Infinity variant) |

| Best for | Retail spends on Tata Neu app |

Design

Both variants of the card come with a vertical design and are of different shades of blue. Card number is mentioned on the back side which gives this card a clean look.The Infinity variant looks more premium compared to the Plus variant. and is available on the Visa & the Rupay platform.

Fees & Charges

Joining & Renewal Fees

| Variant | Plus | Infinity |

| Joining Fee | Rs. 499 + 18% GST | Rs. 1499 + 18% GST |

| Joining Fee Waiver | Limited time offer for First year free | Limited time offer for First year free |

| Joining Benefit | 499 NeuCoins (only on paid cards) | 1499 NeuCoins (only on paid cards) |

| Renewal Fee | Rs. 499 + 18% GST | Rs. 1499 + 18% GST |

| Renewal Benefit | N/A | N/A |

| Renewal Fee Waiver | 1 lakh spend | 3 lakh spend |

Note: Joining benefit is applicable on 1st Transaction done within 30 days of card issuance and will be available to claim inside Tata Neu App within 60 days of such transaction. Joining benefit NeuCoins will expire in 365 days.

There is no official Joining fee waiver criteria as such but from time to time HDFC & Tata Neu runs First year free offer on both the variants. Infact when this card was launched, some people also got the life time free offer on these cards as well.

Tip: If you want this card as FYF or LTF, spend regularly on TATA Neu app via HDFC Bank Credit Card (if existing HDFC Credit Card holder) & wait for the offer to kick in OR If you have high NRV with HDFC bank and received the card FYF, push them to get it converted to LTF.

Other Charges

Supplementary Card

There is no fee for applying for supplementary card for Visa network card.

Note: For the RuPay network card, you can not apply for supplementary card.

Forex Payments

Infinity variant – 2% of the transaction value + 18% GST (which adds up to 2.36%)

Plus variant – 3.5% of the transaction value + 18% GST (which adds up to 4.13%)

Fuel Purchases

Both variants of the card allow for 1% surcharge waiver on minimum transaction of Rs. 400 & maximum transaction of Rs. 5000. Applicable taxes on surcharge are not waived as usual.

Plus variant has a capping of Rs. 250 per billing cycle and Infinity variant has a capping of Rs. 500 per billing cycle. Also, there are no reward points on fuel purchase.

If you spend less than Rs. 15000 per transaction on fuel, no additional fee will be charged. However, if you spend more than Rs. 15000 per transaction on fuel, a 1% fee will be charged on the entire amount and capped at Rs. 3000 per transaction.

Note: There is no Fuel Surcharge applicable on UPI payments. Therefore, no fuel surcharge waiver will be provided. So if you use the RuPay network card then, you can avoid paying any surcharge altogether.

Rent Payments

Rent transactions are not eligible for any cashback. Also, if you use services like (but not limited to) CRED, PayTM, Cheq, MobiKwik, Freecharge, and others to pay rent, a 1% fee will be charged on the transaction amount and capped at Rs. 3000 per transaction. Also, these portals charge a rent payment fee of their own.

EMI Fees

For EMI transactions, a one-time processing fee of up to Rs. 299 + taxes is charged.

Benefits

Reward Points

The reward points awarded or credited on the Tata Neu Plus/Infinity HDFC Bank Credit Card are in the form of Tata NeuCoins (1 NeuCoin is equivalent to Re. 1) which can be redeemed on Tata Neu app for various products & services which we will see later.

| Spend Category | Plus variant Reward rate (as NeuCoins) | Infinity Variant Reward rate (as NeuCoins) |

| Spends on Tata Neu app (inclusive of 5% NeuCoins with NeuPass Membership on select categories) | 7% | 10% |

| Non-EMI Spends on Partner brands (online & store) | 2% | 5% |

| EMI Spends on Partner brands (online & store) | 1% | 1.5% |

| Bill payment via Tata Neu app (Tata Pay) | 2% | 5% |

| Any other Domestic & International spends (including EMI) | 1% | 1.5% |

| UPI spends (only on RuPay cards) (max. 500 NeuCoins can be earned in a calendar month | 1% (using Tata Neu UPI ID) 0.25% (using other UPI ID) | 1.5% (using Tata Neu UPI ID) 0.5% (using other UPI ID) |

| Reward points Expiry | 365 days after your last transaction involving an eligible earn or use of NeuCoins | 365 days after your last transaction involving an eligible earn or use of NeuCoins |

| Redemption Fee | N/A | N/A |

| Exclusions | Fuel, Government, Rent, Post-transaction EMI conversion & Wallet loads, Gift or Prepaid Card load, Education Payments* | Fuel, Government, Rent, Post-transaction EMI conversion & Wallet loads, Gift or Prepaid Card load, Education Payments* |

- For any individual utilities transaction more than Rs. 50000, a 1% fee will be charged on the entire amount capped at Rs. 3000 per transaction. Insurance transactions are not considered as Utility transactions.

