Recently, I got my hands on the Amex Platinum Charge card and here is the unboxing experience and some quick thoughts. You can read the detailed review of this card if you are looking to apply for it.

- Application for Card Upgrade

- Post Application

- Amex Card Issuing Criteria

- Primary Card Unboxing

- Supplementary Card Unboxing

- The Card

- Card Activation

- Getting Started

- Final Thoughts

Application for Card Upgrade

I had received an offer from Amex to ‘upgrade’ from Amex Platinum Travel credit card to Amex Platinum Charge card. For the welcome benefit they gave two options (applicable on spending 50K in 90 days) –

- Offer 1: Rs. 55000 worth of Taj Experiences eGift Card

- Offer 2: 115000 Membership Rewards Points

If you apply for the Amex Platinum charge card on their website, the only option you get there is Rs. 45000 worth of Taj eGift card. So compared to that these options were better and in fact the ‘Offer 2’ was even more valuable as 115000 reward points are anyway equivalent to 57500 worth of Taj eGift card or even more (given that your points account is common between Platinum Charge card and Plat Travel OR MRCC card)

With Amex, the card upgrade doesn’t mean they will replace your existing card with the new card but instead they will issue a new card to you and the existing card can continue as it is.

Post Application

I chose the 2nd option (115000 MR points) and submitted my consent for the ‘upgrade’. Also, my existing Platinum Travel card was made a companion card to the Platinum Charge card which means that as long as I keep the Platinum Charge card, the Platinum Travel card will be a free card.

[Apply through the link above to get 10000 Reward points in addition to Taj e-vouchers worth 45000]

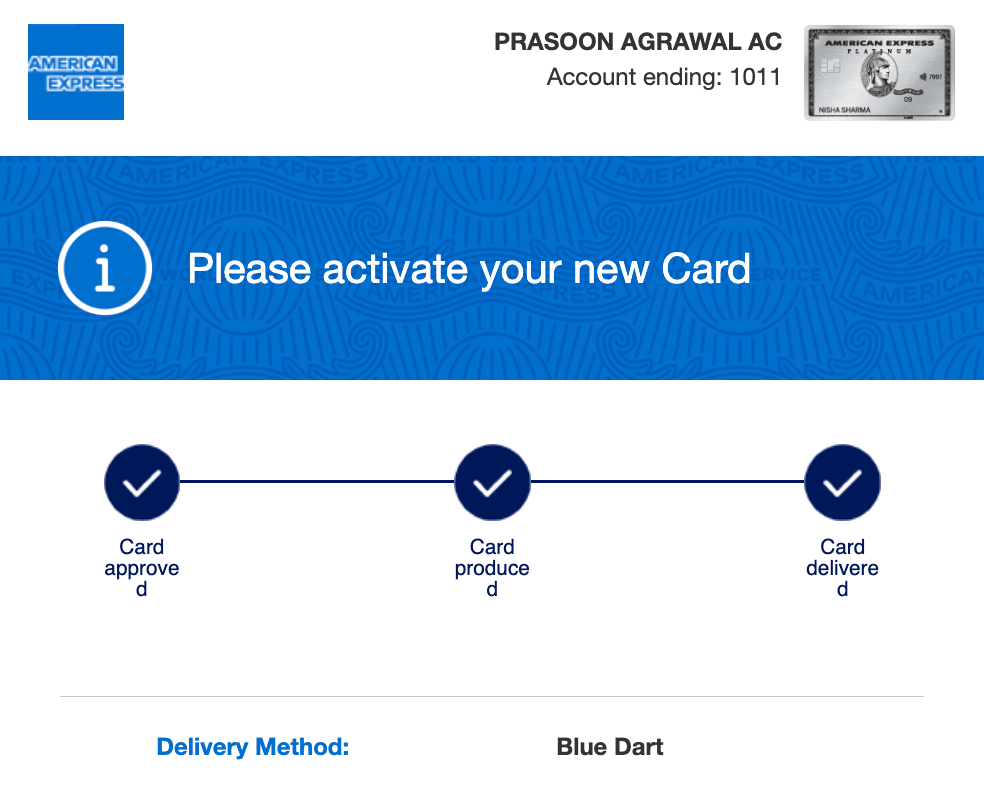

The ‘application’ got approved in no-time (since they had reached out with the offer, it was sort of a pre-approved application). I got a confirmation email on the same day about the approval and the within a week the card arrived. Below is the timeline –

