If you have a HDFC bank credit card (or Debit card for that matter), you would have heard about SmartBuy and would be familiar to an extent about how it can help to earn rewards points at an accelerated rate. In case you haven’t, then brace yourself and continue reading to find out several ways in which SmartBuy can help you save a lot on all sorts of spends like flight ticket booking, purchasing gift vouchers or buying that shiny new iPhone online :).

Let’s look at how SmartBuy works and how you can use it to boost the reward rate of your HDFC card.

- What is SmartBuy?

- Accelerated Points Earn rate on SmartBuy

- Capping on reward points & cashback

- Savings through SmartBuy

- Points Redemption on SmartBuy

- Bottomline

What is SmartBuy?

SmartBuy is HDFC bank’s in house portal which you can use to book flights, bus or train tickets, do hotel reservations, purchase gift vouchers of various brands and shop on preferred merchants while earning reward points (or cashback) at a higher rate than the cards base earn rate. Higher the card in the hierarchy of HDFC card’s portfolio, higher the bonus rewards will be.

You can also redeem reward points via SmartBuy portal for travel bookings, purchase gift vouchers or redeem for cash.

Accelerated Points Earn rate on SmartBuy

When you shop through SmartBuy, you earn bonus reward points or cashback. The bonus points or cashback will vary depending on which category of spend you are doing.

For super premium credit cards like HDFC Infinia, HDFC Diners Club Black and premium credit cards like HDFC Diners Club Privilege, HDFC Regalia Gold or HDFC Regalia the accelerated earn rate can be as high as 10X (i.e. 10 times of base earn rate). For any other HDFC credit card (except for HDFC Tata Neu credit card) and Debit cards, you get additional cashback of 5% or 10%.

| Category | Infinia Metal & Infinia card (Reward points) | Diners Club Black Metal & Diners Black Card (Reward Points) | Diners Club Privilege & Regalia cards (Reward Points) | Other HDFC Bank credit Cards & all Debit cards (CashBack) | PayZapp Wallet used on PayZapp Shop (Cashpoint) | Debit Card used on PayZapp Shop (Cashpoint) |

| IGP.com | 10X | 10X | 10X | 10% | 10% | 10% |

| Flights (Cleartrip, EaseMyTrip, Yatra & Goibibo) | 5X | 5X | 5X | 5% | 5% | 3% |

| Hotels (Cleartrip, MMT, Yatra) | 10X | 10X | 10X | 5% | 5% | 5% |

| Train (IRCTC) | 3X | 3X | 3X | 5% | 5% | 5% |

| Bus (RedBus) | 5X | 5X | 5X | 5% | 5% | 3% |

| Instant Vouchers (Gyftr) | 5X | 3X | 5X | 5% | 5% | 3% |

| Apple Imagine Tresor | 5X | 3X | 5X | 5% | 5% | 5% |

| Flipkart | 3X | 2X | 3X | 1% | 1% | N/A |

| Zoom Car | 5x | 5x | 5x | 5% | 5% | N/A |

| Nykaa | 5x | 5x | 5x | 5% | 5% | N/A |

| Jockey | 10x | 10x | 10x | 10% | 10% | N/A |

All the detailed rules are available here for reference but the main points you should know are-

- Reward points or cashback is posted in 90 working days from the last date of transaction month.

- Reward points or cashback for credit card is posted on card account.

- For Debit Card transaction done through SmartBuy, cashback is posted as cashback points on card account which can be redeemed via Net Banking.

- For Debit Card transaction done through PayZapp Shop, cashpoints (PayZapp currency; 1 Cashpoint = Rs. 1) will be credited on PayZapp Wallet on immediate basis.

- For PayZapp wallet transactions done through PayZapp Shop, cashpoints (PayZapp currency; 1 Cashpoint = Rs. 1) will be credited on PayZapp Wallet on immediate basis.

You can ignore the fancy terms like cashpoints or cashback points and instead just think of these simply as cashback that you get. 1 cashpoint or cashback point is equivalent to Rs. 1.

For HDFC Tata Neu credit card, you will get additional NeuCoins (Tata Neu app currency) on SmartBuy spends as per below-

| Category | HDFC Tata Neu Plus card | HDFC Tata Neu Infinity card |

| IGP.com | 4% | 6% |

| Flights (Cleartrip, EaseMyTrip, Yatra & Goibibo) | 1% | 1.50% |

| Hotels (Cleartrip, MMT, Yatra) | 4% | 6% |

| Train (IRCTC) | 1% | 1.50% |

| Bus (RedBus) | 1% | 1.50% |

| Instant Vouchers (Gyftr) | 1% | 1.50% |

| Apple Imagine Tresor | 1% | 1.50% |

| Flipkart | 1% | 1.50% |

NeuCoins are posted within 90 working days from the last date of transaction month in card account and transferred to the Tata Neu account for redemption within 7 working days of subsequent statement generation.

