Axis and Vistara have created a bouquet of credit cards together for flyers of all types. There are three cards in total with benefits positioned for different categories of air travel – Axis Vistara Platinum credit card for Economy class, Axis Vistara Signature credit card for Premium Economy class and Axis Vistara Infinite credit card for Business class. Depending on what sort of lifestyle you have and how frequently you fly, one of these cards would suit you better than the other. And for those who aspire to have rich life experiences, it is always a good way to get credit cards which can help you achieve those aspirations 🙂

All these cards have similar features but the scale of benefits and the fees vary as we go up the hierarchy. To make it easier for you to understand the features and simultaneously do a comparison, all three cards are covered in the same article. Let’s understand the way these card works in a simple manner and try to find out which of these cards should be in your kitty.

Overview

Axis Vistara credit cards are travel focussed credit cards with user being able to earn complimentary flight ticket vouchers and earn CV points which is the loyalty currency of Vistara membership. These cards also have perks like airport lounge access and golf privileges except for the platinum card.

| Axis Vistara Platinum | Axis Vistara Signature | Axis Vistara Infinite | |

| Type | Entry level Rewards Travel Credit Card | Semi- Premium level Rewards Travel Credit Card | Premium level Rewards Travel Credit Card |

| Reward Rate | upto 5% | upto 8% | upto 10% |

| Best for | Air Travel & Lounge benefits | Air Travel benefits; | Air Travel benefits |

Design

All the cards look very similar and have the logo of Vistara placed at the centre on a black background. The card number is on the back side giving the card a clean look from the front. The only differentiating element among these cards is the color of the logo itself to convey the CV membership tier you get (Vistara Platinum – Purple; Vistara Signature – Silver , Vistara Infinite – Golden) and the Visa variant these cards comes with. These cards are issued on Visa network – Platinum, Signature & Infinite which is obvious from the card name itself.

Among these three cards, Vistara Infinite credit card is the best looking with the golden color of Vistara logo as well as the AXIS BANK and CLUB VISTARA lettering in the corners in golden too shining on black backdrop giving it the premium look it should have.

Fees & Charges

Joining & Renewal Fees

| Axis Vistara Platinum | Axis Vistara Signature | Axis Vistara Infinite | |

| Joining Fee | Rs. 1500 + 18% GST | Rs. 3000 + 18% GST | Rs. 10000 + 18% GST |

| Joining Fee Waiver | N/A | N/A | N/A |

| Joining Benefit | Complimentary Economy Class ticket voucher & Club Vistara Base Membership | Complimentary Premium Economy Class ticket voucher & Club Vistara Silver Membership | Complimentary Business Class ticket voucher & Club Vistara Gold Membership |

| Renewal Fee | Rs. 1500 + 18% GST | Rs. 3000 + 18% GST | Rs. 10000 + 18% GST |

| Renewal Benefit | Complimentary Economy Class ticket voucher & Club Vistara Base Membership | Complimentary Premium Economy Class ticket voucher & Club Vistara Silver Membership | Complimentary Business Class ticket voucher & Club Vistara Gold Membership |

| Renewal Fee Waiver | N/A | N/A | N/A |

Note: Don’t get confused with use of word ‘Platinum’ in the card name. In case of Visa, Platinum is the Intermediate tier level with highest tier being Infinite. But in case of Club Vistara, Platinum is the highest tier level. That is why with Axis Vistara Platinum card, you get CV Base membership and not Platinum membership.

You can expect the complimentary ticket voucher and the CV membership to be awarded within 10 days of the joining/renewal fee payment. The voucher is credited in the Club Vistara account as “On Demand voucher”.

With all the three cards, the joining & renewal benefit is amazing and you get almost the double of what you paid. Sometimes these cards may have offers for first year free but joining benefits may not be applicable then. Below is the approx. fare you can expect with Vistara based on the travel class-

- Economy ticket = ~3000 – 4000

- Premium Economy ticket = ~7000 – 9000

- Business Class ticket = ~18000 – 20000

Note: The vouchers will only cover the base fare component of the one-way ticket on Vistara domestic network. Any additionals like taxes, surcharges etc. (which can be from ~500 to ~1000 per individual ticket) needs to paid separately while booking the ticket.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card on all the three cards.