- 31st Oct: Submitted the application & got the approval email

- 2nd Nov: Got email about card being dispatched

- 3rd Nov: Card got delivered within a day instead of 4-5 days

Amex Card Issuing Criteria

Amex lets you have 2 credit cards and 1 charge card at one time. Charge cards don’t have any pre-set spending limit like a usual credit card. What they have is a system determined ‘purchasing power’ which is arrived at by the assessment of your purchase habits & repayment patterns as per their system algorithm.

The reason why they only let you have only 1 charge card in general is that if you hold more than 1 charge card then the ‘purchasing power’ may get diluted due to distribution among two charge cards.

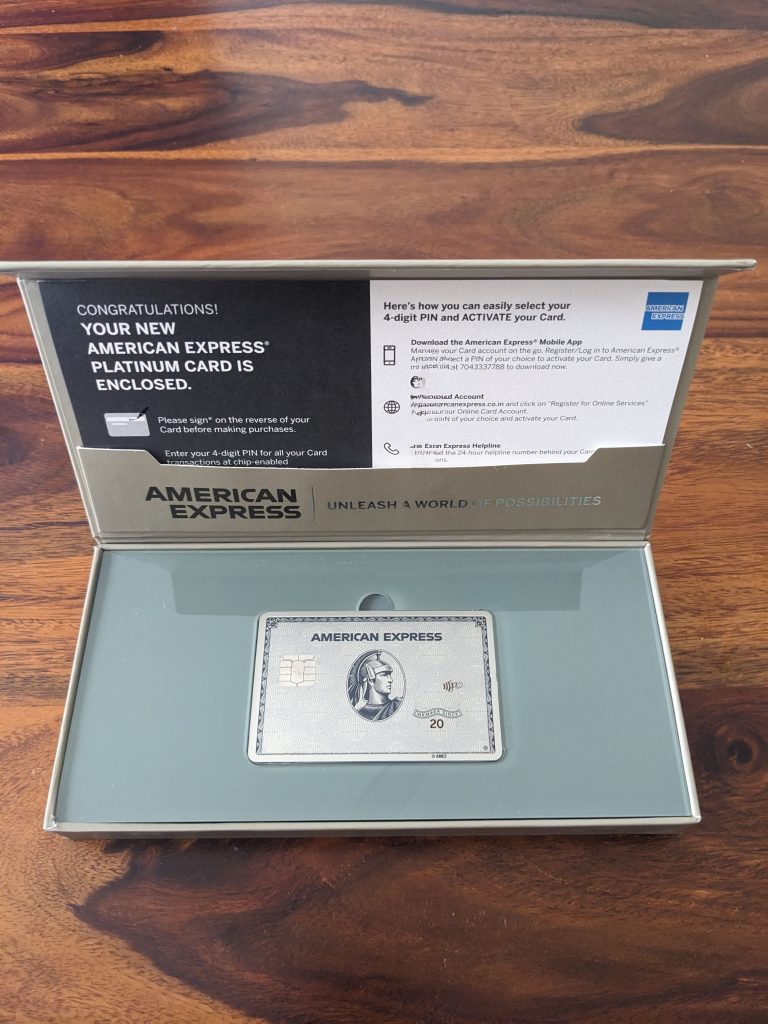

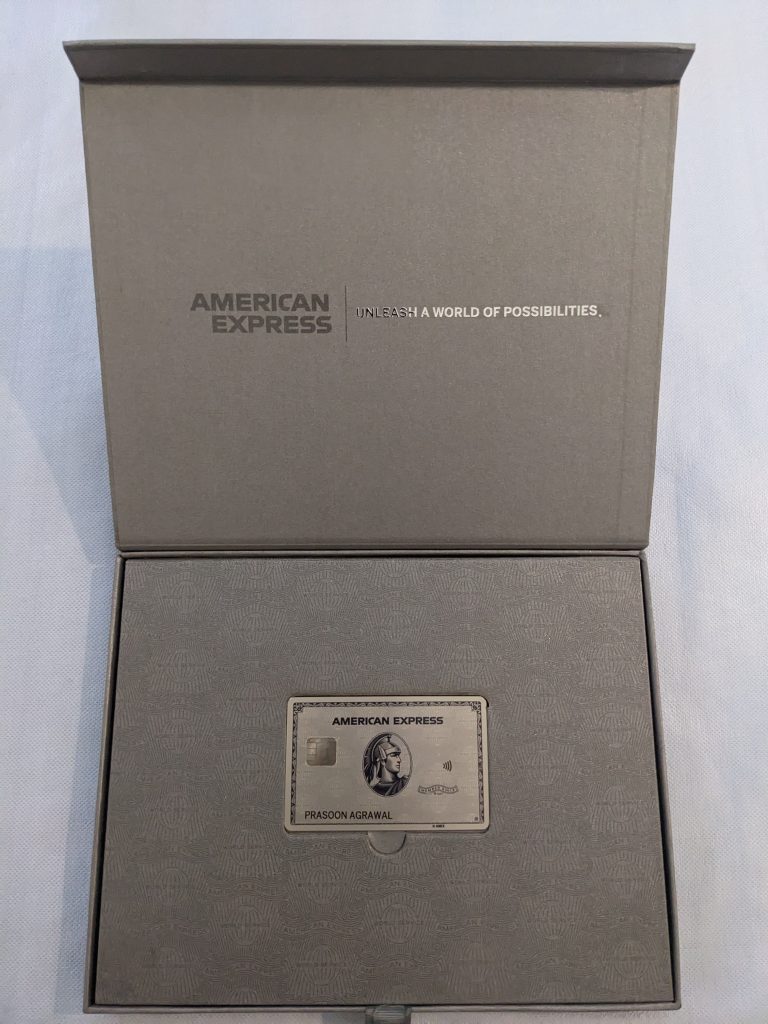

Primary Card Unboxing

The card came in a dark grey color box and within the box there was the credit card and some leaflets about the card features and privileges.

