In 2023, HDFC bank has been very active when it comes to their credit card portfolio. Some of the credit cards got devalued (like HDFC Regalia credit card), some new cards got launched (like HDFC Marriott credit card, HDFC Swiggy credit card & HDFC Regalia Gold credit card) and we also saw existing cards getting repackaged and launched as a refresh like the HDFC Diners Club Black Metal Edition credit card.

The Diners Club Black Metal Edition card is the upgraded version of Diners Club Black card and it belongs to the same category where another flagship card of HDFC bank sits which is HDFC Infinia Metal Edition credit card.

In this post we will talk about what’s special about Diners Club Black Metal Edition card and what is new here compared to non-metal edition of this card. Let’s see the card features and benefits in detail.

- Overview

- Diners Club Black Metal Edition v/s Plastic Edition

- Design

- Fees & Charges

- Benefits

- Best way to use this card

- How to apply

- Verdict

Overview

Infinia is super-premium rewards credit card and in terms of feature set it covers all the aspects that a card of this stature should have. The key features of this card include a premium looking metallic design, complimentary Club Vistara membership, unlimited airport lounge access across the globe, high reward rate and much more.

| Type | Premium Rewards Credit Card |

| Reward Rate | 3.3% to 33% |

| Best for | Airport lounge access, Accelerated earn rate on Smartbuy spends, Golf privileges |

Diners Club Black Metal Edition v/s Plastic Edition

All the differences between the two cards are tabulated below. The differences which actually matter are the renewal fee waiver criteria (8 lakh v/s 5 lakh), milestone benefit and renewal benefits.

| Benefit | Metal Edition | Plastic Edition |

| Fuel Surcharge Waiver | N/A | 1% fuel surcharge waiver on min. Rs 400 transaction |

| Milestone Benefits | 10000 RPs on quarterly spend of Rs. 4 lakh | 2 vouchers worth 500 each on monthly spend of Rs. 80000 |

| Joining Benefit | Complimentary Annual memberships of Club Marriott, Amazon Prime, Swiggy One on spending Rs. 1.5 lakh within first 90 days of card issuance | Complimentary Annual memberships of Club Marriott, Forbes, Amazon Prime, Swiggy One (3 months) and MMT BLACK on spending Rs. 1.5 lakh within first 90 days of card issuance or joining fee realisation |

| Renewal Fee Waiver | Waived off on spending Rs. 8 lakhs | Waived off on spending Rs. 5 lakhs |

| Renewal Benefit | None | Complimentary Annual memberships of Club Marriott, Forbes, Amazon Prime, Swiggy One (3 months) and MMT BLACK on spending 8 lakh in previous membership year |

| Smartbuy Points cap | Monthly cap of 10000 RPs | Monthly cap of 7500 RPs & Daily cap of 2500 RPs |

For anyone thinking about upgrading from plastic card to metal edition card, you should do it only if your current card is not LTF and you are spending north of 8 lakh in a year.

If you have a LTF plastic edition card then obviously you shouldn’t upgrade to Metal card as Metal card upgrades will be free for 1st year post which you would have to pay the fee every year. In case you have a paid plastic card, then also you should not upgrade to the Metal Edition card. HDFC bank is luring the customers by offering a shiny metal card instead of actually offering a better value proposition because

- If your spends are above 5 lakh but below 8 lakh, atleast you get the fee waiver

- If your spends are above 8 lakh, you get the fee waiver + complimentary memberships worth >13000

On upgrading, all your existing reward points on the plastic Diners Black card are transferred to the Diners Black Metal with the points validity being set to 3 years from the date of card upgrade.

Design

The design of the Metal edition Diners Club Black card is exactly same as the plastic edition of the card. With its all black look and now metal form factor to complement it, this is probably one of best looking cards in the country.

Because it is a Diners Club card, it is issued on Diners Club network which has been an issue due to its relatively low acceptance at PoS terminals, especially in non-metro cities.

