If you need a simple entry level credit card from SBI then the best option right now is the SBI Cashback credit card. If for some reason, you can’t get that card then you may opt for for SBI SimplyClick credit card which is a rewards credit card and gives decent returns mainly for online shopping. Here’s everything you need to know about this exciting must-have cashback credit card.

Overview

SBI SimplyCLICK credit card used is a decently rewarding credit card when it comes to online spends. Not so much for offline spends though. You can get rewards upto 2% and also if you achieve milsetones then the reward rate can touch 3%.

[Apply using above link to get voucher worth Rs. 500 on doing a transaction of Rs. 500 or above ]

| Type | Entry level Rewards Credit Card |

| Reward Rate | 3.25% – 3.8% |

| Best for | Online shopping to get up to 2% rewards |

Design

For the entry level credit card that this is, it still looks better than others in comparison as it has nice artistic pattern design with embossed card number digits. Card is issued with Visa Platinum or Mastercard Titanium network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 499 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | Amazon voucher worth Rs. 500 |

| Renewal Fee | Rs. 499 + 18% GST |

| Renewal Fee Waiver | waived off on spending Rs. 1 Lakh |

| Renewal Benefit | N/A |

The joining benefit offsets the joining fee of the card and the renewal fee waiver criteria is also not difficult to achieve. The Amazon voucher code is sent on registered mobile number within 30 days post paying the joining fee.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%). You should avoid using this card for foreign trips.

Fuel Purchases

There is no reward on fuel purchases but you do get 1% fuel surcharge waiver across all petrol pumps in India as long as transactions are between Rs. 500 – Rs. 3000, exclusive of GST and other charges.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

There is a capping of Rs. 100 per statement cycle for surcharge waiver which should be enough if your monthly fuel expenses are below Rs. 10000.

Rent Payments

For rent payments, an additional charge of Rs. 199 + 18% GST is levied. As you get only 1X points on rent payments from this card, I would recommend to avoid this card for rent payments unless you really have to.

Utility Payments

If the utility payments (Water, Gas, Electricity, etc.) exceeds Rs. 50000 in a billing cycle then a 1% fee will be charged on total amount (not just the excess of Rs. 50000). Any transaction reported with Merchant Category code 4900 by the network partners to SBI will be considered an utility payment.

EMI Fees

For EMI transactions, an additional charge of Rs. 199 + 18% GST is levied.

Benefits

Reward Points

You earn reward points based at three different rates. The base rate is 1 point for each Rs. 100 of purchase. 1 point is equivalent to 25 paise which means 0.25% reward rate.

| Spend Category | Reward Rate |

|---|---|

| Online Spends at exclusive partners (Apollo 24×7, BookMyShow, Cleartrip, Dominos, Eazydiner, Myntra, Netmeds, Yatra) | 10X Points (2.5%) |

| Other Online Spends | 5X Points capped at 10000 points per month (1.25%) |

| Offline Spends & Rent payments | 1X Point (0.25%) |

| Exclusions | Wallet loads, Cash Advance, Balance Transfer, Fuel |

Note: Cleartrip transactions done from affiliate channels (via Flipkart) will not be eligible for 10X

Reward Points. You need to book directly via Cleartrip app or website to get 10X points.

With recent devaluation, they have introduced the capping of 10000 points for 5X category. Post reaching that limit any eligible online spend would accrue only 1 point per 100. Thankfully, there is no capping for 10X category yet 🙂 but keep an eye of the exclusive partners list as it can change over the time.

Utility Bill Payments done via using SimplyCLICK SBI Card on SBI Card website/mobile app will not accrue 5X Reward Points so use any other app like Amazon, Paytm, Freecharge etc. for that. Insurance payments fall under 5X category.

Milestone Benefit

There are two milestones that you can achieve to boost the reward rate a little. Assuming you spend 2 lakh a year (50% on 10X and 50% on 5X category), then your total reward rate would be –

2.5*100000/100 + 1.25*100000/100 + 2000 + 2000 = 3.8% which is pretty good for an entry level card 🙂

Even if you spend entire 2 lakh in 5X category (by doing utility and insurance payments), your reward rate would still be above 3%. Also, the renewal fee gets waives off on spends above 1 lakh so that’s another saving of Rs. 500. 🙂

| Milestone | Benefit | Reward Rate |

|---|---|---|

| 1 lakh | Voucher worth Rs. 2000 (Cleartrip/Yatra) | 2% |

| 2 lakh | Voucher worth Rs. 2000 (Cleartrip/Yatra) | 2% |

There are certain restriction on the voucher that you should know about-

- Cleartrip voucher is valid only for Domestic or International Flight bookings. Voucher is valid for a single transaction only and cannot be clubbed with any existing offer. If the booking amount is less than the amount of the voucher, the unutilized balance will lapse.

