HDFC has been in full swing in 2023 after the RBI ban got lifted which was a major roadblock for them to launch new credit cards. In July 2023, they launched a credit card with Swiggy and just a couple of months later they have come up with India’s 1st co-branded hotel credit card in partnership with Marriott.

This is the first time Marriott has partnered with a bank in India to launch a co-branded credit card unlike other markets where they have lot of cards in partnership with American Express, Chase, etc. Hopefully someday we may even see a Marriott Amex card in India too. 🙂

In the launch event, spokesman from both side said that Marriott Bonvoy HDFC bank credit card aims to become one of the most rewarding travel cards in India which might be an overstatement in my opinion 🙂 but instead of taking their word for it let’s see the card features and benefits in detail and figure out whether this card really is one of the best travel cards or not.

Overview

This is semi-premium rewards credit card based on fee and the benefits that come with this card. As this card is Marriott Bonvoy card which is the loyalty program of Marriott, you get certain exclusive benefits with Marriott unlike any other credit card in India like one free night award and accelerated points earn rate on eligible spends with Marriott.

| Type | Semi-premium Travel Credit Card |

| Reward Rate | 0.66% to 2.66% |

| Best for | Free night awards at Marriott properties |

Design

This is the best looking credit card among all the plastic credit cards out there. Although I am biased towards black color so that just might be me 🙂 Still, the card exudes class and emulates the aura of a really premium credit card.

The golder color lettering on the black background looks so exquisite and it has a clean look with card number details kept on the back. It is issued on the Diners Club network which is a minor issue as Diners club still has low acceptance in India unlike Visa and Mastercard.

Fees & Charges

Joining & Renewal Fees

| Joining Fee | Rs. 3000 + 18% GST |

| Joining Fee Waiver | N/A |

| Joining Benefit | 1 free night award at Marriott properties (worth 15000 points); |

| Renewal Fee | Rs. 3000 + 18% GST |

| Renewal Fee Waiver | N/A |

| Renewal Benefit | 1 free night award at Marriott properties (worth 15000 points) |

Note: If primary cardmember closes their card account after fee realisation, free night award will be cancelled. 🙂 So yeah! they have thought about this.