Fees & Charges

Joining & Renewal Fees

| Metal Edition | Plastic Edition | |

| Joining Fee | Rs. 10000 + 18% GST | Rs. 10000 + 18% GST |

| Joining Fee Waiver | N/A | N/A |

| Joining Benefit | Complimentary Annual memberships of Club Marriott, Amazon Prime, Swiggy One on spending Rs. 1.5 lakh within first 90 days of card issuance | Complimentary Annual memberships of Club Marriott, Forbes, Amazon Prime, Swiggy One (3 months) and MMT BLACK on spending Rs. 1.5 lakh within first 90 days of card issuance or joining fee realisation |

| Renewal Fee | Rs. 10000 + 18% GST | Rs. 10000 + 18% GST |

| Renewal Fee Waiver | Waived off on spending Rs. 8 lakhs | Waived off on spending Rs. 5 lakhs |

| Renewal Benefit | N/A | Complimentary Annual memberships of Club Marriott, Forbes, Amazon Prime, Swiggy One (3 months) and MMT BLACK on spending 8 lakh in previous membership year |

Note: The HDFC Diners Black metal card is currently being offered as a first-year free to most plastic edition Diners Club Black card holders which you may for in your net banking page or mobile app.

With the upgrade to a metal edition, the card fee has been kept the same but the renewal fee waiver criteria has been raised from just 5 lakhs to 8 lakhs which is a 60% jump!! Another big disadvantage of metal edition card is the absence of any kind of renewal benefit which the plastic edition card gets on spending 8 lakh in previous membership year.

Complimentary membership benefits are covered in Benefits section in detail.

Other Charges

Supplementary Card

There is no fee for applying for a supplementary card.

Forex Payments

2% of the transaction value + 18% GST (which adds up to 2.36%). As the base reward rate of this card is 3.33%, you would effectively save ~1% on using this card for overseas spends.

On top of that if you enroll in the HDFC Global value program, you can save close to ~2% as Global value program gives 1% cashback of up to 1000 per statement cycle.

Fuel Purchases

On Metal Edition card, for fuel purchases, there are no reward points awarded and even fuel surcharge waiver is not applicable.

With the plastic edition of this card, you atleast get 1% fuel surcharge waiver on min. transaction of Rs. 400 with a capping of Rs. 1000 per statement cycle.

If you spend less than Rs. 15000 per transaction on fuel, no additional fee will be charged. However, if you spend more than Rs. 15000 per transaction on fuel, a 1% fee will be charged on the entire amount and capped at Rs. 3000 per transaction.

Rent Payments

Rent transactions are not eligible for any reward points. Also, if you use services like (but not limited to) CRED, PayTM, Cheq, MobiKwik, Freecharge, and others to pay rent, a 1% fee will be charged on the transaction amount and capped at Rs. 3000 per transaction. Also, these portals charge a rent payment fee of their own.

EMI Fees

For EMI transactions, a one-time processing fee of up to Rs. 299 + taxes is charged.

Benefits

Reward Points

The base points earn rate on this card is 5 points for every Rs. 150 spent.

| Spend Category | Points Earn Rate | Reward Rate |

| Retail Purchases (including Utilities, Insurance, Education) | 5 points on every Rs.150 spent | 3.33% |

| Weekend Dining spends | 10 points on every Rs.150 spent | 6.66% |

| Train ticket booking on Smartbuy | 15 points on every Rs.150 spent (3X) | 10% |

| Flight booking and Vouchers purchases on Smartbuy | 25 points on every Rs.150 spent (5X) | 16.67% |

| Hotel spends on Smartbuy | 50 points on every Rs.150 spent (10X) | 33.33% |

| Reward Points Expiry | 3 years | |

| Points Redemption Fee | NIL | |

| Exclusions | Fuel, EMI transactions, Post-transaction EMI conversion, Government services, Rent, Wallet loads |

- For any individual utilities transaction more than Rs. 50000, a 1% fee will be charged on the entire amount capped at Rs. 3000 per transaction. Insurance transactions are not considered as Utility transactions.

- Education payments through third-party apps like (but not limited to) CRED, PayTM, Cheq, MobiKwik and others will attract a 1% fee capped at Rs. 3000 per transaction. Education payments through college/school websites or their POS machines will not have any additional charges. International education payments are excluded from this charge.