- Yatra voucher is valid for Flights (Domestic / International), Hotels (Domestic) and Holidays (Domestic) booking. Voucher is valid for a single transaction only and cannot be clubbed with any existing offer. If the booking amount is less than the amount of the voucher, the coupon will not be valid

Reward Redemption

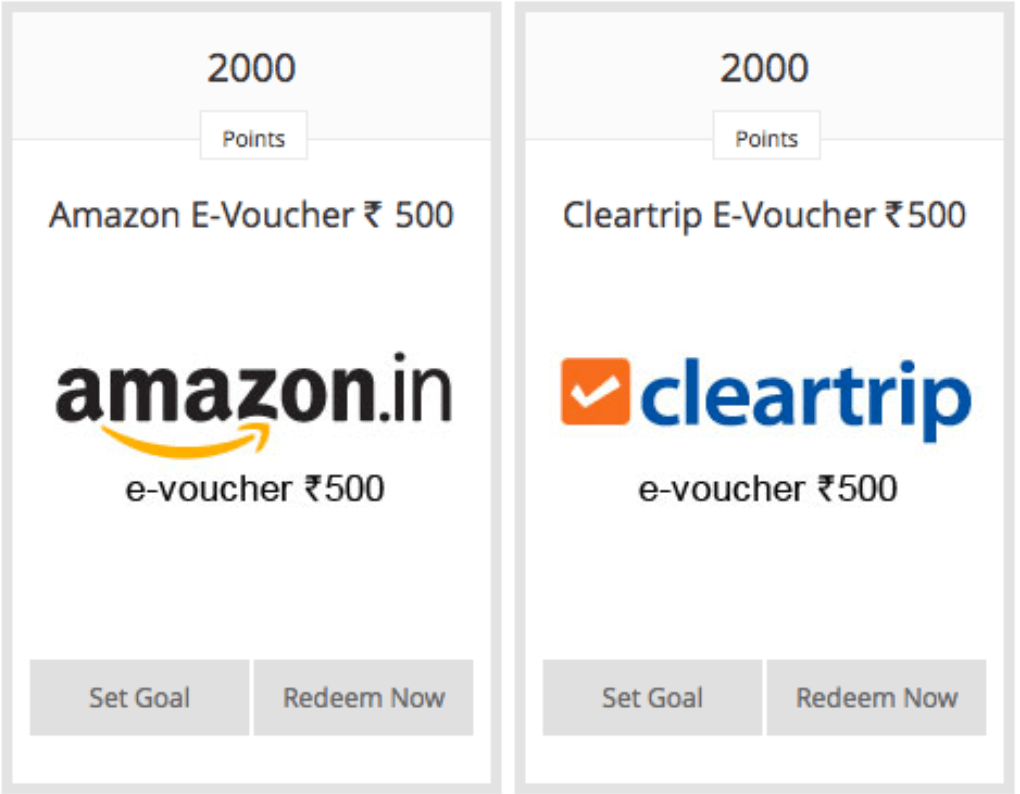

The points accrued on the card account can be redeemed for vouchers of various brands from the SBI app or website. The best option is Amazon e-voucher. For 2000 points, you get a voucher worth Rs. 500.

Travel Benefits

Airport Lounge Access

This card doesn’t offer complimentary Airport Lounge access.

Best way to use this card

- Do online spends on exclusive partners apps/website to maximize rewards

- Spend at least 1 lakh to get voucher worth Rs. 2000 & renewal fee waiver

How to apply

SBI has simplified their online application process and you can get this card, once approved, within a week through their SBI sprint portal using the link below.

[Apply using above link to get voucher worth Rs. 500 on doing a transaction of Rs. 500 or above ]

Verdict

The SBI SimplyCLICK credit card is not a MVP for sure but it is still a very good card for an online shopper with low spends in range of around 2 lakh. There are definitely other credit cards in the entry level segment that are equally or even more rewarding like Axis Ace, Amex MRCC, Amex Gold and their own SBI Cashback card. Hence, you should get this card if you don’t have an SBI card already or you are not able to get any of the other cards from different banks.

What are your thoughts about the SBI SimplyCLICK Credit Card? Feel free to share your views in the comment section below.