Forex Payments

When it comes to overseas transactions, a fee of 3.50% of the transaction value + 18% GST (which adds up to 4.13%) is applied.

At least for the Vistara Infinite card, they should have considered a lower forex transaction fee but given the the card benefits with any of these cards are primarily focussed on domestic flying so it sort of makes sense.

Fuel Purchases

Vistara Platinum and Vistara Signature don’t offer 1% fuel surcharge waiver which is really a letdown as even the most basic credit cards offer surcharge fee waiver. Though you get reward points for fuel purchases with these two credit cards.

On the other hand, with Vistara Infinite card you don’t get reward points on fuel purchase but you get 1% fuel surcharge waiver across all petrol pumps in India as long as transactions are between Rs. 400 – Rs. 4000, exclusive of GST and other charges. There is no capping for surcharge waiver as well.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

Rent Payments

Rent payments are not eligible for earning reward points plus a charge of 1% of the transaction value + GST capped at Rs. 1500 per transaction is levied. Also, all the portals for rent payments take their own convenience fee which means use of these card for rent payments is not a good idea.

EMI Fees

For EMI transactions, a one-time processing fee of 1.5% or Rs. 250 whichever is higher is charged on the date of conversion.

Benefits

The benefits on these cards can be classified in two categories – Club Vistara benefits (Joining benefits, Ongoing benefits and Milestone Benefits) and Lifestyle benefit (Golf & Lounge access, Dining benefits etc.)

We already know about the amazing joining benefits so now let’s look at the Ongoing benefits of reward points and others as we go along.

Reward Points

On all the three credit cards, for eligible spends you earn reward points which are called CV points (Club Vistara). These points can be used for Award Flights or Upgrade Awards which we will see in the Redemption section later. 1 CV point is worth Rs. 1 while doing bookings via Vistara.

The points get posted to your Club Vistara account within 4-5 days from the date of transaction.

| SPEND TYPE | Axis Vistara Platinum | Axis Vistara Signature | Axis Vistara Infinite |

|---|---|---|---|

| Regular Spends | 2 points per Rs. 200 (1% reward rate) | 4 points per Rs. 200 (2% reward rate) | 6 points per Rs. 200 (3% reward rate) |

| Exclusions | Cash withdrawal, Interest charges, EMI Transactions, Fee & other charges, Wallet load, Rent | Cash withdrawal, Interest charges, EMI Transactions, Fee & other charges, Wallet load, Rent | Cash withdrawals, Interest charges, EMI Transactions, Fee & other charges, Wallet load, Rent, Fuel |

| Points Expiry | 3 years | 3 years | 3 years |

| Point Redemption Fee | Nil | Nil | Nil |

Milestone Benefits

The base reward rate on these cards (1%-3%) is not really exciting but the overall reward rate shoots up really fast when you consider the Milestone benefits that you get with these cards.

Note: Spend exclusions mentioned in Reward points section earlier apply to milestone benefits too.

There is an activation benefit (kind of an additional joining benefit) that you get only for 1st year of the card. And other than that, there are 4 more milestones (3 for Platinum card) that you can achieve. Both of these benefits are activated on CV account within 10 working days of reaching the spend threshold.

With each of these milestones, you get 1 ticket voucher of the corresponding travel class. i.e. 1 Economy class ticket voucher with Platinum card, 1 Premium Economy class ticket voucher with Signature card and 1 Business class ticket voucher with Infinite card.

If we recalculate the reward rate (which is mentioned against the cards at their respective milestones and includes base rewards too) we can see the Infinite card gives a mind boggling reward of more than 10% at all the milestones (15% @ 2nd milestone :)). The Signature card is also good with reward rate in high single digits for upto 4.5 lakh spends. Platinum card on other hand is pretty moderate with reward rate.

