If you are into credit cards, then you would have definitely heard about Axis Magnus credit card. It was crème de la crème of credit card world for a period of almost 1 year until Axis Bank devalued it during their restructuring of their entire credit card portfolio in August 2023. This was a serious blow to all those who care about credit cards and even more so to those who have or looking to get the Magnus card.

But this is all part of the game. If a credit card has features that seem too good to be true sooner or later it would get devalued. Having said that, we should re-evaluate this famous credit card and see whether it it is still an exciting product or the days of this card as the sweetheart of credit card world are over. Let’s talk about the benefits and features of this card in detail.

- Overview

- Magnus for Burgundy Customers

- Design

- Fees & Charges

- Benefits

- Best way to use this card

- How to apply

- Verdict

Overview

Axis Magnus credit card is positioned as a super premium credit card based on the hierarchy of Axis bank credit cards and the features this card offers. Like with any premium rewards credit card, the reward rate is not fixed and depends on how and where you use the card to earn the rewards and how well you utilize those rewards. But if you know the game, then this card can give you double digit rewards if you are a high spender.

| Type | Super Premium Rewards Credit Card |

| Reward Rate | 1.2% to 24% |

| Best for | Travel spends via Axis Travel Edge Portal; High spenders |

Magnus for Burgundy Customers

Before getting into the details of card features & benefits, you should know that Axis Bank has technically created two Magnus cards now –

- Magnus Card for non-Burgundy A/C holders – card has lower points transfer limit & conversion rate

- Magnus Card for Burgundy A/C holders who meet ‘Burgundy Relationship Eligibility Criteria‘

The Magnus Card for Burgundy comes with a much better points conversion rate (5:4 instead of 5:2) and also the capping to transfer the reward points is raised to 10 lakh points in a calendar year. All the additional advantages for Burgundy customers are highlighted in the relevant sections below.

To meet the eligibility criteria, you need to have Avg Quarterly Balance of Rs. 10 lakhs in the Savings Account OR Receive a net salary credit in excess of Rs 3 lakhs per month lakhs every month in Axis Bank Salary Account. There are other options too which can be found here.

If you already hold the Magnus card & meet the Burgundy criteria, you can call on 1800 419 0065 & give consent to upgrade to new Magnus Credit Card for Burgundy (no additional joining benefit is awarded in this case).

One way to look at this is that Axis Bank wants to have more of your money in their hands to let you get full benefits of Magnus card 🙂

Design

The card comes in a metal form factor on Visa Infinite platform. The instant you hold the card you know that this card is a premium credit card 🙂 The design of the card is also very classic and minimal with a vertical orientation. Some may have the plastic version of this card issued on Mastercard World network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. |

| Joining Fee Waiver | N/A |

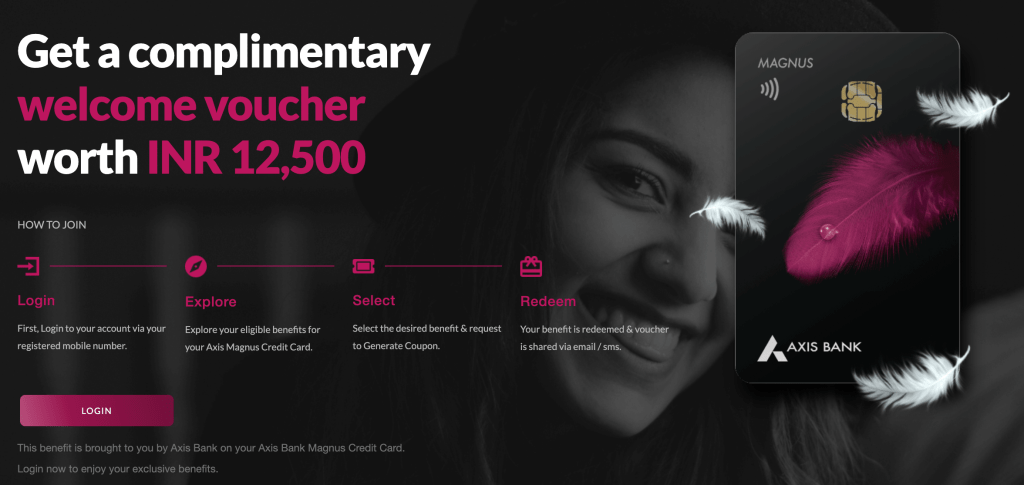

| Joining Benefit | Voucher worth Rs. 12500 (Luxe gift card or Postcard Hotels gift voucher or Yatra gift voucher) |

| Renewal Fee | Rs. |

| Renewal Benefit | N/A |

| Renewal Fee Waiver | waived off on annual spends greater than Rs. Rent, EMI transactions, Wallet loads, Government services and Utilities payments aren’t eligible for renewal fee waiver |