Note: If the card is not used for more than 365 days, reward points accrued will be nullified even though the points expiry deadline is of 3 years.

As per the TnC, some limitations applicable to HDFC Diners Club Black card are –

- The maximum reward points that can be earned in a statement cycle is 75000

- There is a capping of 2000 RPs per calendar month on grocery transactions

- There is a capping of 5000 RPs per day for Insurance transactions.

- On Metal Edition card, for SmartBuy transactions, there is only a monthly cap of 10000 RPs.

- On Plastic Edition card, for SmartBuy transactions, there is a cap of 7500 RPs per month & 2500 RPs per day.

The base reward rate of this card is the best in the country and only matched by cards like Standard Chartered Ultimate credit card & HDFC Infinia Metal Edition credit card. Also, to top it off, any spends done via SmartBuy portal will get accelerated rewards at 2X/3X/5X/10X rate which means the reward rate in some cases can be as high as 33%!!

If you don’t have any immediate spend, you can always purchase a gift voucher and use them later while still getting 16% returns. You can buy gift vouchers of Amazon, Flipkart, Croma, Vijay Sales, Tata Cliq, Reliance Smart, BigBasket, Blinkit, Swiggy, Zomato, Ola and many more. Check out all the available options here.

The capping on points is very generous so you don’t have to worry about breaching the limit. Also Insurance, Education & Utilities transactions are eligible for reward points which is a big plus as with 3.3% base reward rate one can save a lot on such high value transactions.

Milestone Benefits

The milestone benefits structure has been changed for the Diners Club Metal Edition card. Instead of monthly milestone which the non-metal edition Diners Club Black card has, there is a quarterly milestone for metal edition card.

I have mixed feeling about this change. The good thing about it is that the reward rate is double now (2.5% v/s 1.25%) and you won’t have to keep track of multiple vouchers as you get points instead which don’t expire for 3 years.

The not so good thing is that now the spend target for reaching the milestone has increased as now you would have to spend ~1.33 lakh on an average per month instead of 80000 per month.

| Card | Spend Milestone | Reward | Reward Rate | Total Reward Rate (with 3.33% Base reward rate) |

| Diners Club Black Metal Edition | 4 lakh spends in a calendar quarter | 10000 Reward points | 2.5% | 5.8% |

| Diners Club Black | 80000 spends in a calendar month | Any 2 options among 1. Rs. 500 BMS voucher 2. Rs. 500 Ola voucher 3. Rs. 500 TataCliq voucher 4. 1 month membership ofcult.fit Live | 1.25% | 4.58% |

Reward Redemption

There are several options for redeeming the rewards on this card and the value you get is simply fantastic. One cannot go wrong with any of the options (except for statement balance redemption). Let’s have a look at all the options –

| Redemption Type | Value | Limit (per calendar month) |

| Flights and hotel bookings | 1 RP = Rs. 1 | 75000 RPs. The redemption of RPs will be capped at 70% of the total value. The remaining amount must be paid using credit card. |

| Air Miles conversion | 1 RP = 1 air mile | 75000 RPs |

| Products & Vouchers | 1 RP = upto 50p 1 RP = Rs. 1 for Apple products and Tanishq vouchers | For some Products & Vouchers (like Apple, Tanishq), the redemption of RPs will be capped at 70% of the total value. The remaining amount must be paid using credit card. Redemption for Tanishq vouchers capped at 50000 points per calendar month |

| Redemption against statement balance | 1 RP = 30p | 50000 RPs |

Anyone who is familiar with Air Miles game can even get value as high as Rs. 2 per point as the point redemption rates of flights tickets are dynamic and booking during off-season time could make a lot of difference.

Welcome Benefits

As pointed out earlier, there are a few differences between these two cards when it comes to Welcome & Renewal benefits. We all know that Amazon Prime & Swiggy One memberships are really useful and a great benefit to have. Club Marriott membership is also a valuable benefit which I have detailed in the nexts section.

