Axis has a lot of credit cards ranging from entry level to premium to super premium. But there is something even above that – Axis Reserve credit card. This isn’t a card for the masses andis aimed at affluent customers because it is their flagship product and is positioned as an ultra-premium credit card that sits above Axis Magnus credit card.

This card was also affected with the devaluation which Axis Bank did in August 2023. So it stands to reason to revisit the card benefits and find the answer to the question whether it can justify the high fees it demands. Let’s talk about the benefits and features of this card in detail.

- Overview

- Reserve for Burgundy Private

- Design

- Fees & Charges

- Benefits

- Best way to use this card

- How to apply

- Verdict

Overview

Axis Reserve is an ultra-premium rewards credit card that is for affluent customers with very high spends and have a luxury lifestyle. Like with any premium rewards credit card, the reward rate is not fixed and depends on how and where you use the card to earn the rewards and how well you utilize those rewards.

Features and perks of this card are designed to give your rich life experiences so the reward rate is sort of misleading as the experiences you get with this card needs to be valued based on personal parameters.

| Type | Ultra Premium Rewards Credit Card |

| Reward Rate | 1.5% – 3% |

| Best for | Very high spenders; Airport concierge & transfer benefits |

Reserve for Burgundy Private

Before getting into the details of card features & benefits, you should know that Axis Bank has technically created two Reserve cards now –

- Reserve Card – card has lower points transfer limit & conversion rate

- Reserve Card for Burgundy Private A/C holders – card has higher points conversion rate

The Reserve Card for Burgundy Private A/C holders comes with a better points conversion rate (5:4 instead of 5:2) and also the capping to transfer the reward points is raised to 10 lakh points in a calendar year.

To open a Burgundy Private A/C, you need to have Total Relationship Value (TRV) of Rs. 5 crore. The TRV is calculated at Customer ID or Family ID level. You can check the TRV calculation details here. It is obvious that this option is for the HNIs.

Design

The card comes in a metal form factor on Visa Infinite platform. Individually just looking at the card, it won’t make you feel like you hold something so valuable in your hand as there are metal cards out there with 1/5 of the fee of this card like Axis Magnus credit card.

The design on the front of the golf ball and the club emphasizes the biggest privilege that comes with this card. Overall, the design is minimal and should appeal to majority of the people out there.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 50000 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | 50000 EDGE Reward points (only for paid cards) |

| Renewal Fee | Rs. 50000 + 18% GST |

| Renewal Benefit | 50000 EDGE Reward points (only for paid cards) |

| Renewal Fee Waiver | waived off on annual spends greater than Rs. 35 lakh; Rent, EMI transactions, Wallet loads, Government services and Utilities payments aren’t eligible for renewal fee waiver |

The points for the joining benefit are awarded (only for paid cards) post doing 1st transaction within 30 days from card issuance date. 50000 points are worth Rs. 10000 if redeemed on EDGE Rewards portal but there are better ways to utilize the points which we will see later.

Other Charges

Supplementary Card

There is no fee for applying for supplementary cards. You should definitely get supplementary cards as they come with complimentary domestic & international airport lounge access 🙂

Forex Payments

1.5% of the transaction value + 18% GST (which adds up to 1.77%).

Reward rate for forex transactions is 3% at least. What that means is use of this card overseas will not only save money but you will in fact earn 1.2% :).

Fuel Purchases

If the transaction is below Rs. 400 or above Rs. 4000, then you get 15 points per Rs. 200 spend without any surcharge fee waiver.

If the transactions are between Rs. 400 – Rs. 4000, then there is no reward but you do get 1% fuel surcharge waiver across all petrol pumps in India, exclusive of GST and other charges.

There is a capping of Rs. 400 per statement cycle for surcharge waiver which is more than enough.

Rent Payments

A charge of 1% of the transaction value + GST capped at Rs. 1500 per transaction is levied. As rent transactions (upto 1 lakh) are eligible for rewards, you can consider using this credit card for rent payments if you use the points for partner transfer option.

EMI Fees

For EMI transactions, a one-time processing fee of 1.5% or Rs. 250 whichever is higher is charged on the date of conversion.

Cash Withdrawal

Usually withdrawing cash from credit cards is a horrible idea, but not with this credit card. There are no charges on taking out cash so in those situations where you can’t use your card to pay, this could be a life-saver.