Post the devaluation, the renewal benefit (voucher equivalent to the fee) has been discontinued and the waiver criteria has also been revised (increased by 10 lakh). Unless you have high spends, keeping this card would not be a sound decision as recovering the fee wouldn’t be easy.

The voucher for the joining benefit is awarded (only for paid cards) post doing 1st transaction within 30 days from card issuance date and can be redeemed (within 6 months from card activation date) from here once you get an SMS on your number for the same.

There are various terms & conditions regarding the voucher validity & redemption which you should check here.

Note: Burgundy customers acquiring new ‘Magnus for Burgundy Credit Card’ can choose from one complimentary economy class one way domestic flight ticket or a Luxe Gift voucher or PostCard Hotels gift voucher worth upto Rs. 5000. Also, joining & renewal fee is waived off for Burgundy customers till 30th Nov 2023!!

Other Charges

Supplementary Card

There is no fee for applying for supplementary cards. You should definitely get supplementary cards as they come with complimentary domestic airport lounge access 🙂

Forex Payments

2% of the transaction value + 18% GST (which adds up to 2.36%). In case your spends are high (>1.5 lakh), then you should use this card on foreign trips.

Fuel Purchases

There is no reward on fuel purchases but you do get 1% fuel surcharge waiver across all petrol pumps in India as long as transactions are between Rs. 400 – Rs. 4000, exclusive of GST and other charges.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

There is no capping for surcharge as well.

Rent Payments

A charge of 1% of the transaction value + GST capped at Rs. 1500 per transaction is levied. As rent transactions are eligible for rewards, you can consider using this credit card for rent payments but only if you use the points for partner transfer option.

EMI Fees

For EMI transactions, a one-time processing fee of 1.5% or Rs. 250 whichever is higher is charged on the date of conversion.

Cash Withdrawal

Usually withdrawing cash from credit cards is a horrible idea, but not with this credit card. There are no charges on taking out cash so in those situations where you can’t use your card to pay, this could be a life-saver.

Benefits

Reward Points

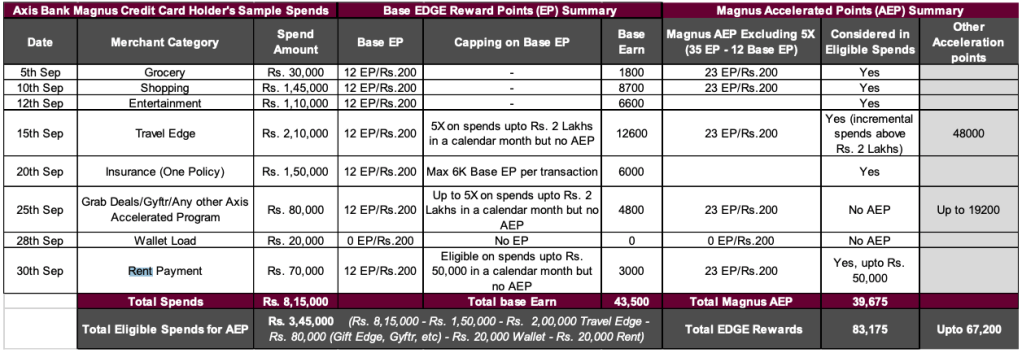

With Magnus card, the reward rate is 12 Edge Reward points (Base points) on Rs. 200 spent. For incremental spends above Rs. 1.5 lakh, Axis has introduced Accelerated Reward Point benefit (35 Edge Rewards points per Rs. 200 spent.). This has been introduced in place of the monthly milestone benefit.

