Another co-branded credit card has landed and this time it is not the frontrunners like HDFC or Axis but Kotak bank. The other name in this partnership is fashion e-commerce giant Myntra. Myntra Kotak credit card got launched in June 2023 and at first glance it looks like a good deal for someone who does online shopping on Myntra but we should look at the fine details to answer the question whether is it just another card that would get lost in the crowd or will make a place for itself and stand the test of time.

And for that let’s talk about the benefits and features of this card in detail.

Overview

Myntra Kotak credit card is for new-age online shoppers who use Myntra as their go-to place for all their fashion needs. The card also gives additional benefits like lounge access, 5% cashback* with preferred partners, free movie tickets and some other perks.

| Type | Entry-level Cashback Credit Card |

| Reward Rate | 1.25% – 5% |

| Best for | Myntra shopping |

| USP | 7.5% instant discount on Myntra |

Design

The card has a very colorful & vibrant look that sets it apart from other monochrome look cards. There is a big Myntra logo at the center. It is issued on the RuPay and Mastercard network.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 500 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | Myntra voucher worth 500 on card activation + Myntra voucher worth 500 on 1st transaction (>500) on Myntra |

| Renewal Fee | Rs. 500 + 18% GST |

| Renewal Benefit | N/A |

| Renewal Fee Waiver | waived off on annual spends greater than Rs. 2 lakh |

The joining benefit takes care of the fee as you are getting almost the double of what you paid and the criteria to get renewal fee waiver is very much in reach.

Even if you are not able to spend 2 lakh in a year, the renewal fee is very minimal in my opinion as even a cumulative shopping bill of Rs. 6000 on Myntra will be just enough to recover the fee.

Note: Joining benefit vouchers are sent within 30 days of meeting the criteria. You should activate your card within 30 days of getting it to get the 1st voucher. Beyond 30 days, the card is cancelled as per RBI rules. For 2nd voucher, transaction on Myntra should be worth Rs. 500 or more.

Other Charges

Supplementary Card

There is a fee of Rs. 299 + 18% GST for applying for a supplementary card.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%) which means it is not a good option to use it for foreign trips.

Fuel Purchases

There is no cashback on fuel purchases but you do get 1% fuel surcharge waiver across all petrol pumps in India on minimum transaction of Rs. 500 & maximum transaction of Rs. 3500 There is a capping of Rs. 300 per month for surcharge waiver which is more than enough.

Ex. If you purchase fuel of Rs. 2000 then 1% surcharge of Rs. 20 is first applied and then waived off but the 18% GST of Rs. 3.6 is levied.

Rent Payments

Rent payments aren’t eligible for cashback. On top of that there is 1% + GST fee imposed on rent payments which makes this card not a suitable option for rent payments.

EMI Fees

For EMI transactions, there might be a one-time processing fee which I couldn’t see in the TnC document but you can check with the customer care team.

Benefits

Cashback

Base cashback rate is 1.25% on all spends across all online and offline merchants. Since this is a cashback card, the cashback earned on any eligible transaction is credited in the form of statement credit within 30 days from the date of settlement which lowers the outstanding amount in the next billing cycle.

| Spend Category | Cashback | Limit | Exclusions |

| Myntra Spends | 7.5% Instant discount | Rs. 750 per transaction | None |

| Preferred Partners (Swiggy, Swiggy Instamart, PVR, Cleartrip, Urban Company) | 5% | Rs. 1000 per billing cycle | None |

| Any UPI Spends (for RuPay card) | 1.25% | No limit | Rent Payment, Fuel Spends, EMI transactions, Wallet loading transactions, Education services, Transactions equal to & below 2000 |

| Any Other Spends | 1.25% | No limit | Rent Payment, Fuel Spends, EMI transactions, Post Purchase EMI, Wallet loading transactions |

Just for Myntra spends, instead of cashback, you get an upfront discount of 7.5%. For any other spends, the cashback is credited to the statement.

Also, as long as you keep the shopping cart value below Rs 10000, you will not lose any discount. Only when you are doing a big purchase (>10000) like buying a luxury watch or an expensive suit, the discount will get restricted to only Rs. 750 which will leave a bad taste in your mouth.

The cashback will be rounded down for each individual transaction. For eg. If for a transaction of

Rs. 1750, the customer is eligible for a cashback of 1.25% i.e., 1750 * 1.25% = Rs. 21.875. Only Rs. 21 will

be credited to the customer for that individual transaction. This is not a customer centric approach as you are losing some value here. They should have instead rounded off the cashback to closest integer.