You can the entire unboxing here

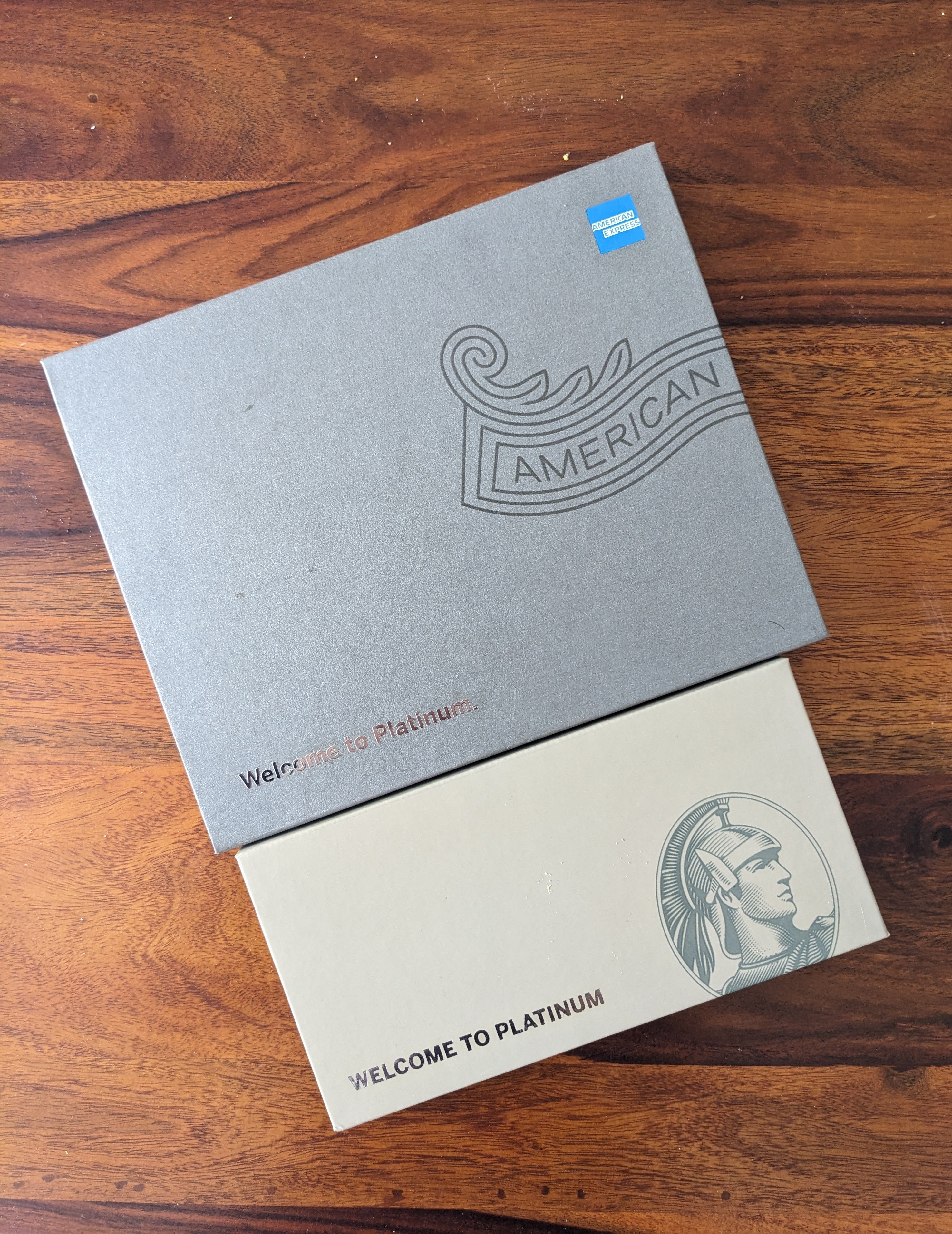

Supplementary Card Unboxing

I had also applied for a supplementary card for one of my family member and the application got approved within a day and card was delivered 3 days later. Here are some pics of the supplementary card unboxing.

The had sent a rectangular shape box for supplementary card which is smaller is size and has a different color.