Base Points are credited in T+15 days for all eligible spends in the calendar month and post completion of calendar month, the accelerated reward points are credited in 45 days from the evaluation month end date.

| SPEND TYPE | REWARD | REWARD RATE (EDGE REWARDS PORTAL) | REWARD RATE (POINTS TRANSFER) |

|---|---|---|---|

| Regular Spends | 12 points per Rs. 200 (1X) | 1.2% | 2.4% – 4.8% |

| Incremental Spends above Rs 1.5 lakh per month | 35 points per Rs. 200 | 3.6% | 7.2% – 14.4% |

| Travel Edge portal spends upto Rs. 2 lakh per month | 60 points per Rs. 200 (5X) | 6% | 12% – 24% |

| Travel Edge portal spends beyond Rs. 2 lakh per month | 35 points per Rs. 200 | 3.6% | 7.2% – 14.4% |

| Redemption Fee | NIL |

2. Rent transactions only upto Rs. 50000 are eligible to earn base rate & counted for 1.5 lakh threshold

3. Grab Deals, Gyftr, Gift Edge spends are ineligible for reaching 1.5 lakh threshold (these spends will earn extra points as usual)

4. Travel Edge portal spends upto Rs. 2 lakh are ineligible for reaching 1.5 lakh threshold

5. A single Insurance transaction can earn max. 6000 points

Reward rate on EDGE Rewards portal is calculated considering 1 point as 20 paise. Reward rate for points transfer will vary (varies from 40p to 80p) as per the partner transfer rate and redemption timing.

Note: Burgundy customers have the same reward rate structure.

Tip: You can use Axis Magnus Card to buy gift cards using Axis Grab Deals portals to earn 5X/10X rewards.

Milestone Benefits

Earn 25000 points on reaching spend threshold of Rs. 1 lakh in a month. This amazing perk has been discontinued post devaluation. Instead they have introduced the concept of accelerated reward points option that we saw above.

Redemption

For points redemption, you have below options –

- Edge Rewards Catalogue or Gift Edge portal – gives 20p/point value – Don’t do this!!

- Pay with points across partner stores – Don’t do this either!!

- Points Transfer to Travel Partners via Travel Edge portal at conversion rate of

5:45:2 – Best option to redeem points!!- 5 EDGE Reward Points = 2 Partner Points/Miles

- Check the partner names & transfer process here

- The “point value” shoots up to ~40p (Marriott) or even ~80p if you explore airline partners.

The reward rate is simply wonderful when you use points for partner transfer. For points transfer to partners, there is a yearly limit of 5 lakh points per calendar year across 19 travel partners.

Note: Burgundy Customers get conversion rate of 5:4 & can transfer upto 10 lakh points per calendar year.

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge (Primary & Add-on) | Visa / Mastercard | Unlimited | – |

| International Lounge (Only Primary) | Priority Pass | Unlimited | 8 per anniversary year |

With this card, you get unlimited complimentary access to domestic & international lounges 🙂 which is seriously an amazing perk and you don’t need to track your usage which is a great benefit for regular flyers. What’s even better is add-on cards are also eligible for domestic lounge access. You can have your guests get access too.

For international lounge access, you need to use the Priority pass which is delivered in the welcome kit along with Magnus card.

Essentially what this means is with the combo of Magnus card (primary & add-on) + Priority pass, you won’t have to worry about lounge visits ever 🙂

List of domestic airport lounges can be checked here & for international lounge access via Priority Pass check here. There are certain domestic lounge in tier 2 cities that you can access via Priority pass-

- Agartala – Primus Lounge

- Allahabad/Prayagraj – Zesto Executive lounge

- Amritsar – Costa Coffee

- Bhopal – Primus Lounge

- Cochin – Earth Lounge

- Dibrugarh – Primus Lounge

- Guwahati – The Lounge

- Kannur – Pearl Lounge Domestic

- Madurai – Primus Lounge

- Varanasi – Take Off Bar

Airport Concierge Service

Axis Magnus card comes with concierge service as part of which one can get assistance to have smooth and hassle-free airport transfer. The service includes assistance across airport processes, such as check-in, security check, and immigration processes, and porter services. You can book this service from Axis Extraordinary Weekends portal

| ACCESS TYPE | LIMIT | GUEST ACCESS |

|---|---|---|

| Airport Concierge Service | 8 per calendar year | Yes |

Using this service will surely make you feel like a celebrity 🙂 at the airport and it could be very helpful during international trips when you have to deal with immigration process. For detail terms of this service check here.

Dining Benefits

For foodies out there, Magnus card gives lot of benefits. You will get complimentary annual Eazydiner membership (costs around ~2400 per year) that renews every year on card anniversary date. The membership code is shared along with the primary card and is valid for 6 months from card issuance date.