| Milestone | Vistara Platinum | Reward Rate | Vistara Signature | Reward Rate | Vistara Infinite | Reward Rate |

|---|---|---|---|---|---|---|

| Bonus CV points as Activation Benefit (only for 1st year) | 1000 points (on spending 50000 in first 90 days) | 3.0% | 3000 points (on spending 75000 in first 90 days) | 6.0% | 10000 points (on spending 100000 in first 90 days) | 13% |

| Milestone 1 | 1.25 lakh | 4.2% | 1.5 lakh | 9.3% | 2.5 lakh | 15% |

| Milestone 2 | 2.5 lakh | 3.8% | 3.0 lakh | 8.3% | 5.0 lakh | 13% |

| Milestone 3 | 6.0 lakh | 2.6% | 4.5 lakh | 8.0% | 7.5 lakh | 12.3% |

| Milestone 4 | – | 9.0 lakh | 5.8% | 12 lakh | 10.5% |

But but but 🙂 nothing is as good as it seems. Keep in mind that these calculations are done without considering the additional charges (refer Redemption section). Also, these are not ‘actual’ savings. If you already don’t fly Business or Premium Economy class then these calculations are more subjective.

Redemption

Now we know all about how we earn the points. Let’s see how we can burn the points. As mentioned earlier, you get the points and the vouchers credited to your CV account which can be used for travel bookings. Ensure to do the bookings at least 10 days in advance to get the award seats as availability is limited. Also, it depends on the season and the sector you want to book.

Voucher Redemption

Vouchers can only be used to make domestic flight bookings for the corresponding travel class for which you have the voucher. All the vouchers are first credited in the Club Vistara account as “On Demand voucher“. You need to use the “On Demand Voucher” to “issue” a voucher ticket within 6 months otherwise OR it will be automatically converted to a voucher ticket. Steps for issuing voucher ticket-

- Login to Club Vistara Account

- Navigate to “My Account” and select ‘My Vouchers’

- Select On-demand voucher generation

- Select the complimentary voucher to be issued from the list

- Click on ‘Issue’ to generate the Voucher ticket

A voucher ticket once issued will expire if not used within 3 months. So, in total you get 9 month validity. To extend the validity, you can follow the process given here. Post getting the voucher ticket follow below steps for booking-

- Log in to Club Vistara Account and visit the ‘My Vouchers’ section.

- Click on the ‘Redeem Complimentary Vouchers’ tab and choose the Voucher to redeem.

- Select desired flight, fill in the required details and complete booking.

You can also redeem the voucher by contacting Vistara Customer Service Center at +91 9289228888.

Points Redemption

You can use the points to either book the tickets for any travel class with Vistara OR do an upgrade to a higher travel class. To redeem for flights go to Vistara website.

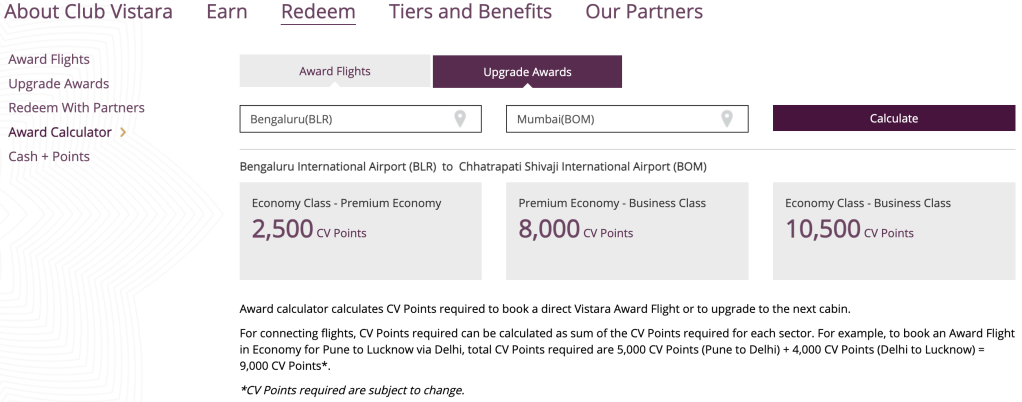

For doing an upgrade, you can use the Vistara’s Award calculator to find out how many points you need for upgrade and then connect with their customer service at +91 9289228888 or Airport ticketing office to do the rest. You can’t upgrade a “points” redemption ticket using points.

Tip: use CV points for upgrades to get better value.

If you wish you travel international and want to use CV points, you can also transfer your CV points to Vistara’s travel partners like Singapore Airlines, United Airlines and Lufthansa to travel across the world.