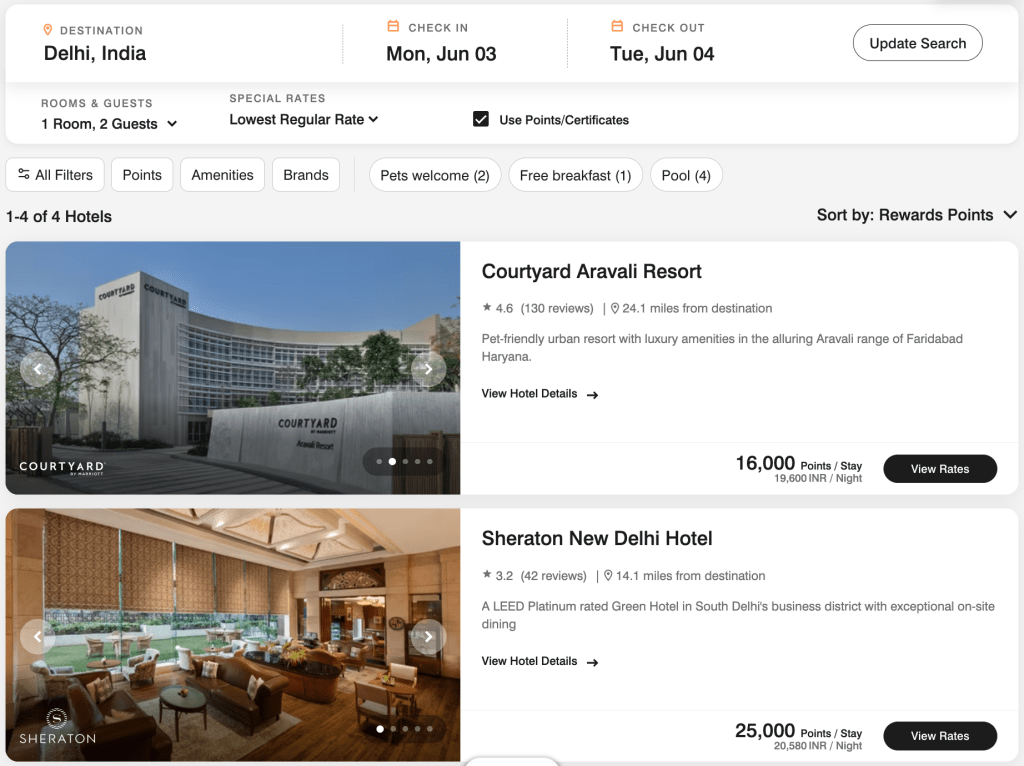

There isn’t any fee waiver criteria but 1 free night award benefit (upto 15000 points) is easily 2-3 times the value of the fee and can be used for one night (redemption level at or under 15000 Marriott Bonvoy points).

Someone who is familiar with Marriott properties would know that 1 free night stay at a premium Marriott property like JW Marriott Prestige Golfshire Resort & Spa during non-peak season would easily cost at least ~30000 points or ~Rs. 25000 so with 15000 points already in the kitty you can accumulate remaining points using regular spends (which we will discover in Benefits section) to book 1 night stay at such a premium luxury resort.

Even with 15000 points, you can get great options if you do a little research and book accordingly.

Note: It may take up to 12 weeks after paying the joining Fee or renewal fee for free night award to be credited into Marriott Bonvoy account.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

3.50% of the transaction value + 18% GST (which adds up to 4.13%) which means it is not a good option to use this card for overseas spends.

Fuel Purchases

For fuel purchases, there are no reward points awarded and also you won’t get any fuel surcharge waiver. This is definitely a bummer as it is a very basic feature that comes with even with most of the entry-level cards.

If you spend less than Rs. 15000 per transaction on fuel, no additional fee will be charged. However, if you spend more than Rs. 15000 per transaction on fuel, a 1% fee will be charged on the entire amount and capped at Rs. 3000 per transaction.

Rent Payments

Rent transactions are not eligible for any reward points. Also, if you use services like (but not limited to) CRED, PayTM, Cheq, MobiKwik, Freecharge, and others to pay rent, a 1% fee will be charged on the transaction amount and capped at Rs. 3000 per transaction. Also, these portals charge a rent payment fee of their own.

EMI Fees

For EMI transactions, a one-time processing fee of up to Rs. 299 + taxes is charged.

Benefits

Reward Points

The reward points earned using this credit card are in the form of Marriott Bonvoy points which can be good or bad depending on who you are. It’s good for those who are Marriott loyalist and visit their properties often and bad for those who are not into Marriott and want rewards that are more versatile in terms of redemption. The base reward rate is 2 Marriott Bonvoy points per Rs. 150.

| Spend Category | Reward | Reward Rate |

| Purchases at Marriott properties (Homes & Villas by Marriott not covered) | 8 Marriott Bonvoy points (8X) per Rs. 150; 2 points per Rs. 150 after spends worth 10 lakh per month | 2.66% |

| Purchases on travel, dining, and entertainment | 4 Marriott Bonvoy points (4X) per Rs. 150; 2 points per Rs. 150 after spends worth 5 lakh per month | 1.33% |

| All other eligible purchases | 2 Marriott Bonvoy points (2X) per Rs. 150; 0 points after spends worth 1.5 lakh per month | 0.66% |

| Reward points Expiry | 2 years | |

| Points Redemption Fee | NIL | |

| Exclusions | Fuel, Government, Rent, Post-transaction EMI conversion & Wallet loads, Gift or Prepaid Card load |

- For any individual utilities transaction more than Rs. 50000, a 1% fee will be charged on the entire amount capped at Rs. 3000 per transaction. Insurance transactions are not considered as Utility transactions.

- Education payments through third-party apps like (but not limited to) CRED, PayTM, Cheq, MobiKwik and others will attract a 1% fee capped at Rs. 3000 per transaction. Education payments through college/school websites or their POS machines will not have any additional charges. International education payments are excluded from this charge.

Regarding points expiry, Marriott Bonvoy points stay active for 2 years from the date of your last activity. Even when points are credited to Marriott Bonvoy account, it is counted as an activity so as long as you use your card for an eligible spend to earn points, your points would not expire.