Also as part of Axis Dining Delight program, you will able to double dip while paying the dining bills on Eazydiner because you get 40% for using Magnus card to pay the bill and additional discount from the membership.

- Offer: 40% off upto Rs. 1000

- Min. Transaction: Rs. 2500

- Usage limit: Once a month per customer

There is a special offer of 50% discount on the dining bill applicable just on birthdays

- Offer: 50% off upto Rs. 3000

- Min. Transaction: N/A

- Usage limit: Once on birthdays

More details on Axis Bank Dining Delight program are available here.

Movie Ticket Benefits

You can book movie or even event tickets from BookMyShow and get upto Rs. 500 off on 2nd ticket. This is an amazing perk and gives lot of value. Even if you use it 6 times a year, you save a cool Rs. 3000 (20% of the card fee) assuming you hit the price ceiling.

- Min Transaction: Book at least 2 tickets

- Usage limit: 5 times per month

- How to use: Apply ‘Axis Bank Magnus Credit card offer’ on BMS

Since the Magus card is on Visa Infinite, you can even use the Visa Infinite offer on BMS to get ticket discounts but Visa offers may get maxed out (its first come first serve) pretty fast compared to the direct BMS offer on Magnus, so the separate Magnus offer still makes sense.

Other Benefits

Golf Games

Axis doesn’t the golf games perk on the Magnus credit card. They have kept this privilege limited to other premium cards like Axis Reserve credit card, Axis Vistara credit card , Burgundy Private Credit card & surprisingly Axis Select credit card.

24×7 Concierge

For their premium credit card holders like Axis Magnus, Axis Reserve & Burgundy customers, Axis has concierge services (call 1800 103 4962) to provide assistance for flight bookings, table reservations, event/shows etc. This could come in handy but the service level they offer might not be as good as Amex does for the Amex Platinum charge card.

Insurance

You you get additional insurance benefits for travel related mishaps & purchases. You can find the cover & claim procedure details here.

- Counterfeit/Lost card liability upto credit limit

- Purchase protection upto Rs. 2 lakh

- Loss/Delay in baggage & personal documents cover of $500

- Credit Shield cover of Rs. 5 lakh

Personally, I haven’t ever used this option and I hope you also don’t ever have to but this certainly gives additional peace of mind.

Health & Wellness Perks

Axis has partnered with Aspire Lifestyles to enable certain health services for Magnus card holders which include

- Medical Concierge Program

- You can get tele-consultation, Diet & Nutrition Consultation, Physiotherapy at home at discounted rates. The exhaustive list of services is mentioned here. You might get slightly better rates with Axis compared to what you get from Practo or some other apps. With the same concierge, you can get your medical reports reviewed for 2nd opinion by doctors from reputed hospitals but the service is too costly in my opinion.

- Preventive Healthcare Packages

- Also, if you need any sort of preventive healthcare packages, you can book that too from their concierge. They have tie ups with Dr. Lal Path labs and Metropolis. Again the rates may be better but cross check for that. I feel you can good discounts from apps like Pharmeasy anyway.

- Global Travel & Medical Assistance

- This service is primarily for the situation when you need any travel assistance like visa or inoculation related during foreign trips.

These services can be booked by calling the concierge @ 1800 103 4962 or email @ AxisBankConcierge@aspirelifestyles.com

Best way to use this card

- Make travel bookings via TravelEdge portal for 6% reward rate

- Transfer reward points to travel partners like Marriott, ITC or Vistara etc. for great value

- Book movie or events on BMS

- Pay for dining bills on EazyDiner app

- Avail unlimited airport lounge visits

How to apply

With Axis you can hold up a maximum of three cards. You can apply either on Axis bank website website or at your nearest Axis bank branch.

Verdict

The question remains – Should we get/keep the Axis Magnus credit card post the devaluation? My recommendation is that if you are a high spender (>1.5 lakh every month) then definitely Yes! But if your spends are in 5 digits then you can still get this card given that you extract value by using other benefits like Concierge service, Lounge visits, BOGO movie offer and bragging rights for metal form factor card 😉

In case you don’t see any value in the misc benefits, only then you should disregard this credit card and can consider other options like Amex Platinum Travel credit card which is a great card for half the fee (free for first year) and gives high single digit rewards.

What are your thoughts about the Axis Magnus Credit Card? Feel free to share your views in the comment section below.