Axis Select credit card sits in the middle among the long list of cards card offered by Axis Bank. This card is suitable for medium to high spenders and has a decent reward rate. It is a level above the Axis Privilege card and hence you get some additional benefits on top of that card.

Someone who already has an entry level credit card with Axis can consider upgrading to this depending on how well it complements their lifestyle. Let’s talk about the benefits and features of this card in detail.

Overview

This card is targeted towards medium to high spenders and can even appeal to some high spenders as it comes with decent milestone benefits, 24*7 concierge service and golf game perks. There are offers for young users like BOGO on BookMyShow, Swiggy and Big Basket discounts etc.

| Type | Premium Rewards Credit Card |

| Reward Rate | >2% |

| Best for | Retail Spends, Movie & Food offers, Lounge Access |

Design

Like most of the Axis credit cards, this one too has a vivid graphic design on a black backdrop. Not sure why the went for the ‘clock’ motif. Nevertheless, the card looks nice to hold and look at. It is issued on the Visa Signature network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 3000 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | 10000 EDGE Reward points worth 2000 (only for PAID cards) |

| Renewal Fee | Rs. 3000 + 18% GST |

| Renewal Benefit | N/A |

| Renewal Fee Waiver | waived off on annual spends greater than Rs. 6 lakh; Rent transactions (MCC 6513) and wallet load transactions (MCC 6540) aren’t eligible for fee waiver |

The points for joining benefit are credited to EDGE Rewards account within two weeks of doing 1st transaction as long as it is done with 30 days of card issuance.

It is a little disappointing to see no renewal benefit at all as the renewal fee waiver criteria is a little on the higher side.

Note: If you hold a Axis Burgundy A/C (criteria – Average Quarterly Balance of Rs. 10 lakhs in the Savings A/C OR Net salary credit in excess of Rs. 3 lakhs every month in Salary A/C), then you can get this card LTF.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%) which means it is not a good option to use it for foreign trips as you would end up paying 2.13% extra (4.13% – 2%).

Fuel Purchases

There is no reward on fuel purchases but you do get 1% fuel surcharge waiver across all petrol pumps in India as long as transactions are between Rs. 400 – Rs. 4000, exclusive of GST and other charges.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

There is a capping of Rs. 400 per statement cycle for surcharge waiver per credit card account which is more than enough.

Rent Payments

No reward points on rent payments plus a charge of 1% of the transaction value + GST capped at Rs. 1500 per transaction is levied. Also, all the portals for rent payments take their own convenience fee which means use of this card for rent payments is not a good idea.

EMI Fees

For EMI transactions, a one-time processing fee of 1.5% or Rs. 250 whichever is higher is charged on the date of conversion.

Benefits

Reward Points

Reward points for regular spends earn at base rate of 10 points per Rs. 200 and for retail spends reward rate is 2X.

| Spend Cateogry | Reward | Reward Rate |

| Spends up to 20000 | 20 points for every Rs. 200 (2X) | 2% |

| Retail Shopping Spends (Dept. Stores, Grocery Stores, Clothing & Apparel Stores for Women, Children, Family etc.) | 20 points for every Rs. 200 (2X) | 2% |

| Any Other Spends beyond 20000 | 10 points for every Rs. 200 (1X) | 1% |

| Reward Point Expiry | Never | |

| Redemption Fee | NIL | |

| Exclusions | Insurance, Rent, Fuel, Education Services, Utilities, Government Institutions, EMI transactions |

Any spend up to 20000 will get 2X rewards whether it is retail spend or not. Post 20000, if it is retail spend then 2X reward rate is applicable otherwise 1X reward rate is applied.

Tip: You can use Axis Select Card on gift cards using Axis Grab Deals portals to earn 5X/10X rewards.

Milestone Benefit

On reaching spend threshold of Rs. 3 lakh, 5000 bonus reward points are awarded. If we consider spends of 6 lakh a year (50000 per month with half of it on retail spends), then the reward rate could would easily go above 2%.

For points redemption, you can do so on Edge Rewards Catalogue which gives 20p/point value.

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Domestic Lounge (Primary) | Visa | 2 per quarter |

| International Lounge (Primary) | Priority Pass | 12 per year |

With this card, you get 2 complimentary domestic airport lounge access per quarter (equates to 8 visits a year) which is a great value for regular flyers. For the International lounge visits, you would get complimentary Priority Pass for which there are some conditions to fulfil –

- Year 1 – on completing one successful transaction on Select card in the 1st 90 days of card issuance.

- Year 2 onwards – Renewal for Priority Pass is done on spending Rs.3 Lakhs in the preceding card anniversary year.

The coverage of lounge and the limit is good for the card of this price range. List of eligible airport lounges can be checked here. For international lounge list, you can check here.

Dining Benefits

As part of Axis Dining Delight you can get upto 25% off upto Rs. 800 at restaurants by using EazyDiner to pay the bill.

- Offer: 25% off upto Rs. 800

- Min. Transaction: Rs. 2500

- Usage limit: Once a month per customer on EazyDiner

More details on Axis Bank Dining Delight program are available here.

Movie Ticket Benefits

You can book movie or event tickets from BookMyShow and get 2nd ticket for free. This is an amazing perk and gives lot of value.

