Amazon Pay ICICI Bank Credit Card was launched back in 2018 and was one of its kind at that time. It was launched with the invite only strategy and then was opened to masses. This card still retains its value and has not been devalued much which is a great deal in itself as when a card reaches critical mass, we start seeing the card get devalued to prolong its life from a bank’s point of view.

Although, several other cards have come into existence which more or less serve the same purpose but for someone who is invested in Amazon ecosystem and wants a simple cashback card that’s LTF then this card is still the one to beat.

Let’s see the card features and benefits in detail and figure out whether this card deserves a place in your wallet or not.

Overview

It is a entry level cashback credit card with a very easy to understand reward structure and cool perks when used for buying good & services on Amazon. And as we know, one can get almost everything under the sun on Amazon, be it buying electronics, clothes, appliances, grocery, bill payments etc., this card will be able to serve all the use cases and then some.

| Type | Entry level cashback card |

| Reward Rate | up to ~5% |

| Best for | Amazon shopping for Prime members |

| USP | No limits on cashback |

Design

The card comes in black color which is a good start 🙂 All the essentials like the Name, card number and everything is on the front itself which makes it look a bit cluttered. It would have been better if some of the information could have been moved to the back of the card to give it a cleaner look. Card is issued on the Visa network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Lifetime free |

| Joining Fee Waiver | N/A |

| Joining Benefit | N/A |

| Renewal Fee | Lifetime free |

| Renewal Benefit | N/A |

| Renewal Fee Waiver | N/A |

The good thing about this card is they have kept things really simple by issuing the card as lifetime free. The bad thing is there is no joining & renewal benefit with this card but with no fee this is something we should not complain about :).

Back when this card was launched one used to get Amazon vouchers or complimentary Amazon Prime membership but that benefit has been discontinued.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%) which means it is not a good option to use it for foreign trips as you would end up paying 3.13% extra (4.13% – 1%).

Fuel Purchases

There is no cashback on fuel purchases but you do get 1% fuel surcharge waiver across all petrol pumps in India, exclusive of GST and other charges.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

There is a no capping for surcharge waiver which is an advantage compared to other credit cards.

Rent Payments

1% fee is applied on rent payments and there is no cashback for that. All the transactions routed through Merchant Category Code (MCC) 6513 will be considered as rent pay transactions.

EMI Fees

For EMI transactions, standard EMI processing fees is applied.

Benefits

Cashback

The cashback is awarded in the form of Amazon Pay balance and is credited to Amazon Pay wallet within a day of the statement generation. One important thing regarding cashback is that you should use this card on the same amazon account which was used to apply for this card to earn 5% cashback. Otherwise you may only get 3% cashback.

| Spend Category | Reward Rate |

| Purchase on Amazon (except Physical & Digital Gold) | 5% for Prime members; 3% otherwise |

| Flight & Hotel bookings via Amazon | 5% for Prime members; 3% otherwise |

| Purchase of gift cards, e-books & digital products, Bill payments, Recharges, Amazon wallet loads | 2% |

| Payments to Amazon Pay partner merchants | 2% |

| Any payment outside Amazon & not done to Amazon Pay partner merchants | 1% |

| International spends | 1% |

| Redemption Fee | N/A (Cashback credited as Amazon Pay balance) |

| Exclusions | EMI transactions, Post purchase EMI conversion, Fuel, Insurance, Gold, Rent |

Overall, I would say the reward structure is very fair and rewards well to Amazon shoppers. These days a lot of apps like Zomato, Swiggy, Urban Company, BigBasket, BookMyShow, Pharmeasy, etc. support Amazon Pay option so that guarantees 2% cashback. Also, this card let’s you earn 1% on Government and Education service payments unlike other credit cards.