Capping on reward points & cashback

Based on whether you use credit card or debit card or PayZapp wallet, the capping for the points or cashback you can get will vary. Only for Diners Black, Diners privilege & Regalia cards there is daily capping as well. For rest, there is just a monthly capping which is less restrictive and a big advantage.

| Source of Payment | Max. cap per calendar month | Max. cap per day |

| Infinia credit card (Reward Points) | 15000 | N/A |

| Diners Club Black Metal Edition credit card (Reward Points) | 10000 | N/A |

| Diners Club Black credit card (Reward Points) | 7500 | 2500 |

| Diners Club Privilege and Regalia credit cards (Reward Points) | 4000 | 2000 |

| Other Credit Cards (Cashback) | 1000 | N/A |

| Debit Cards (Cashback) | 1000 | N/A |

| PayZapp Wallet (Cashback) | 1000 | N/A |

| Tata Neu HDFC cards (Neu Coins) | 1000 | N/A |

Savings through SmartBuy

If you have a non-premium credit card (or a Debit card or PayZapp Wallet) the cashback benefit you get from using SmartBuy is not exciting at all as the capping is very low. To put that in context, assume you booked a hotel room for Rs. 15000 & a train ticket for Rs. 10000 which are a 5% category spend, then you get a cashback of just Rs. 1000.

| Spend | Amount | Cashback (at 5% rate) |

| Hotel | 15000 | 750 |

| Train Ticket | 10000 | 250 (instead of 500 due to capping) |

| Total | 25000 | 1000 |

For such low reward rate, it is not worth to go through additional steps as saving additional 1000 per month is hardly going to make an impact. Only if you have a premium or higher category credit card, you should use SmartBuy for actual meaningful savings which we can get a better understanding of from below analysis.

| Credit Card | Value/point | Points (per 150 spent) & Reward Rate on 1X category | Points (per 150 spent) & Reward Rate on 10X category (Hotel) | Points (per 150 spent) & Reward Rate on 5X category (Flights, Bus) | Points (per 150 spent) & Reward Rate on 3X category (Train) | Points cap on SmartBuy spends | Max. Savings per month |

| Infinia credit cards (Reward Points) | Rs. 1 | 5 (3.3%) | 50 (33.33%) | 25 (16.66%) | 15 (10%) | 15000 per month | 15000 @ Value/point = Rs. 1 |

| Diners Club Black Metal credit card (Reward Points) | Rs. 1 | 5 (3.3%) | 50 (33.33%) | 25 (16.66%) | 15 (10%) | 10000 per month | 10000 @ Value/point = Rs. 1 |

| Diners Club Black credit card (Reward Points) | Rs. 1 | 5 (3.3%) | 50 (33.33%) | 25 (16.66%) | 15 (10%) | 7500 per month, 2500 per day | 7500 @ Value/point = Rs. 1 |

| Diners Club Privilege and Regalia credit cards (Reward Points) | 50p | 4 (1.33%) | 40 (13.33%) | 20 (6.65%) | 12 (4%) | 4000 per month, 2000 per day | 2000 @ Value/point = 50p |

As evident from above table, you can save a whopping 33% on hotels if you have Infinia or Diners Club Black Metal card and max. monthly saving can be up to 15000!! With Regalia cards, the savings would be not much but still it is double of what we get from rest of the non-premium credit cards.

Gift vouchers bought on SmartBuy give a ~16% reward rate (10% with Diners Club Black). There is a long list of brands available like Amazon, Flipkart, Croma, Tata Cliq, BigBasket, Blinkit, Swiggy, Zomato, Ola, etc. However, for some brands like Amazon, you would have to pay a processing fee of up to 2.5% which lowers the effective reward rate.