Note 1: Points & Vouchers can be used to book tickets for your family or friends too. You just need to declare them as a nominee (can add up to 8) on Vistara website.

Note 2: You need to pay additional taxes on voucher redemption: Rs. 400-1000 per ticket.

Club Vistara Membership Privileges

Club Vistara has 4 membership tiers – Base, Silver, Gold & Platinum (not given with Axis Vistara cards). Since you get complimentary CV membership with these cards, there are several additional benefits to reap based on which membership tier you hold. Main benefits are mentioned below –

| Benefits | Vistara Platinum (Base) | Vistara Signature (Silver) | Vistara Infinite (Gold) |

|---|---|---|---|

| Priority Check-in | N/A | Premium Economy Counter | Business Class Counter |

| Carry on plus (Cabin Baggage) | N/A | N/A | upto 12 Kg (inclusive of standard baggage allowance) |

| Priority Boarding | N/A | N/A | Yes |

| Priority Baggage Handling | N/A | N/A | Yes |

| Increased Check-in Baggage Allowance | N/A | additional 5Kg | additional 10Kg |

| Class Upgrade Vouchers | 1 | 3 | |

| Rescheduling Fee Waiver | N/A | N/A | Yes |

| Access to Partner Lounges for members | N/A | N/A | Yes |

As you can see Base CV membership is of hardly any use. With Silver membership you get an upgrade voucher and baggage allowance but the real perks come with Gold membership.

If you think about the value of all the perks that come with Gold, it would be at least 40000 🙂 (upgrade vouchers alone are worth 30000).

Tip: Use the class upgrade vouchers to upgrade from Premium Economy class to Business class for max. benefit as this way you can get value of around 10000 from a voucher.

All the upgrade vouchers are added to CV account. Details on how to use the upgrade Class upgrade voucher can be found here.

The redemption of upgrade vouchers and ticket vouchers is included in the pool of award redemptions. Consequently, their availability is limited on each flight, even for the Vistara credit card holders. Typically, Vistara provides 6 Economy, 4 Premium Economy, and 2 Business class award seats per flight. Thus, on popular routes, it is possible that you may be unable to obtain a free ticket or upgrade if the allocated quota has already been filled.

Travel Benefits

Airport Lounge Access

| Access Type | Access Via | Axis Vistara Platinum | Axis Vistara Signature | Axis Vistara Infinite |

|---|---|---|---|---|

| Domestic lounge | Visa Card | 2 per quarter | 2 per quarter | 2 per quarter |

The lounge list can be checked here. If you have the Vistara Infinite card, then through your CV Gold membership also , you can get complimentary lounge access but you need to check with the lounge desk if they have tie up with Vistara for the lounge program or not.

Even with Axis Vistara Signature card there are no complimentary International lounge access which is a bummer as this card is a premium credit card.

Dining Benefits

Since these are Axis credit cards, they are part of the Axis Dining Delight program. As part of this program, you can get good discount on your dining bills by using EazyDiner to pay the bill.

- Offer: 25% off upto Rs. 800 for Vistara Platinum & Vistara Signature cards; 40% off upto Rs. 1000 for Vistara Infinite card

- Min. Transaction: Rs. 2500

- Usage limit: Once a month per customer

Just with Axis Vistara Infinite card comes complimentary annual Eazydiner membership (costs around ~2400 per year) that renews every year on card anniversary date. The membership code is shared along with the primary card and is valid for 6 months from card issuance date. You will able to double dip while paying the dining bills on Eazydiner because you get 40% for using the card to pay the bill and additional discount from the membership.

There’s even more. For Vistara Infinite card users there is a special offer of 50% discount on the dining bill applicable just on birthdays

- Offer: 50% off upto Rs. 3000

- Min. Transaction: N/A

- Usage limit: Once on birthdays

More details on Axis Bank Dining Delight program are available here.

More details on Axis Bank Dining Delight program are available here.

Other Benefits

Insurance

All three cards come with additional insurance benefits for travel related mishaps. You can find the cover & claim procedure details here.

- Purchase protection cover upto Rs. 1 lakh

- Delay of check-in baggage cover of $300

- Loss of check-in baggage cover of $500

- Loss of travel documents cover of $300

Golf Games

Axis has something called Extraordinary Weekends under which it has promotes certain perks like Golf games, Airport concierge service and Airport transfers that it reserves for its premium and super-premium credit cards.

