There are almost no cards out there which give rewards on all the spends as every credit card has some or the other restrictions & exclusions on rewards or cashback that you earn. But fret no more. If you are in hunt for a credit card that can give rewards at a rate on par with a premium credit card and that too with hardly any constraints then look no further than Standard Chartered Ultimate credit card which is their flagship offering in India. In early 2023, this card got slightly devalued but is still a damn good credit card.

Let’s look at the card features and benefits in detail to understand what’s so great about this card.

Overview

It is a premium rewards credit card and is the flagship product of Standard Chartered. The base reward rate of 3.3% (with some exceptions) is comparable to the likes of HDFC Infinia or HDFC Diners Black and there are no restrictions on earning and redemption.

| Type | Premium Rewards Credit Card |

| Reward Rate | 3.3% |

| Best for | Voucher Redemption from SC Catalogue |

| USP | No restrictions on rewards earning & redemptions |

Design

It is a plastic card with a black background and all the text in golden color. There is a constellation motif on the card which looks nice. Overall, this looks like a premium card but not as good as the images you would see in the marketing materials and ads. The card is issued on Visa Infinite or Mastercard World network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 5000 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | 6000 Points (worth Rs. 6000 voucher) |

| Renewal Fee | Rs. 5000 + 18% GST |

| Renewal Benefit | 5000 points (worth Rs. 5000 voucher) |

| Renewal Fee Waiver | N/A |

Joining benefit is sufficient to cover the fees including the GST part. Also, the renewal benefit is also good but a tad bit lower which is not a deal breaker. The points are credited within 60 days after paying the fees. You can redeem the points to get any voucher from their reward catalogue which we will see in the benefits section.

There is no fixed criteria to get renewal fee waived off but based on how much you spend on your card you may get some one time offer by calling the customer support. But don’t have any high hopes for this.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

3.5% of the transaction value + 18% GST (which adds up to 4.13%). You also get a cashback of 1.5% of the transaction amount on the overseas transactions which is credited to the card account within 60 days of transaction date

As you get 3.3% reward rate, this card becomes an amazing companion for foreign trips as you would end up earning ~0.7% extra (3.3% + 1.5% – 4.13%) when you swipe it for any transaction.

Fuel Purchases

Post the devaluation done in March 2023, this card no longer earns rewards on Fuel purchases which was a major advantage that came with this card. What you get now is 1% fuel surcharge waiver excluding the GST and charges.

Rent Payments

This was probably one of the very few cards that even rewarded for rent payments. But post devaluation the effective reward rate is almost non existent.

2% reward points on rent payments is awarded plus a charge of 1% of the transaction value + GST is levied resulting in net reward of 0.82%.

And assuming you use NoBroker or some other app to pay rent where at least 1% additional convenience fee is levied, you are looking at a negative reward rate.

Pro Tip: If you still want to earn reward on rent payments, register on RedGirraffe (lowest convenience fee of only 0.39% + GST) and load money in Payzapp wallet with this card to pay rent via RedGirraffe ID to get 3.3 reward rate minus the minor convenience fee 🙂

EMI Fees

For EMI transactions, the standard charges may apply. It is not seen in the MITC documents so for this you could consult with the bank first.

Benefits

Reward Points

The reward points are accumulated in the card account as soon as the transaction is posted and are available for redemption with any capping. 1 reward points = Re. 1.

Before devaluation, it was a simple affair as any category of spend would be eligible for 3.3% reward rate but now (effective April 2023) certain categories have been moved to 2% reward category.

| Spend Category | Reward Rate |

| Regular Spend | 5 points on every Rs. 150 spent (3.3%) |

| Rent & property Management, Insurance, Utilities, Supermarkets, Schools & Government payments | 3 points on every Rs. 150 spent (2%) |

| Reward points Expiry | 3 years |

| Redemption Fee | Rs. 99 + 18% GST |

| Exclusions | Fuel, Cash withdrawals |

Although they say 5 points per Rs. 150 spent but as per their reward calculation rewards are calculated basis every 30 rupees i.e. 1 point for every Rs. 30 spent which is even more beneficial.

Reward Redemption

For redeeming the rewards, you can either go to the SC mobile app>360 Rewards or do it on their website. There are 5 categories to choose from-

- Electronics

- Home & Family

- Lifestyle

- Vouchers

- Travel

With all the options the ratio is 1:1 so you get Re. 1 value for 1 point redeemed. In my opinion best way to redeem the points is to utilize them for Vouchers and you hardly get anything good in rest of the categories that is worth your time.