During festive seasons & sales, we can see additional 5% upfront discount + the usual 5% cashback that this card fetches. However, other ICICI bank credit cards may get 10% discount during such sales. I feel if there is a credit card like Amazon Pay ICICI credit card which is tailor made for Amazon shopping then that card should get edge in terms of discount/rewards over every other credit card. We have even seen with Flipkart Axis Bank credit card that they limit the upfront discount to 5%

Tip: One can make insurance payments by loading wallet using this card and still get 2% cashback.You can purchase grocery directly from Amazon Fesh to get 5% cashback if your pincode is serviceable.

Note: If you use the card for Amazon Business transactions (where you provide GST) then none of the cashback mentioned above are applicable. Also, purchases made at other Amazon marketplaces (including Amazon.com, Amazon.ca, Amazon.co.uk, Amazon.de, Amazon.fr, or Amazon.co.jp) will be eligible for 1% cashback.

Travel Benefits

Airport Lounge Access

This card doesn’t offer Airport Lounge access.

Best way to use this card

- Use for Amazon shopping & buy Amazon Fresh groceries to get 5% cashback

- During sale season, get double dip opportunity (upfront discount + 5% cashback)

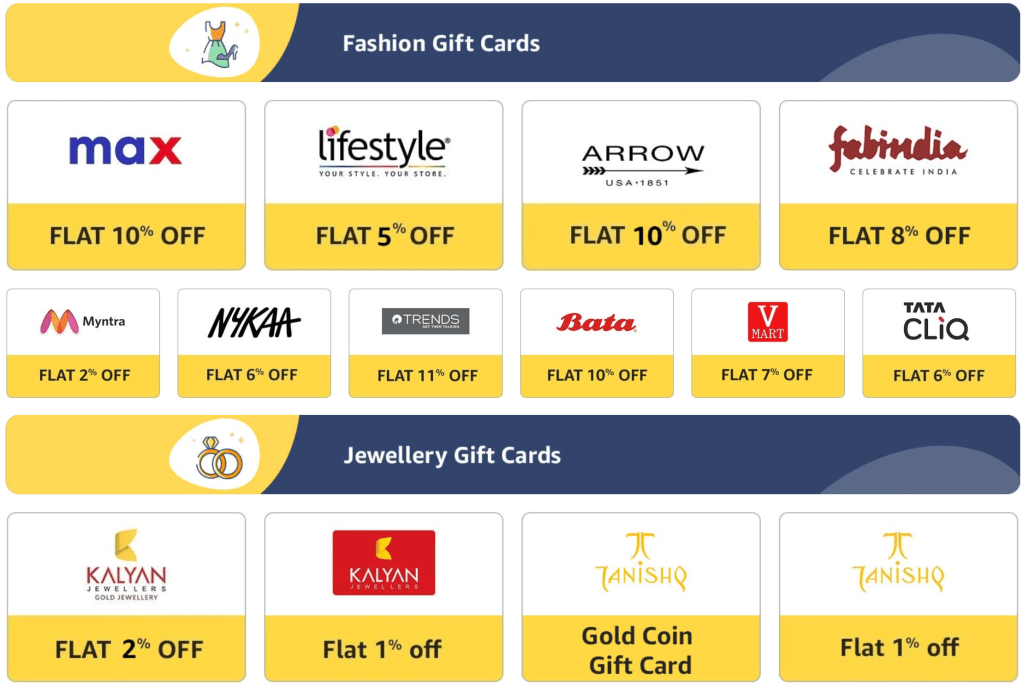

- Buy gift cards on Amazon at discount and also get 2% cashback on paying with this card.

How to apply

You can apply for this card either from Amazon app/website or directly with ICICI.

Verdict

Despite this being an entry-level credit card, it gives very good reward of 5% when you do shopping on Amazon and 2% for any bill payments via Amazon Pay. Also, you can even double dip by purchasing discounted gift card from Amazon using this card to get 2% cashback on top of that.

There are other credit cards out there which will give good value like Amex Membership Rewards Credit Card, Flipkart Axis bank credit card or SBI Cashback credit card which is quite similar to this card in terms of reward rate if not better.

What are your thoughts about the Amazon Pay ICICI Bank Credit Card? Feel free to share your views in the comment section below.