Benefits

Reward Points

With Reserve card, the base reward rate is 15 Edge Reward points (Base points) on Rs. 200 spent. For international spends reward rate is double of that.

| SPEND TYPE | REWARD | REWARD RATE (EDGE REWARDS PORTAL) | REWARD RATE (POINTS TRANSFER) |

|---|---|---|---|

| Regular Spends | 15 points per Rs. 200 (1X) | 1.5% | 3% – 6% |

| International Spends | 30 points per Rs. 200 (2X) | 3% | 6% – 12% |

| Redemption Fee | NIL | ||

| Exclusions | 1. Government services and Utilities payments are ineligible for points 2. Rent transactions (MCC 6513) only upto Rs. 100000 are eligible to earn rewards at base rate (7500 points per month) 3. Fuel transactions below 400 and above 4000 will be eligible for reward points |

Reward rate for Points Transfer will vary as per the partner transfer rate and redemption timing.

As you see the reward rate is simply wonderful when you use points for partner transfer.

Note: Burgundy customers have the same reward rate structure.

Tip: You can Axis Reserve Card to buy gift cards using Axis Grab Deals portals to earn 5X/10X rewards.

Redemption

For points redemption, you have below options –

- Edge Rewards Catalogue or Gift Edge portal – gives 20p/point value – Don’t do this!!

- Pay with points across partner stores – Don’t do this either!!

- Points Transfer to Travel Partners via Travel Edge portal at conversion rate of

5:45:2 – Best option to redeem points!!- 5 EDGE Reward Points = 2 Partner Points/Miles

- Check the partner names & transfer process here

- The “point value” shoots up to ~40p (Marriott) or even ~80p if you explore airline partners.

For points transfer to partners, there is a yearly limit of 5 lakh points per calendar year across 19 travel partners.

Note: Burgundy Customers get conversion rate of 5:4 & can transfer upto 10 lakh points per calendar year.

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge (Primary & Add-on) | Visa / Mastercard | Unlimited | 12 per calendar year |

| International Lounge (Primary & Add-on) | Priority Pass | Unlimited | 12 per anniversary year |

With this card, you get unlimited complimentary access to domestic & international lounges 🙂 per which is seriously an amazing perk and you don’t need to track your usage which is a great benefit for regular flyers. What’s even better is add-on cards are also eligible for domestic & international lounge access. You can even have your guests accompany you for the lounge visits.

For international lounge access, you need to use the Priority pass for the primary and add-on card member which is delivered in the welcome kit along with Reserve credit card.

Essentially what this means is with the combo of Reserve card (primary & add-on) + Priority pass, you won’t have to worry about lounge visits ever 🙂

List of domestic airport lounges can be checked here & for international lounge access via Priority Pass check here. There are certain domestic lounge in tier 2 cities that you can access via Priority pass-

- Agartala – Primus Lounge

- Allahabad/Prayagraj – Zesto Executive lounge

- Amritsar – Costa Coffee

- Bhopal – Primus Lounge

- Cochin – Earth Lounge

- Dibrugarh – Primus Lounge

- Guwahati – The Lounge

- Kannur – Pearl Lounge Domestic

- Madurai – Primus Lounge

- Varanasi – Take Off Bar

Airport Concierge Service

Axis Reserve card comes with Airport concierge service as part of which one can get assistance to have smooth and hassle-free airport transfer. The service includes assistance across airport processes, such as check-in, security check, and immigration processes, and porter services. You can book this service from Axis Extraordinary Weekends portal but should be done at least 48 hours in advance.

| ACCESS TYPE | LIMIT | GUEST ACCESS |

|---|---|---|

| Airport Concierge Service | 8 per calendar year | Yes |

Using this service will surely make you feel like a celebrity 🙂 at the airport and it could be very helpful during international trips when you have to deal with immigration process. For detail terms of this service check here.