Note: One should avoid doing payments on Myntra or Preferred partners using UPI option as in that case those spends will only qualify for 1.5% cashback.

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Domestic Lounge (Primary card only) | Mastercard, RuPay | 1 per quarter |

The lounge access limit is very low but it is without any conditions so it is still acceptable as the fee of this card is very low. There is no international lounge access with this card which is not a surprise.

The coverage of lounge is good for a card of this price range. List of eligible airport lounges can be checked here.

Movie Ticket Benefits

Another decent perk you get with the card is 2 PVR tickets worth Rs. 250 each on reaching a spend target of Rs. 50000 per quarter. This is actually marketed as a milestone benefit by Kotak and spends done on Rent, Wallet and Fuel categories will not be considered within the Rs. 50000 bucket for evaluation of quarterly benefit.

To redeem the movie ticket vouchers (known as M-Coupons), you need to follow these steps on the Kotak Mobile App-

- Login to MB App / Kotak Net Banking section

- Go to Credit Card Overview Section

- Select PVR Card

- Select PVR Coupon Claim / Unlock PVR coupons, enter the month eligible

- Get M-Coupons eligible for the month

- View the Validity of the M-Coupons

- Use them at PVR Cinemas

Other Benefits

Myntra Insider Program Benefits

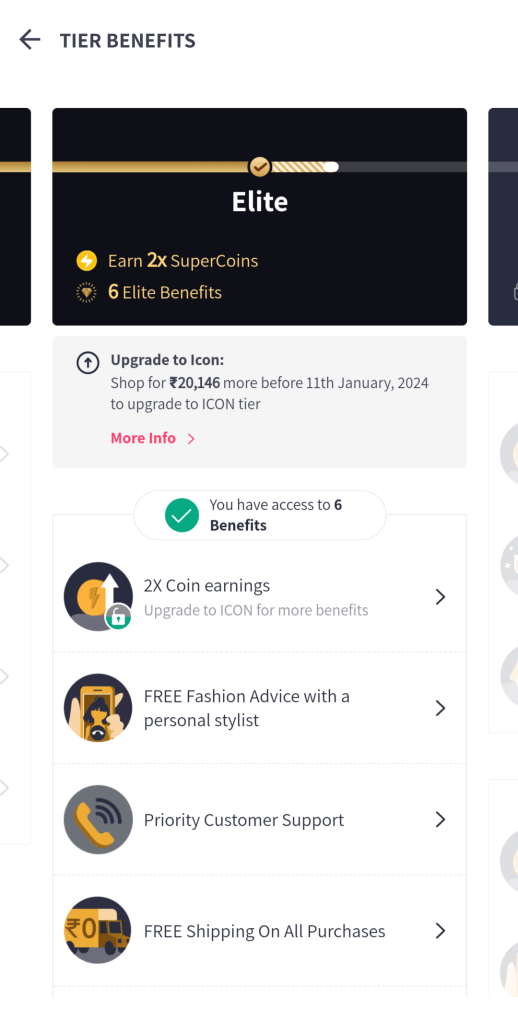

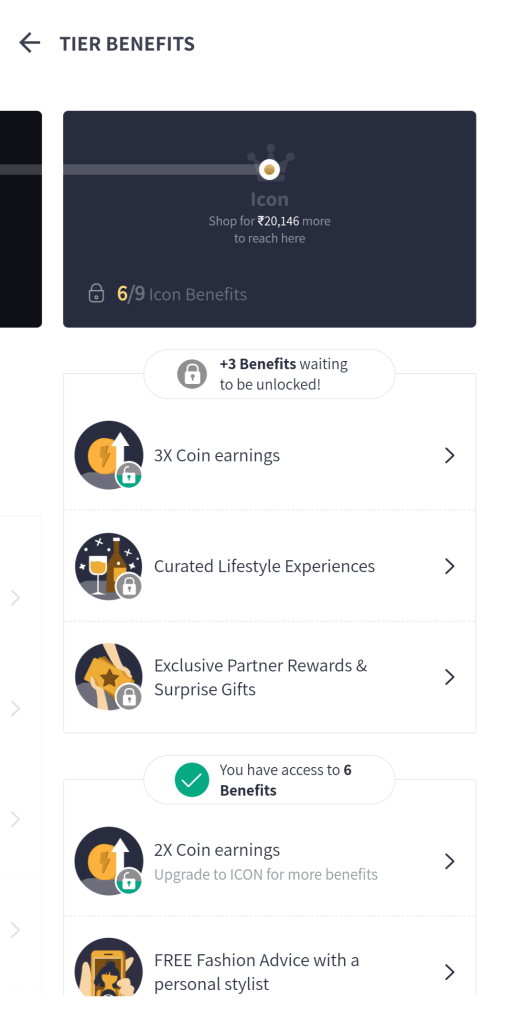

Myntra Insider is Myntra’s loyalty program through which shoppers earn SuperCoins (loyalty currency of Flipkart & Myntra) on their purchases among other benefits like early sale access, free shipping, etc. These supercoins can be redeemed for Myntra gift cards and additional discounts.