- Reward Points earned on Utility transactions will be capped at 2000 Reward Points per calendar month.

- Reward Points earned on Telecom & Cable transactions will be capped at 2000 Reward Points per calendar month.

- Education payments through third-party apps like (but not limited to) CRED, PayTM, Cheq, MobiKwik and others will attract a 1% fee capped at Rs. 3000 per transaction and no reward points will be awarded. Education payments through college/school websites or their POS machines will not have any additional charges and will be eligible for reward points. International education payments are excluded from this charge.

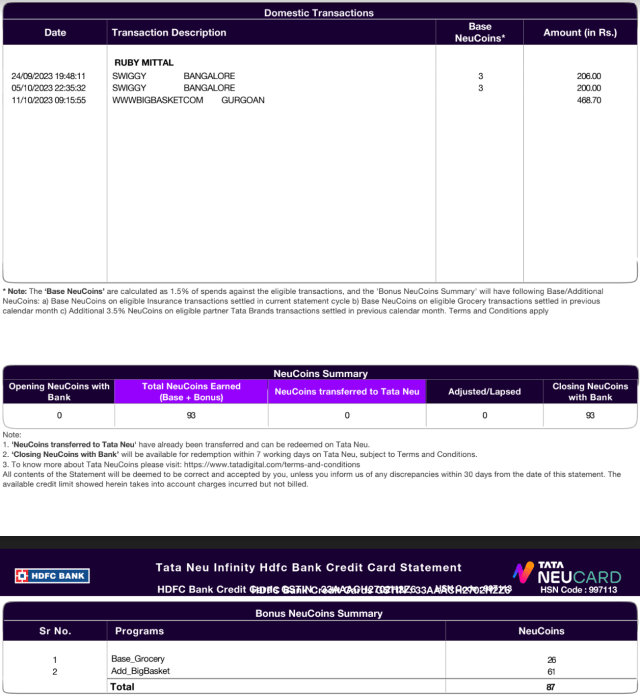

One thing important to point out in regards to how the NeuCoins appear in the monthly statement is that on these cards there is something called Base and Additional NeuCoins. Let’s take an example – If you use Infinity variant card to buy grocery on Bigbasket

- via TataNeu app then you get 5% (NeuPass) + 1.5% (Base) + 3.5% (Additional) NeuCoins

- via Bigbasket app/store then you get 1.5% (Base) + 3.5% (Additional) NeuCoins

| For Eligible Transactions | Plus variant | Infinity variant |

| Base NeuCoins | 1% | 1.5% |

| Additional NeuCoins on Partner Tata Brand Transactions | additional 1% | additional 3.5% |

| Total | 2% | 5% |

The partner Tata brands include – BigBasket, Croma, Westside, Tata CliQ, Tata Cliq Luxury, Tata Play, Titan (Eyeplus, Taneira, Titan, Fastrack, Helios, World of Titan ), Tanishq (Tanishq, Caratlane, Mia, Zoya), Air India, Air India Express, IHCL (Taj Hotels, Vivanta Hotels, President IHCL Select, Ginger hotels, Piem Hotels), Qmin, 1mg, Cult (Cultfit, Curefit)

Starting 1st Oct 2023, Air India got added to the list but Vistara is still missing. Hopefully after the merger we will see that get included as well.

Reward Earning limitations

- Bill Payment (Tata Pay), Tanishq, Cult.fit, Air India, Tata Play spends are not eligible for additional 5% NeuCoins via NeuPass Membership.

- The maximum Neucoins that can be earned in a statement cycle is 50000 for Infinity variant and 25000 for Plus variant.

- NeuCoins for Croma transactions on TataNeu app is capped at 750 NeuCoins per transaction

- NeuCoins for Insurance Spends is capped at 2000 NeuCoins per day

- NeuCoins for Grocery Spends is capped at 1000 NeuCoins per month (Plus variant) & 2000 NeuCoins per month (Infinity variant).

- NeuCoins for SmartBuy spends is capped at 1000 per month

- Fair usage policy applies on NeuCoins reward rate to all brands and categories on usage of Plus & Infinity cards.

Reward Points Redemption

You can use your accumulated NeuCoins for your purchases at Tata Neu app/website as well as Partner Tata Brand app/websites/stores (except for Air India, Tata Play, and Bill Payment on Tata Neu). The applicable Partner Tata Brands and redemption process is tabulated below.