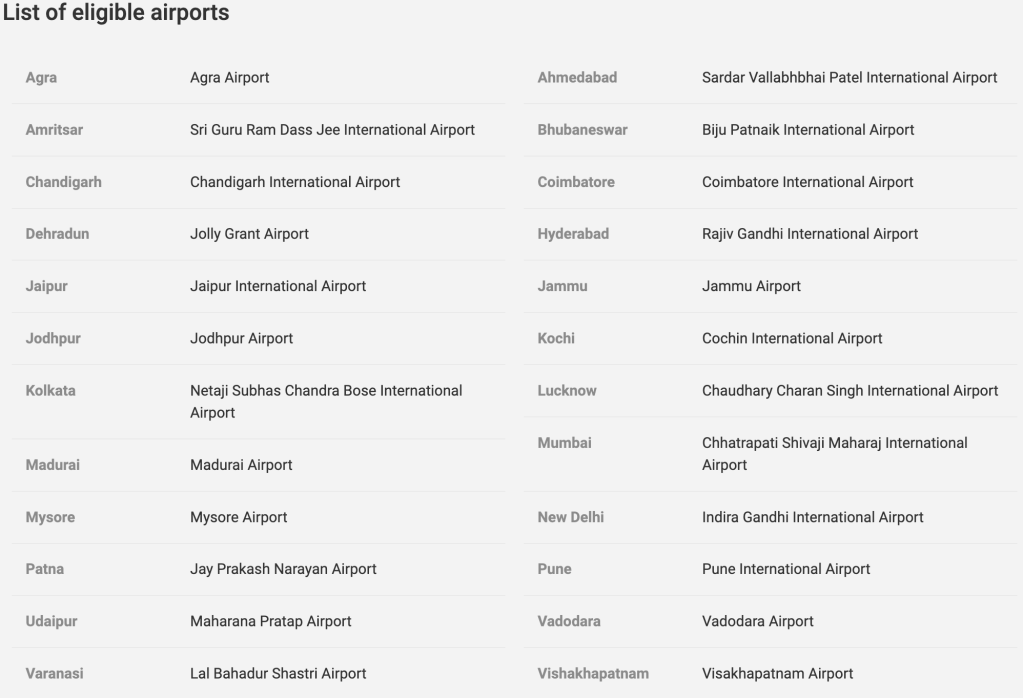

Airport Transfers

One privilege that you might get with 99.99% of the cards out there is the Airport pick-up service. The only other card I know of which comes with this perk is Axis Atlas.

What this entails is the privilege to avail Luxury Airport transfer service which means you can get upto 4 complimentary airport rides per year in a luxury sedan or regular sedan as per the availability. This service can be booked on Axis Extraordinary Weekends portal.

Luxury Hotel Stay Perks

There are several offers that Reserve card offers with 5 different hospitality chains. For three of them, you get the yearly membership by filling this consent form. Below are brief details about all of them-

Club ITC Culinaire Membership

You will get complimentary ITC Culinaire membership as long as you hold the card. What you get is a bunch of ‘certificates’ (read Vouchers) that can be used for room upgrades, free night stay, dining discounts etc. This can be easily valued at Rs. 20000. Read the details here.

Accorplus Membership

As part of this perk, you will get complimentary Accorplus membership and certificates for accomodation, food & beverage. Refer the offer details here.

Marriott Membership

Although Marriott has its own membership program called Marriott Bonvoy but with Reserve card you will get some sort of tailored membership that will come with similar benefits. You will get bunch of certificates for accomodation, food & beverage. Refer the offer details here.

Marriott properties are always great to visit and they go out of their way to make you feel special so I will recommend to use this option.

Oberoi Hotels Offer

Axis Reserve can get you 15% off on Best Available Rates (BAR) on International & Domestic Oberoi Properties plus OR 3rd night complimentary. Additionally, Complimentary room upgrade to next category could be availed but that’s always depends on room availability. Refer the offer details here.

Postcard Hotels Offer

At Postcard hotels, you can get 15% off on best available room rates by booking from this link and using code ‘AXISVIP’ plus you also get

- Anytime complimentary artisanal breakfast

- Anytime check in and check out

- Complimentary welcome drink from a choice local spirits, cocktails and non-alcoholic beverage

Refer the offer details here. Postcard hotels are limited in number but if you wanted to visit one then use this to save some money.

Dining Benefits

For foodies out there, Reserve card gives lot of benefits. You will get complimentary annual Eazydiner membership (costs around ~2400 per year) that renews every year on card anniversary date. The membership code is shared along with the primary card and is valid for 6 months from card issuance date.

Also as part of Axis Dining Delight program, you will able to double dip while paying the dining bills on Eazydiner because you get 40% for using Reserve card to pay the bill and additional discount from the membership.

- Offer: 40% off upto Rs. 1000

- Min. Transaction: Rs. 2500

- Usage limit: Once a month per customer

There is a special offer of 50% discount on the dining bill applicable just on birthdays

- Offer: 50% off upto Rs. 3000

- Min. Transaction: N/A

- Usage limit: Once on birthdays

More details on Axis Bank Dining Delight program are available here.

Movie Ticket Benefits

You can book movie or event tickets from BookMyShow and get 2nd ticket for free. This is an amazing perk and gives lot of value.

- Offer: upto 500 off on movie ticket OR upto 1000 off on non-movie ticket

- Min Transaction: Book at least 2 tickets

- Usage limit: 5 times per month each for movie & non-movie bookings

- How to use: Apply ‘Axis Reserve credit card offer’ on BMS

Even if you use it 10 times a year just for movies, you save a cool Rs. 5000 (10% of the card fee) assuming you hit the price ceiling.