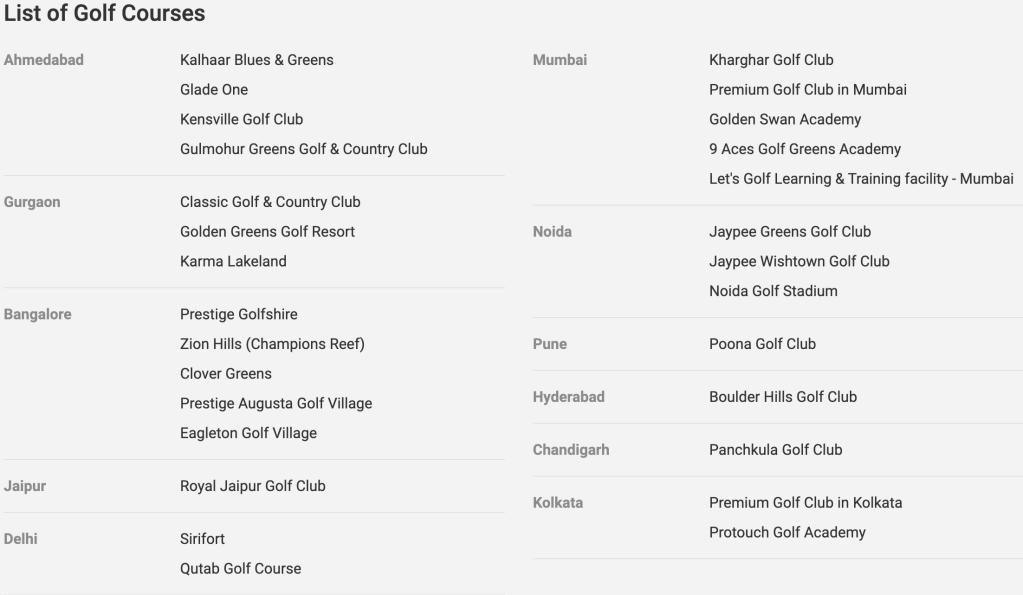

With Axis Vistara cards (only Signature & Infinite), you get complimentary golf games/lessons.

| Access Type | Axis Vistara Platinum | Axis Vistara Signature | Axis Vistara Infinite |

|---|---|---|---|

| Golf games/lessons | N/A | 3 rounds per year | 6 rounds per year |

You can book a golf lesson using Axis Extraordinary Weekends portal at any of the Golf courses that you see below. For detailed terms and booking process refer this.

Trident Hotel Offer

Just with Axis Vistara Infinite credit card, you can get 15% off on Trident hotel booking.

Best way to use these cards

- Axis Vistara Platinum

- Spend around 2.5 lakh (3.8% @2nd Milestone) to maximize rewards

- Avail the dining benefits

- Axis Vistara Signature

- Get this card if you fancy to travel with little extra comfort and leg space 🙂

- Spend around 4.5 lakh (8.0% @3rd Milestone) to get good value out of this card

- Avail complimentary lounge access & dining benefits

- Axis Vistara Infinite

- Get this card to fly like the elites 🙂

- Even if you spend 2.5 lakh, you get 2 Business class vouchers + 20000 CV points

How to apply

With Axis you can hold up a maximum of three cards. You can apply either on Axis bank website or at your nearest Axis bank branch. Axis Bank has improved their turnaround time for processing new card applications so you should be able to get the card approved within a week from the date of application.

Verdict

Among the three credit cards, the Axis Vistara Infinite is The Card you should get without an iota of doubt. With this card you will get the Business class experience, CV Gold membership, complimentary lounge access and Golf games. I don’t think I need to say more 🙂

If you are not eligible for the Axis Vistara Infinite credit card, then only you should opt for Axis Vistara Signature credit card as this one still has good value proposition. I would recommend to avoid getting the Axis Vistara Platinum card as that one is not worth all the hassle for less than 4% reward rate as you are better off other cashback cards like Axis Ace, Amex MRCC, Amex Gold and SBI Cashback card.

What are your thoughts about the Axis Vistara Credit Cards? Feel free to share your views in the comment section below.