One not so good thing is that they keep changing the options in the catalogue and don’t have Amazon or Flipkart vouchers, earlier we had Croma & Taj Hotels vouchers which got removed too. Some good options among the Voucher category are mentioned below-

- Shopping: Allen Solly, Decathlon, Fabindia, Levis, Louis Philippe, Ray Ban, Van Heusen, Titan

- Personal Care & Grooming: Body Craft, The Body Shop, Lakme Salon

- Kids Brands: Firstcry, Gini & Jony, Hamleys, MotherCare

- Electronics: Imagine (Apple reseller)

- Hotels & Restaurants: Marriott Hotels, ITC Hotels, CCD, Barbeque Nation

- Cabs: Uber

- Furniture: Urban ladder

- Luxury Brands: Coach, Jimmy Choo, Michael Kors, Steve Madden, The Collective, Vero Moda

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Domestic Lounge | Visa / Mastercard | 4 per quarter |

| International Lounge | Priority Pass | 1 per month |

For complimentary visit to an international lounge via Priority pass, you have to spend Rs. 20000 in previous month.

You can check the domestic lounge list based on card network for Visa and Mastercard here. For International lounges access via Priority Pass check the list here.

Standard Chartered Ultimate feels restricted when it comes to lounge access unlike other premium credit cards but as long you spend 20000 every month you can manage with it on international trips.

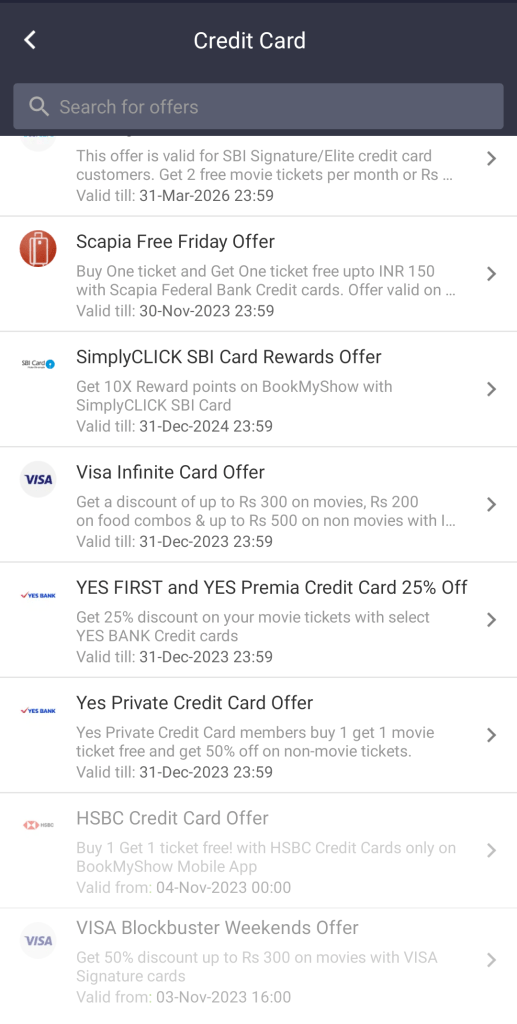

Movie Ticket Benefits

You can get the BOGO offer on movie tickets while booking via BookMyShow if you have Visa Infinite variant of the SC Ultimate credit card. Just check for Visa Infinite card offer under the Credit Card payment option to get upto Rs. 300 off on 2nd movie ticket.

Visa Infinite offer is also applicable on non-movie tickets for upto Rs. 500 off.

Other Misc Benefits

Airport Duty Free Cashback

One cool benefit of this card is that you get 5% cashback on duty free transactions but sadly those are not eligible for reward points.

- Max. Cashback: Rs. 1000 per month

- Fulfillment: Cashback is credited to the card account within 60 days of transaction date