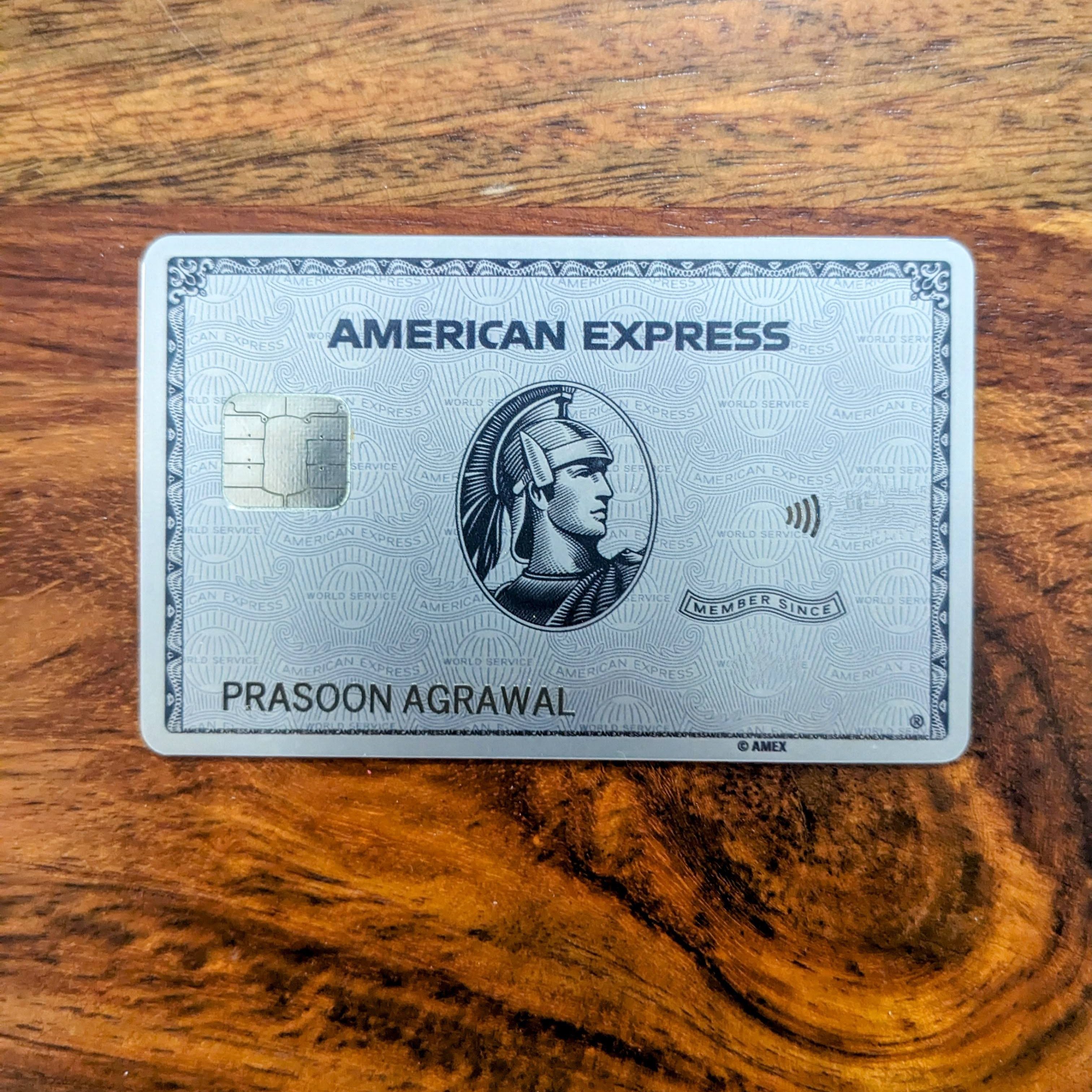

The Card

The card itself sure looks premium in its metal form factor and has some weight to it (~15 grams). Compared to the plastic cards this one is almost three times heavy. The card number, validity date and other misc details are on the back side. The front side of the card just has the name and the 4 digit code.