- Offer: upto 300 off on movie or live event ticket

- Min Transaction: Book at least 2 tickets

- Usage limit: Once per month

- How to use: Apply ‘Axis Bank Select credit card offer’ on BMS

If you use it 12 times a year, you save a cool Rs. 3600 which means you can recoup the entire card fee including GST just by utilizing this perk 🙂

Other Benefits

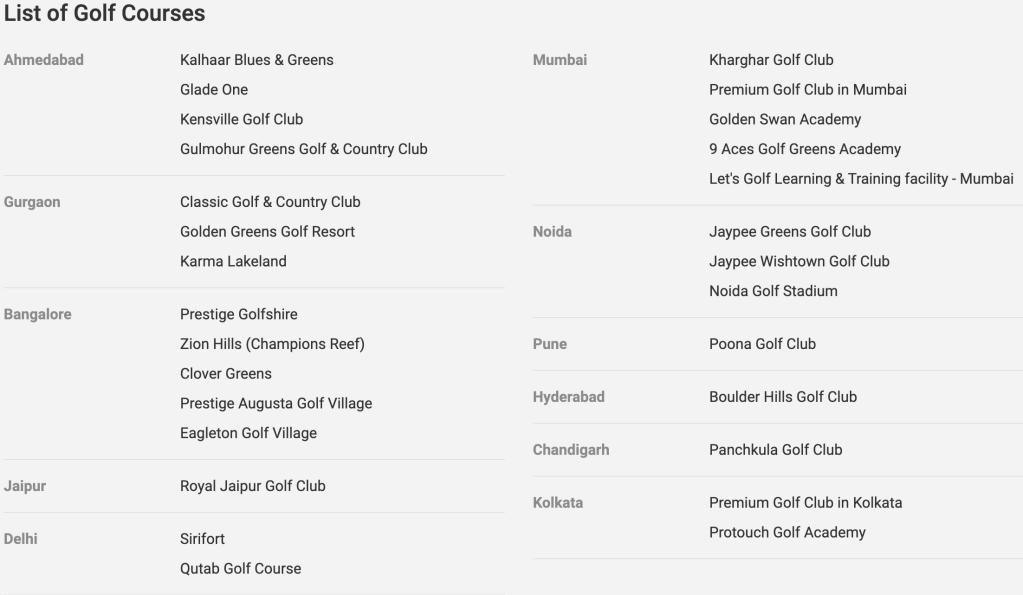

Golf Games

Axis has something called Extraordinary Weekends under which it has promotes certain perks like Golf games, Airport concierge service and Airport transfers that it reserves for its premium and super-premium credit cards.

With Axis Select card, you get upto 6 complimentary golf games/lessons. If your spends go beyond Rs. 3 lakh, then you can unlock 3 more complimentary rounds.

| Access Type | Limit |

|---|---|

| Golf games/lessons | 6 rounds per year |

You can do the booking using Axis Extraordinary Weekends portal at any of the Golf courses that you see below. For detailed terms and booking process refer this.

BigBasket Offer

You will get Rs. 500 discount for grocery shopping on Bigbasket. So the grocery shopping at start of the month can be done using Select card to save big.

- Offer: 20% off upto 500

- Min Transaction: 2000

- Usage limit: Once per month

- How to use: Check the discount code here

Swiggy Offer

For food delivery orders on Swiggy, you can save upto 200 per order

- Offer: Flat 200 off

- Min Transaction: 500

- Usage limit: Twice per month

- Coupon Code: AXIS200

24×7 Concierge

For their premium credit card holders, Axis has concierge services (call 1800 103 4962) to provide assistance for flight bookings, table reservations, event/shows etc. This could come in handy but the service level they offer might not be as good as Amex does for the Amex Platinum charge card.

The entire scope of services they cover is available here.

Insurance

You you get additional insurance benefits for travel related mishaps & purchases. You can find the cover & claim procedure details here

- Purchase protection upto Rs. 1 lakh

- Loss/Delay in baggage & personal documents cover of $500

Personally, I haven’t ever used this option and I hope you also don’t ever have to but this certainly gives additional peace of mind.

Best way to use this card

- Use for movie tickets, grocery shopping or food delivery

- Target Rs. 3-6 lakh spends for renewal fee waiver, milestone benefit & Priority pass renewal

- Avail airport lounge access

How to apply

With Axis you can hold up a maximum of three cards. You can apply either on Axis bank website website or at your nearest Axis bank branch. If you already hold an Axis card, then the credit limit they issue might be combined for this card and your existing one.

Verdict

The Axis Select credit card is a decently rewarding credit card if you look at all the benefits holistically. Yes, the reward rate is not exciting but if you consider the additional benefits like movie, grocery and dining offers plus the airport lounge and golf perks, the picture starts looking really beautiful. 🙂

There are other options out there like Axis Ace, Amex MRCC, Amex Gold and their own SBI Cashback card with similar reward rate that you can consider if this card is not your cup of tea.

Amex cards have a limited time offer going on to get the card free for first year or at reduced fee.

What are your thoughts about the Axis Privilege Credit Card? Feel free to share your views in the comment section below.