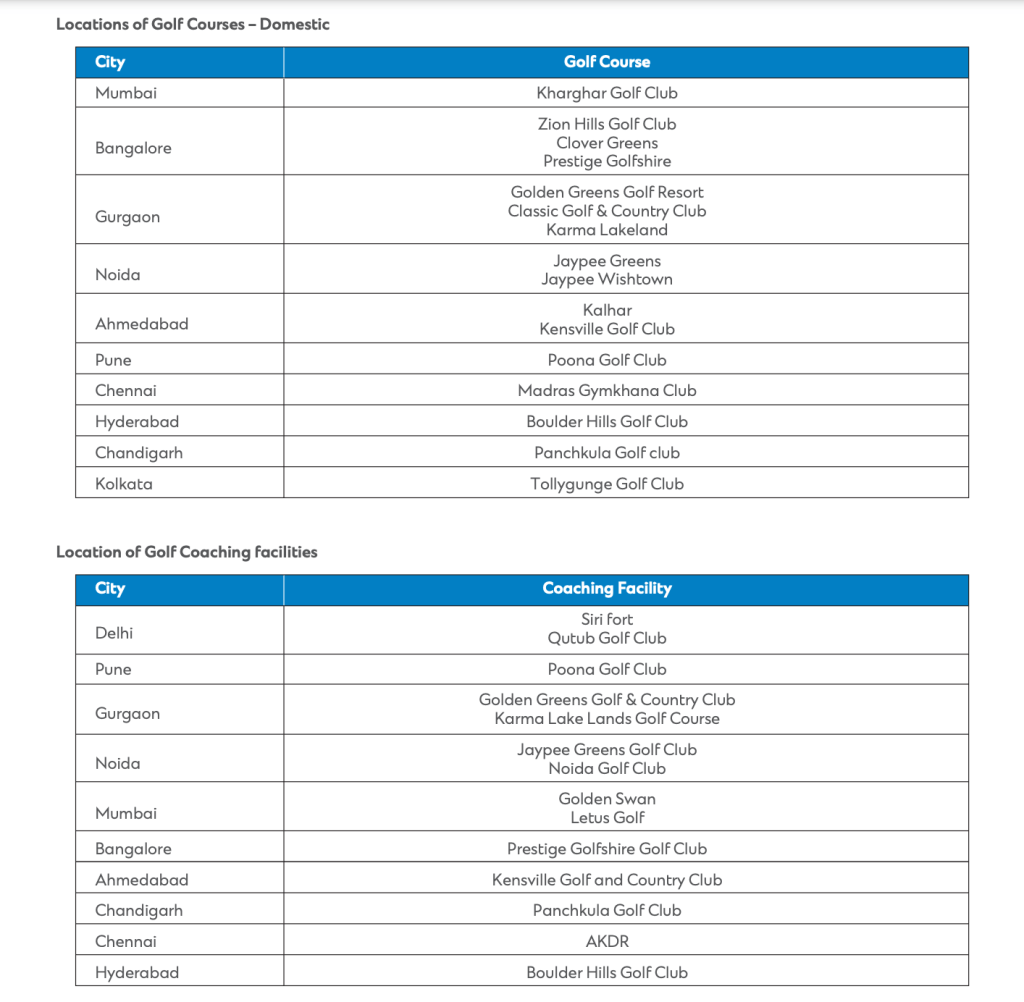

Golf Benefits

Another nice perk of this credit card is the Golf privileges. This benefit is managed by Golflan Technologies and you would have to call on Toll-free Number: 1800-208-7899 (working hours are Monday to Friday between 9AM to 6PM) around 4 days in advance to book/cancel a slot.

- Complimentary Golf Games: 1 per month

- Complimentary Golf Lessons: 1 per month

You would be required to pay convenience charges and other charges as may be applicable even for the complimentary games. The duration of each golf lesson (coaching session) will span a minimum of 30 minutes and will include:

- Fees to access the golf course or driving range

- Fee for the lesson

- Cost of instructor’s fees

- Range golf balls at 50 golf balls per lesson

- Learning equipment

In the event of four Cardholders placing a request for a complimentary slot for the same course and the same date (to play together as a foul ball), a maximum of two complimentary slots will be allotted. All 4 shall be booked only on best effort basis.

Best way to use this card

- Utilize it as go-to card for 3.3% rewards if you don’t have any better cards

- Use for purchases & spends on foreign trips to save on forex fee.

- Use BOGO offer for movie and event tickets

- Access Domestic & International Lounge

- Book Golf lessons

How to apply

You can apply online on Standard Chartered bank website or through their retail bank branch. In case your application is rejected then you may try to first get Standard Chartered Smart Credit Card and then apply for SC Ultimate card as an upgrade using the existing credit card relationship with the bank.

Another option is to get this card via card-on-card basis given that you have high credit limit (around 5-10 lakh) on the other bank credit card.

As a last resort, you can get this card if you have Standard Chartered Priority Savings Account (30 lakh NRV).

Verdict

Standard Chartered Ultimate credit card is one of the best credit cards that you can get. It gives rewards on every kind of spend and is widely accepted. Rewards can be redeemed for a wide variety of vouchers. You also get complimentary lounge and golf benefits, free movie tickets etc.

This card is extremely simple to use when it comes to earning and burning the points without any capping and can be your go-to card in those instances where no other card offer is applicable or no cashback option works.

If you are looking for a similar high rewarding credit card from Amex then you can check out Amex Platinum Travel credit card which is available for free for first year.

What are your thoughts about the Standard Chartered Ultimate Credit Card? Feel free to share your views in the comment section below.