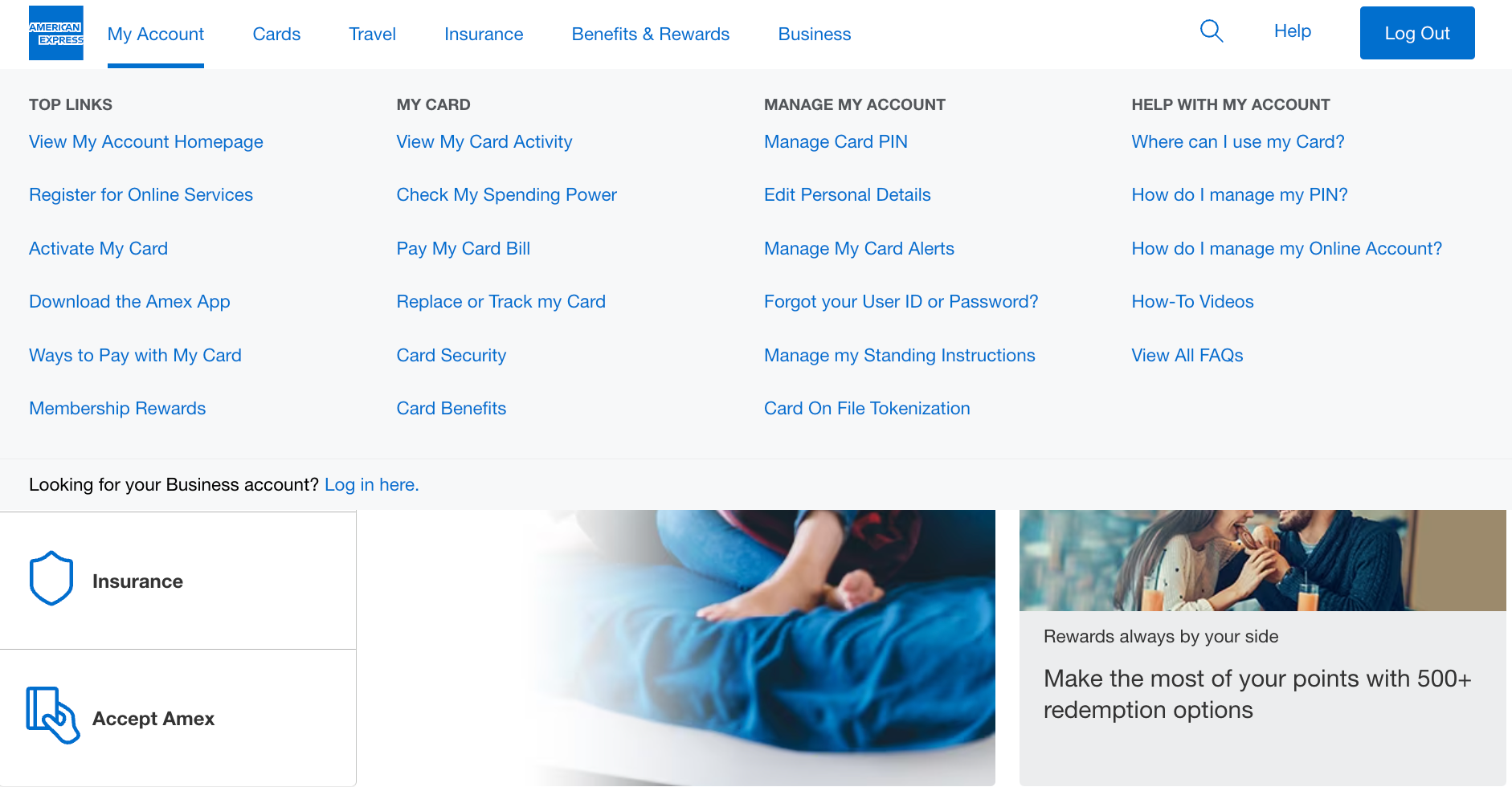

Card Activation

To activate the card just head over to the Amex app or the website and add a new card there.

- App > Account tab > Activate and Add Card to Your Account

- Website > My Account > Activate My Card

Getting Started

Once you have activated the card, the first thing you should do is complete the enrollment process of the memberships that come complimentary with the card for which you can go to this page.

Final Thoughts

Amex Platinum charge card is one of its kind and with its hefty fee it’s not everyone’s cup of tea. You can read the detailed review of this card to get a better understanding of its features and benefits. For the 1st year, if you are getting any good upgrade or fresh application offers then you may apply for it depending on your usage. From 2nd year onwards, the renewal offers are a hit and miss. I have heard some great offers being given to few customers and other have not been so lucky.

Other than that, all the privileges and benefits this card comes with and the festive offers that Amex rolls out plus the ‘Do Anything’ concierge and very good customer service are some of the reasons that you can think of to get this card.

[Apply through the link above to get 10000 Reward points in addition to Taj e-vouchers worth 45000]

If you don’t need such an ultra-premium card, you can opt for the Amex Platinum Travel Credit Card using this link or the Amex Membership Rewards Credit Card which is being issued as “First Year Free” for a limited period.

What are your thoughts about the American Express Platinum Credit Card? Feel free to share your views in the comment section below.