Other Benefits

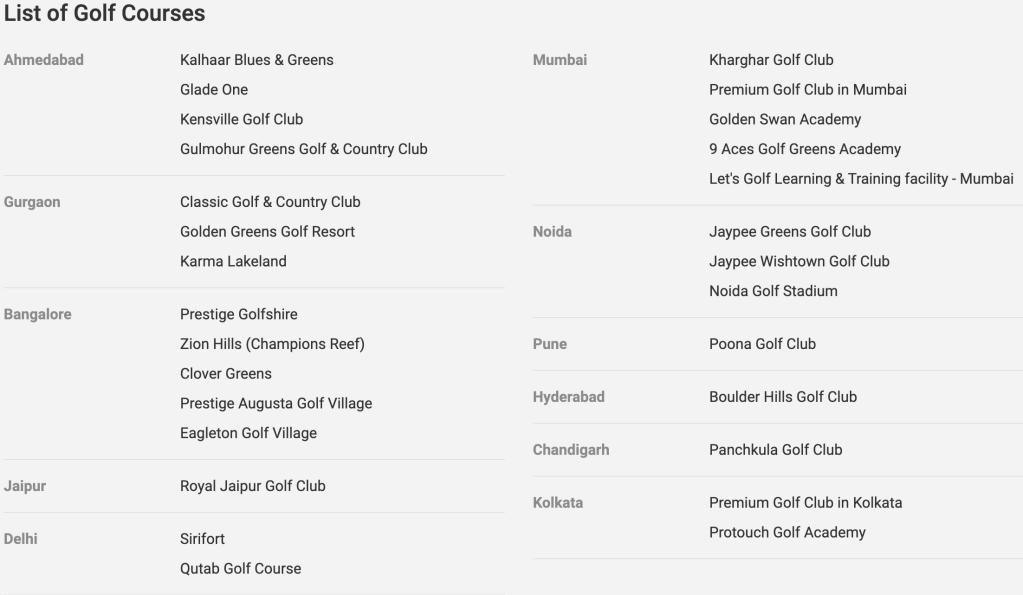

Golf Games

Axis has something called Extraordinary Weekends under which it has promotes certain perks like Golf games, Airport concierge service and Airport transfers that it reserves for its premium and super-premium credit cards.

With Axis Reserve card, you get upto 50 complimentary golf games/lessons. For the target audience of this credit card, this perk should be very useful.

| Access Type | Limit |

|---|---|

| Golf games/lessons | 50 rounds per year |

You can do the booking using Axis Extraordinary Weekends portal at any of the Golf courses that you see below. For detailed terms and booking process refer this.

24×7 Concierge

For their premium credit card holders like Axis Magnus, Axis Reserve & Burgundy customers, Axis has concierge services (call 1800 103 4962) to provide assistance for flight bookings, table reservations, event/shows etc. This could come in handy but the service level they offer might not be as good as Amex does for the Amex Platinum charge card.

Insurance

You you get additional insurance benefits for travel related mishaps & purchases. You can find the cover & claim procedure details here.

- Counterfeit/Lost card liability upto credit limit

- Purchase protection upto Rs. 2 lakh

- Loss/Delay in baggage & personal documents cover of $500

- Credit Shield cover of Rs. 5 lakh

Personally, I haven’t ever used this option and I hope you also don’t ever have to but this certainly gives additional peace of mind.

Best way to use this card

- Utilize for overseas spends

- Avail discounts at luxury hotel properties

- Transfer reward points to travel partners like Marriott, ITC or Vistara etc. for great value

- Book movie or events on BMS

- Have fun playing golf OR get chauffeured in luxury sedan for airport rides

- Pay for dining bills on EazyDiner app

- Avail unlimited airport lounge visits

How to apply

With Axis you can hold up a maximum of three cards. You can apply either on Axis bank website or at your nearest Axis bank branch.

Verdict

For the sky high fee and the not so great welcome benefit, it begs the question that whether one should get the Axis Bank Reserve credit card or not. Well the card’s target audience is primarily upper class affluent customers like executives or businessmen and for them the fee is hardly of any concern.

For others who are earning 6 digit salary, this card might not be the right choice as you need to have a certain lifestyle to actually be able to get good value from this card.

I think one should opt Axis Magnus which can give almost ~80% of the same benefits at ~80% less fee.

If you need something outside of Axis but in ultra-premium category then you should consider Amex Platinum charge card and for something less premium you can look at Amex Platinum Travel credit card which is a great card (free for first year) and gives high single digit rewards.

What are your thoughts about the Axis Reserve Credit Card? Feel free to share your views in the comment section below.