The reward rate is very mediocre but keep in mind that Marriott property award rates are dynamic so you can get value as high as Rs. 1 for a point if you book at the right time which means for the 8X category reward rate can be almost 5%. Having said that if one has to accumulate 10000 Marriott Bonvoy points using this card, they would need to spend

- 1.87 lakh (10000/8 * 150) in 8X category OR

- 3.75 lakh (10000/4 * 150) in 4X category OR

- 7.50 lakh (10000/2 * 150) in 2X category

That’s a lot of spend just for 10000 points which you can get at a much faster rate using other credit cards like Amex Platinum Travel card or Amex MRCC card.

Points earned during a billing cycle are automatically transferred to the primary cardmember’s Marriott Bonvoy account after the end of each billing cycle; It could take up to 12 weeks following the billing cycle for points to be added.

Milestone Benefits

With this card, there are in total 3 milestone that one can achieve in a card membership year. For each milestone, you get a free night award (booking capped at 15000 points) which is valid for 1 year .

| Spend Threshold | Reward | Reward Rate | Cumulative Reward Rate |

| 6 lakh | 1 free night award at Marriott properties (worth 15000 points) | 1.25% | 1.25% |

| 9 lakh | 1 free night award at Marriott properties (worth 15000 points) | 2.50% | 1.66% |

| 15 lakh | 1 free night award at Marriott properties (worth 15000 points) | 1.25% | 1.5% |

The reward rate for milestones is again simply too low. Even if you add the reward rate of regular spends, you hardly touch 3%.

In my opinion, you should not bother about reaching milestones just for the free night award and instead redirect your spends to others travel or rewards credit cards. Even with an entry level cashback credit card like SBI Cashback credit card, you get 5% returns.

Note: It may take up to 12 weeks after fulfilling the relevant spending thresholds for free night award to be credited into Marriott Bonvoy account.

Marriott Bonvoy Membership

This card comes with complimentary Marriott Bonvoy Silver Elite tier membership status which stays active as long as you keep the card. It could take up to 8 weeks from card approval date for Silver Elite Status award to be applied to your Marriott Bonvoy account.

The Silver Elite status is not that beneficial as you don’t get any meaningful benefit from it. Unless you upgrade to Gold Elite or higher status, there is not much to do with this.

Note that if you are already a Marriott Bonvoy member, then while applying for the card, use your existing Marriott Bonvoy member ID otherwise a new Marriott Bonvoy ID will be created for you that you can merge with your original member ID from this link.

Elite Night Credits

With this card, you get 10 Elite Night credits (ENC) every year. An ENC is simply a night credit that gets logged in your Marriott account representing the number of revenue nights you have stayed at a Marriott property in a year. As more ENCs get accumulated in your account, your Marriott Bonvoy membership tier gets upgraded.

There are various tiers in Marriott Bonvoy loyalty program namely Silver, Gold, Platinum & Titanium. To upgrade from Silver Elite tier to Gold Elite tier you need 25 ENCs. With this credit card you get 10 complimentary ENCs every year and if you stay 15 nights (revenue night not award nights) in a calendar year at a Marriott property, you will get upgraded to Gold Elite tier.

An advantage of Gold Elite tier over Silver Elite tier is that you can get one-level room upgrades for free.

Few things to note about ENCs –

- ENCs expire on 31st Dec each year, irrespective of which month your card renews.

- ENCs are credited to your Marriott Bonvoy account within 60 days after payment of the fee.

- Award nights are not counted towards ECN. More details about the ECN are available here.

Reward Redemption

The Marriott Bonvoy points and the Free night awards (FNAs) you get from this card can be used for booking experiences or stay at Marriott Bonvoy properties.

- To redeem FNA, you must log into your Marriott Bonvoy account and apply the FNA during booking

- Each FNA can be redeemed only for a one-night stay with a redemption level up to 15000 points

- You can club multiple FNA together to book a stay for more than 1 night i.e. if you have two FNAs, then you can book for 2 consecutive nights and so on.

FNAs are valid for one year from the date of issuance. FNA can not be combined with cash when redeeming for free night, but you can do a top-off and redeem or purchase up to 15000 Marriott Bonvoy points to expand the value of your FNA in accordance with the Marriott Bonvoy Program Rules. Refer the detailed TnC for more information or how to use FNAs.