With this credit card, you get complimentary Myntra Insider Select tier (base level) membership. To maintain this tier one needs to spend a min of Rs. 7000 and place 5 orders each year on Myntra.

It is really disappointing to see that they are giving base tier. A Myntra co-branded credit card should have come with Icon tier membership (min. Rs 25000 spend criteria) or atleast Elite tier membership (min. Rs. 10000 spend criteria) which gives 3X/2X coins instead of just 1X coins with Select tier.

UPI Payment

Using the RuPay version of this card, one can even do UPI payments to those merchants who don’t accept credit card. You can use an UPI app of your choice like BHIM, GPay, Freecharge, etc. to link this card and start using it for UPI payments.

Below are the steps for card linkage on BHIM app-

- Download BHIM app from Google Play store/App Store.

- Complete the registration using the mobile number with which your credit card account is linked.

- Select Credit Card option in the Add account section or click on the banner for linking Rupay card.

- Select your issuing bank name from the drop down

- Basis the mobile number updated with bank, masked Credit Card will appear on the screen.

- Select the card which you want to link and confirm. Proceed to generate UPI PIN.

Limit on UPI transaction via RuPay card is Rs 5000 for first 24 hrs of linking the card in UPI app and gets increased to Rs. 1 lakh per day per card post that. For some merchants (MCC codes i.e 5960, 6300 & 6529) limit allowed would be Rs 2 lakh for some special. Apart from that, there is no limit to the number of transactions carried out via linked credit card on UPI.

Note: Only payment to merchant (P2M) will be allowed from the linked Credit Card.

Best way to use this card

Let’s look at an example of value chart of this card. Obviously, the spends will vary as per your lifestyle. If you achieve 50000 milestone each quarter, you get 2000 additional value annually in the form of movie vouchers which will increase the return rate by ~1%. Otherwise, you would get close to 6% returns overall.

Personally, I would use this card just for Myntra shopping, 5% cashback with preferred partners, UPI payments and lounge visits.

Worrying about reaching 50000 milestone every quarter just to get 1% extra return of 500 (250 * 2 movie vouchers) is not worth it. If it happens organically, then that’s fine.

| Benefit | Monthly Spends | Annual Spends | Value (Discount/Cashback/Savings) |

| 7.5% Instant Discount on Myntra, capped at Rs.750 per transaction | 8000 | 96000 | 7200 |

| 5% Cashback on Preferred Partners, capped at Rs.1000 per month | 4000 | 48000 | 2400 |

| 1.25% Unlimited Cashback (UPI or otherwise) | 4000 | 48000 | 600 |

| 2 PVR Tickets per quarter | 2000 (250*2*4) | ||

| 1% Fuel Surcharge Waiver | 1000 | 12000 | 120 |

| Fee Waiver | 500 | ||

| Domestic Airport Lounge Access (4 visits) | 2000 (500*4) | ||

| Total | 204000 | 14820 (7.26%) |

How to apply

Kotak bank doesn’t have a good reputation when it comes to issuing the credit card in a timely manner. However for this card, they have created a better workflow and it seems the card is issued within 60 minutes of KYC completion. You can go ahead and apply for it directly from Kotak bank’s website or Myntra app.

Verdict

Anyone who uses Myntra regularly should get this card without any second thought as there is no other credit card out there which gives 7.5% unlimited discount on Myntra. Plus there are some misc. perks like 5% cashback on some apps, lounge access and UPI payment using credit card which is like cherry on top of the cake.

For anyone else, there are better options out there in terms of reward rate like Axis Ace, Amex MRCC, Amex Gold and SBI Cashback card that you can consider if you don’t always shop on Myntra.

You can even get the Amex MRCC card free for first year & Amex Gold card at reduced fee plus 2000 bonus points.

What are your thoughts about the Myntra Kotak Credit Card? Feel free to share your views in the comment section below.