- For Metal edition card, all these memberships are activated only for 1st year on spending Rs. 1.5 lakh within first 90 days of card issuance

- For Plastic edition card, all these memberships are activated on spending Rs. 1.5 lakh within first 90 days of card issuance or joining fee realisation. Memberships are renewed every year if spends are more than 8 lakh

| Membership | Metal Edition (only for 1st year) | Plastic Edition |

| Amazon Prime | Annual membership worth 1499 | Annual membership worth 1499 |

| Swiggy One | Annual membership worth 1199 | 3 month membership worth 299 |

| Club Marriott | Annual membership worth >10000 | Annual membership worth >10000 |

| MMT Black | N/A | Annual membership (not useful) |

| Forbes | N/A | Annual membership |

For the process to track/activate the memberships check here – Metal Edition, Plastic Edition.

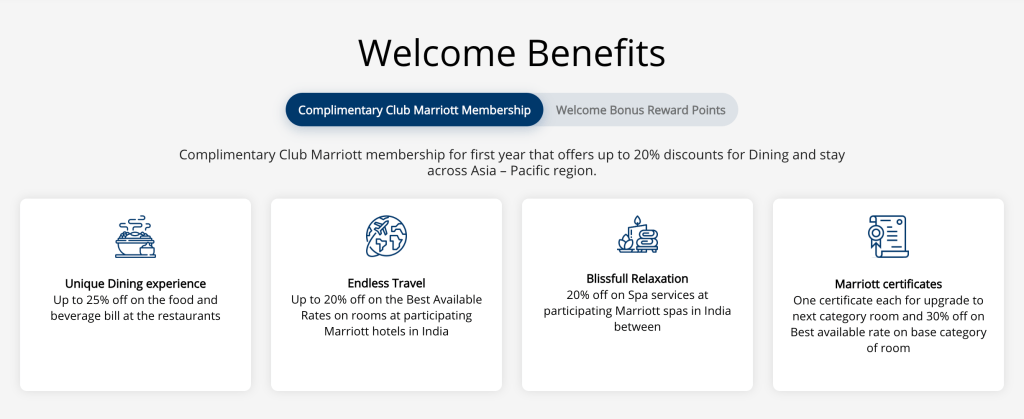

Club Marriott Membership

Only for the first year of card membership, complimentary Club Marriott membership is offered through which various benefits can be availed at Marriott properties in Asia-Pacific region.

As you can see below, you get discounts on dining, spa, discounted booking rates and room upgrade voucher certificates in this membership which could be worth more than 10000. Even if we ignore the discounts on dining & spa services for a moment and consider just the one-class room upgrade certificate, I would say this membership is worth 5000 at the least. On my visit to one of the Marriott properties, I had got a room upgrade which was worth 7000.

The details and process of activating the membership is covered here.

Travel Benefits

Airport Lounge Access

This card (metal & non-metal editon both) offers unlimited lounge visits and the good thing is you don’t have to get a priority pass and just use the credit card itself to visit any lounge anywhere in the world courtesy of Diners Club.

Even the supplementary card holders get unlimited lounge visits so simply get add-on cards for your family and rest assured to get lounge access whether travelling alone or with family anywhere in the entire world 🙂 This is an outstanding advantage of this credit card.

| ACCESS TYPE | Via | Limit |

|---|---|---|

| Domestic (primary & supplementary) | Diners Club | Unlimited |

| International (primary & supplementary) | Diners Club | Unlimited |

List of domestic lounge can be checked here and international lounge list can be found here.

Other Misc Benefits

Golf Games

In a year, one can get a total of 24 golf games from this card (metal & non-metal edition both) which is a pretty good value for a golf-lover.

| ACCESS TYPE | Via | Limit |

|---|---|---|

| Golf games or Golf lessons | Thriwe | 6 per quarter |

The list of domestic golf courses that you can access is here and international golf courses list is here. Detailed terms and conditions for booking and cancellation can be found here.

One would have to call the concierge @ 1800 118 887 | 022 42320226 or email @ dinersblack.support@smartbuyoffers.co to make bookings.