| Redemption on app/website | ||

| How to redeem? | Applicable Brands | |

| via Tata Pay 1. Select ‘Tata Pay’ as payment option on payments page 2. Redeem desired amount of ‘NeuCoins’ on Tata Pay | AirAsia India, bigbasket, Croma, IHCL hotels, Qmin | |

| via ‘NeuCoins’ / ‘Use my NeuCoins’ / ‘Loyalty Redemption’ 1. Select ‘NeuCoins’ / ‘Use my NeuCoins’ / ‘Loyalty Redemption’ option on order page / payments page 2. Redeem the desired amount of NeuCoins | Tata Cliq, Tata Cliq Luxury, Tata 1mg, Titan (via Tata Neu), Tanishq (via Tata Neu) | |

| Redemption at stores | ||

| How to redeem? | Applicable Brands | |

| At Point of Sale / Cashier Desk 1. Voice out your Tata Neu Registered Mobile number to the cashier 2. The cashier will confirm the NeuCoins balance on your Tata Neu account 3. Confirm the amount of NeuCoins to be redeemed 4. Cashier will trigger an OTP to your registered mobile number to initiate redemption 5. Voice out the OTP to the cashier to complete your purchase using NeuCoins | Croma, IHCL hotels, Westside | |

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | Limit for Plus variant | Limit for Infinity variant |

|---|---|---|

| Domestic | 4 (1/quarter) | 8 (2/quarter) |

| International | N/A | 4 (1/quarter) via Priority Pass |

- List of domestic lounge for Plus variant is here & for Infinity variant is here.

- For international lounges via Priority Pass check here. If you exceed the 4 Complimentary (1 per Quarter) visits, you will be charged $27 + 18% GST per visit.

- For international lounges via Rupay check here. A refundable transaction fee of $3.25 will be charged.

Other Misc Benefits

Swiggy Dineout Dining Discount

On all the HDFC cards, you can get 5% – 15% discount on dining bills when you pay through Swiggy Dineout. For some reason HDFC has named it ‘Good Food Trail program’.

With HDFC Tata Neu credit card, you get additional 5% discount up to Rs. 200 on top of 10% Swiggy Dineout discount. This offer is applicable twice a month on a min. transaction value of Rs. 2500 post applying the Swiggy Dineout discount.

- Offer: 5% discount up to Rs. 200

- Min. Transaction: Rs. 2500

- Usage Limit: Twice a month per customer on Swiggy Dineout

UPI Payment

Using the RuPay version of this card, one can even do UPI payments to those merchants who don’t accept credit card. You can use an UPI app of your choice like BHIM, GPay, Freecharge, TataNeu, PayZapp to link this card and start using it for UPI payments.

Below are the steps for card linkage on BHIM app-

- Download BHIM app from Google Play store/App Store.

- Complete the registration using the mobile number with which your credit card account is linked.

- Select Credit Card option in the Add account section or click on the banner for linking Rupay card on homepage.

- Select your issuing bank name from the drop down (HDFC in this case)

- Basis the mobile number updated with your issuing bank, masked Credit Cards will appear on the screen.

- Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Below are the steps for card linkage on PayZapp app-

- Login to PayZapp and go to ‘Accounts & Cards’ section.

- Go to ‘UPI accounts’ and click on ‘+ Add new’

- Select ‘RuPay credit card’ -> Select ‘HDFC Bank credit card’ to fetch and link your HDFC Bank RuPay Credit card.

Limit on UPI transaction via RuPay card is Rs 5000 for first 24 hrs of linking the card in UPI app and gets increased to Rs. 1 lakh per day per card post that. For some merchants (MCC codes i.e 5960, 6300 & 6529) limit allowed would be Rs 2 lakh for some special. Apart from that, there is no limit to the number of transactions carried out via linked credit card on UPI.

Note: Only payment to merchant (P2M) will be allowed from the linked Credit Card.

Best way to use this card

- Use for grocery purchase on Bigbasket via Tata Neu app to get 10% rewards as NeuCoins

- Use for misc. retail spends via Tata Neu app to get 10% rewards as NeuCoins

- Use this card during sale on Tata Neu app to get HDFC card discount + 10% rewards as NeuCoins

- Do UPI payments to merchants who don’t accept credit cards

- Avail lounge benefits

How to apply

Existing HDFC Bank Credit Card holders can also apply for this Card. The Credit Limit of existing HDFC Bank Credit Card will be shared with the Tata Neu HDFC Bank Credit Card. In case of an existing HDFC Bank Credit Card holder the initial limit post card creation will be Rs. 5000. The limit will be reset to your existing card limit in 5 working days from your card issuance date and will be shared across both the cards.

One can apply for this card via HDFC website or Tata Neu directly following below steps

- Login to Tata Neu app >> Finance >> Credit Cards

- Fill in the Tata Neu HDFC Bank Credit Card application form to check your eligibility

- Complete the verification process to get your Tata Neu HDFC Bank Credit Card.

Verdict

Tata Neu HDFC credit card is absolutely a must have card for those who are already invested in the Tata ecosystem. Even if you are using a few of their brands like bigbasket, croma, westside etc. then too this card will be of great value to you and not to forget the option to use this card for day-to-day UPI transactions (RuPay version) is a cherry on top of the cake.

What are your thoughts about the Tata Neu HDFC Credit Card? Feel free to share your views in the comment section below.