Note: It may take up to 12 weeks after paying the joining Fee or renewal fee or fulfilling the relevant spending thresholds for free night awards to be credited into Marriott Bonvoy account.

Travel Benefits

Airport Lounge Access

| ACCESS TYPE | Via | Limit |

|---|---|---|

| Domestic (primary card only) | Marriott Bonvoy HDFC Bank Credit Card | 12 per year |

| International (primary card only) | Marriott Bonvoy HDFC Bank Credit Card | 12 per year |

List of domestic & international lounge can be checked through Diners Club International app that you can download on the app store.

There are a few advantages of this card over other credit cards in same price range –

- Lounge access limits are very good and also capping is for a year rather than quarterly which is useful in case you need to travel multiple times in a short span of time like during festive season.

- You don’t need a separate Priority pass like other HDFC Regalia credit card for International lounge access as this card is issued on Diners Club network.

- You can also access the lounges on the international terminal within India as part of domestic lounge access. Many credit cards don’t allow access to international lounges at domestic airports.

Other Misc Benefits

Swiggy Dineout Dining Discount

On all the HDFC cards, you can get 5% – 15% discount on dining bills when you pay through Swiggy Dineout. For some reason HDFC has named it ‘Good Food Trail program’.

With HDFC Marriott Bonvoy credit card, you get additional 5% discount up to Rs. 200 on top of 10% Swiggy Dineout discount. This offer is applicable twice a month on a min. transaction value of Rs. 2500 post applying the Swiggy Dineout discount.

- Offer: 5% discount up to Rs. 200

- Min. Transaction: Rs. 2500

- Usage Limit: Twice a month per customer on Swiggy Dineout

Golf Games

| ACCESS TYPE | Via | Limit |

|---|---|---|

| Golf games | in partnership with GolfLan | 2 per quarter |

| Golf lessons | in partnership with GolfLan | 2 per quarter |

HDFC has partnered with GolfLan for providing golf games perk. Other than Axis Select credit card, this is probably the only other credit card which offers complimentary Golf games at this price point.

The list of domestic golf courses that you can access is here and the international list is here. You have to call the Golf Concierge at 1800 118 887 to make enquiries or to book a Golf lesson or game.

Detailed terms and conditions for booking and cancellation can be found here.

Insurance benefits

This card comes with certain insurance benefit too. This is a good to have benefit and gives peace of mind.

- Delay or loss of checked-in baggage cover of up to $250

- Loss of travel documents cover of up to $250

- Flight delay cover of up to $250

- Air accidental cover of up to $12500

- Emergency medical expenses up to $18750

- Credit shield of up to Rs. 1 lakh

- Loss liability cover of up to Rs. 1 lakh

You need to register a nominee here. Detailed terms and conditions for the insurance coverage can be found here.

Concierge Service

There is even a concierge service hotline that you can call to get assistance regarding travel bookings, dining reservations, etc. You can call @ 1800 309 3100 or email @ support@marriotthdfcbank.com.

Best way to use this card

- Use the card to get 1 free night stay every year by redeeming Free night award.

- Avail lounge benefits

How to apply

Existing HDFC Bank Credit Card holders can also apply for a 2nd HDFC credit card. The credit limit of existing card will be shared with the new credit card. In case of an existing HDFC Bank credit card holder the initial limit post-card creation will be Rs. 5000. The limit will be reset to your existing card limit in 5 working days from your card issuance date and will be shared across both the cards.

If you already hold 2 HDFC credit cards, then you might get approved for a third card but approval rate might be very low.

You can apply for this card from Marriott’s website or directly through HDFC.

Verdict

Looking at all the benefits of the card and the value one gets on on-going spends, this card has been not up to the standards that I was hoping it to be. Still, if one wants to get a taste of Marriott and get themselves familiar with Marriott Bonvoy loyalty program, this card offers a sweet deal as you get a free night just for 3000 + taxes every year.

Marriott loyalists can ignore this card and get something like Amex MRCC credit card (Apply Now) or Amex Plat Travel credit card (Apply Now) which let you earn Marriott points much faster and are also more versatile for redemption.

Note that on award redemption bookings breakfast is not included and you need to pay for it as you get complimentary breakfast only with membership tiers above Silver Elite tier.

What are your thoughts about the Marriott Bonvoy HDFC Bank Credit Card? Feel free to share your views in the comment section below.