Dining Benefits

On all the HDFC cards, you can get 5% – 15% discount on dining bills when you pay through Swiggy Dineout. For some reason HDFC has named it ‘Good Food Trail program’.

With HDFC Diners Club Black Metal Edition card (& non metal Edition as well), you get additional 10% discount up to Rs. 500 on top of 10% Swiggy Dineout discount. This offer is applicable twice a month on a min. transaction value of Rs. 2500 post applying the Swiggy Dineout discount.

Assuming a dining bill of Rs. 2800, based on below calculation, you get a 19% discount 🙂 Also, you will get reward points too as per the base rate (3.3%) which means almost ~22% cost savings.

| Offer | Discount Rate | Discount | Effective Bill |

| Swiggy Dineout discount | 10% | 280 | 2800 – 280 = 2520 |

| HDFC Diners Club card discount | 10% | 252 | 2520 – 252 = 2268 |

| Total Effective Discount | 19% | 532 | 2268 |

Just in case above offer doesn’t work, as a Plan B, you can save a little by using the standard feature of this card which is 2X points earn rate (i.e. 10 Reward points per Rs. 150 spend) for any weekend (Sat & Sun) dining spends at standalone restaurants capped at 1000 reward points per day. This is applicable only when the bill is paid directly at the restaurant and not through the apps like Swiggy Dineout or Zomato.

Insurance benefits

This card (metal & non-metal edition both) comes with insurance benefits too. This is a good to have benefit and gives peace of mind.

- Accidental air death cover worth Rs. 2 cr

- Emergency overseas hospitalization cover up to Rs. 50 lakhs

- Credit Liability cover up to Rs. 9 lakhs

- Travel Insurance Cover of up to Rs. 55K on baggage delay beyond 8 hours for international flight (Capped to $10/hour)

You need to register a nominee here. Detailed terms & conditions and claim process for the insurance can be found here.

Concierge Service

Infinia & Diners Club Black card have the same concierge team. With Diners Club Black card (metal & non-metal edition both) you get premium 24*7 concierge service for assistance regarding travel bookings, dining reservations, booking golf games, planning itineraries etc. You can call @ 1800 118 887 | 022 42320226 or email @ dinersblack.support@smartbuyoffers.co

Below are some of the services provided by our concierge with full scope covered here

- Golf Booking

- Itinerary and reservation assistance

- Private dining assistance

- International gift delivery

- Event planning and referrals

- Airport VIP service (meet-and-greet)

Best way to use this card

- Use Smartbuy portal for travel bookings or voucher purchases for 16%-33% savings

- Pay dining bills on Swiggy Dineout and get ~22% discount

- Utilize this card for all expenses on foreign trips and save 2%

- Avail unlimited lounge benefits

- Book Golf games or get concierge team to make reservations & bookings

How to apply

Existing HDFC Bank Credit Card holders can also apply for a 2nd HDFC credit card. You can get this card if you meet below criteria –

- For Salaried: Net Monthly Income > Rs 1.75 lakhs per month

- For Self-employed: ITR > 21 lakhs per annum

You can apply for this card from HDFC bank’s website.

Verdict

HDFC Diners Club Black Metal Edition card is a solid card and gives lot of value. The base reward rate is very good, rewards on Smartbuy portal spends using this card are just amazing, lounge access perk is simply superb. And then there are other misc. benefits like complimentary memberships, dining offers, concierge services etc.

There is hardly anything wrong with this card but there is just one issue which is the low acceptance of Diners Club cards in India and in some foreign countries too so you need to always have a backup card of Mastercard or Visa.

If for some reason you can’t get this card but still want something in the HDFC world, then you can opt for HDFC Regalia Gold credit card which also launched in 2023.

If you want a great credit card with overall great value, good travel benefits and versatile reward redemption options you can look at Amex Plat Travel credit card (Apply Now). Within Amex world, a good starting point would be to go for Amex MRCC credit card (Apply Now) or if you need a super-premium credit card from Amex then have a look at Amex Plat charge card (Apply Now)

What are your thoughts about the HDFC Diners Club Black Metal Edition Credit Card? Feel free to share your views in the comment section below.