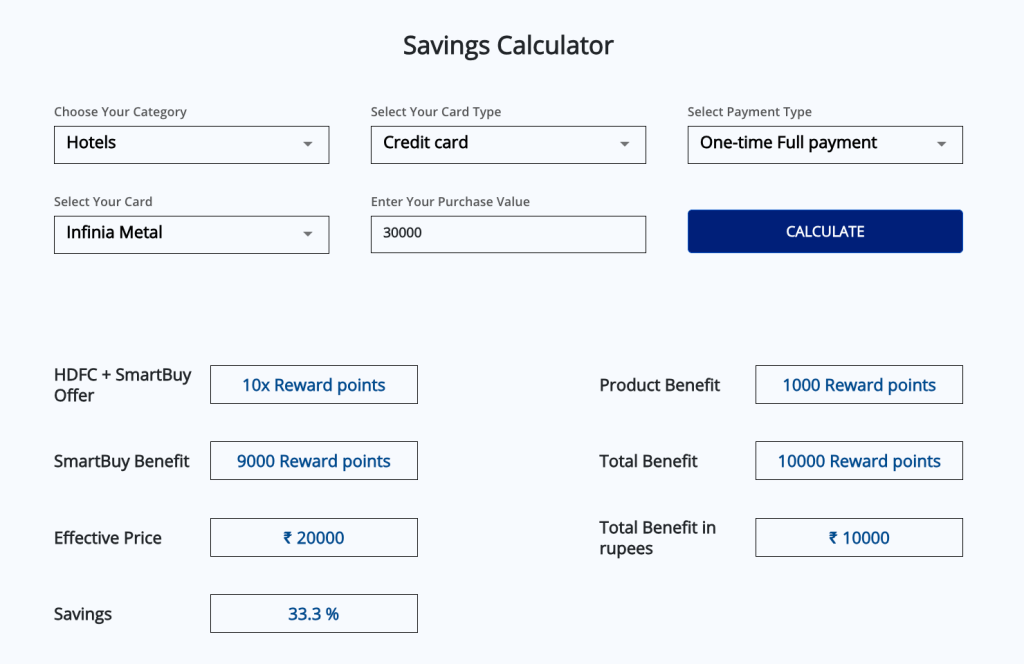

There is a cool calculator as well that you can use to find out exact savings on your card.

Points Redemption on SmartBuy

There are lot of good options to redeem the reward points on SmartBuy portal and the value per point will vary from 20p – Rs 1 based on your card and redemption category.

| Redemption Category | Infinia Metal & Infinia card (Reward points) | Diners Club Black Metal & Diners Black Card (Reward Points) | Diners Club Privilege & Regalia card (Reward Points) | Regalia Gold card |

| Flights and hotel bookings | 1 RP = Rs. 1 | 1 RP = Rs. 1 | 1 RP = 50p | 1 RP = 50p |

| Air Miles conversion | 1 RP = 1 air mile | 1 RP = 1 air mile | 1 RP = upto 0.5 airmiles | 1 RP = upto 0.5 airmiles |

| Gold Collection Catalogue (products from Apple, Bose, Samsung, etc.) | N/A | N/A | N/A | 1 RP = 65p (no redemption limit) |

| Products & Vouchers | 1 RP = upto 50p; 1 RP = Rs. 1 for Apple products and Tanishq vouchers | 1 RP = upto 50p; 1 RP = Rs. 1 for Apple products and Tanishq vouchers | 1 RP = upto 35p | 1 RP = upto 35p |

| Redemption against statement balance (redemption limit is 50000 per calendar month for all cards) | 1 RP = 30p | 1 RP = 20p | 1 RP = 20p | 1 RP = 20p |

| Redemption limits (per calendar month) | 150000 RPs | 75000 RPs | 50000 RPs | 50000 RPs |

There are custom SmartBuy pages for each of the above credit cards where you can go to for redeeming points.

You can also use Netbanking portal for points redemption as well but Travel bookings redemptions are only supported on SmartBuy. Also avoid Netbanking portal for voucher redemption as you get lesser value there as compared to what you get on SmartBuy.

| Redemption Category | SmartBuy | NetBanking |

| Flights and hotel bookings | Yes | No |

| Air Miles (Frequent Flyer Registration & conversion) | Yes | Yes |

| Gold Collection Catalogue (products from Apple, Bose, Samsung, etc.) | Yes | No |

| Products & Vouchers | Yes | Yes |

| Redemption against statement balance | Yes | Yes |

Flight & Hotel Bookings

This is the best option when it comes to redeeming the points as this gives you the max. value with all the cards (except for Regalia Gold for which you get 65p value with Gold collection). The points can be redeemed instantly for up to 70% of the total fare with remaining 30% to be paid by card.

Although this restriction of 70:30 is a little disappointing what’s good is that you will get 10X reward points for the 30% that you pay by card.

This redemption portal uses Cleartrip booking engine. Usually hotel or flight availability wouldn’t be a problem but for hotels the search results might be limited. Also, Air Asia might be missing on the portal but Concierge can book it for you from backend.

Air Miles Transfer

Rather than booking flights using points, you can also transfer points to various Travel partners and then redeem it as per the Loyalty program of that respective airline. HDFC has added quite a few partners in 2023 after this miles transfer game got heated up due to the lead taken by Amex, Citi and Axis.

Apart from above set of options, the older partners AirVistara (Club Vistara) & Singapore Airlines are there too for which you would have to use Netbanking portal as these are not on SmartBuy yet.

Air Vistara: Club Vistara

- Transfer Ratio: 1:1 (Infinia & Diners Club Black)

- Transfer Ratio: 2:1 (Diners Club Privilege, Regalia)

- Validity: 3 Yrs from transferred date

- Usually takes ~3 business days to transfer

If you fly Vistara often, transferring points to Club Vistara and redeeming them for flights makes a lot of sense as you could extract more value on business class, busy routes and during last minute bookings.

You can possibly get a value of 75p to Rs.1 per CV Point for most business class redemptions. Taxes need to paid separately for any CV points redemption while booking tickets.

Singapore Airlines krisflyer

- Transfer Ratio: 1:1 (Infinia & Diners Club Black)

- Transfer Ratio: 2:1 (Diners Club Privilege, Regalia)

- Validity: 3 Yrs from transferred month

- Usually takes ~3 business days to transfer

For international travel, Singapore Airlines is one of the best option and you can extract expect a value of Rs. 1 per point for most business class redemptions.

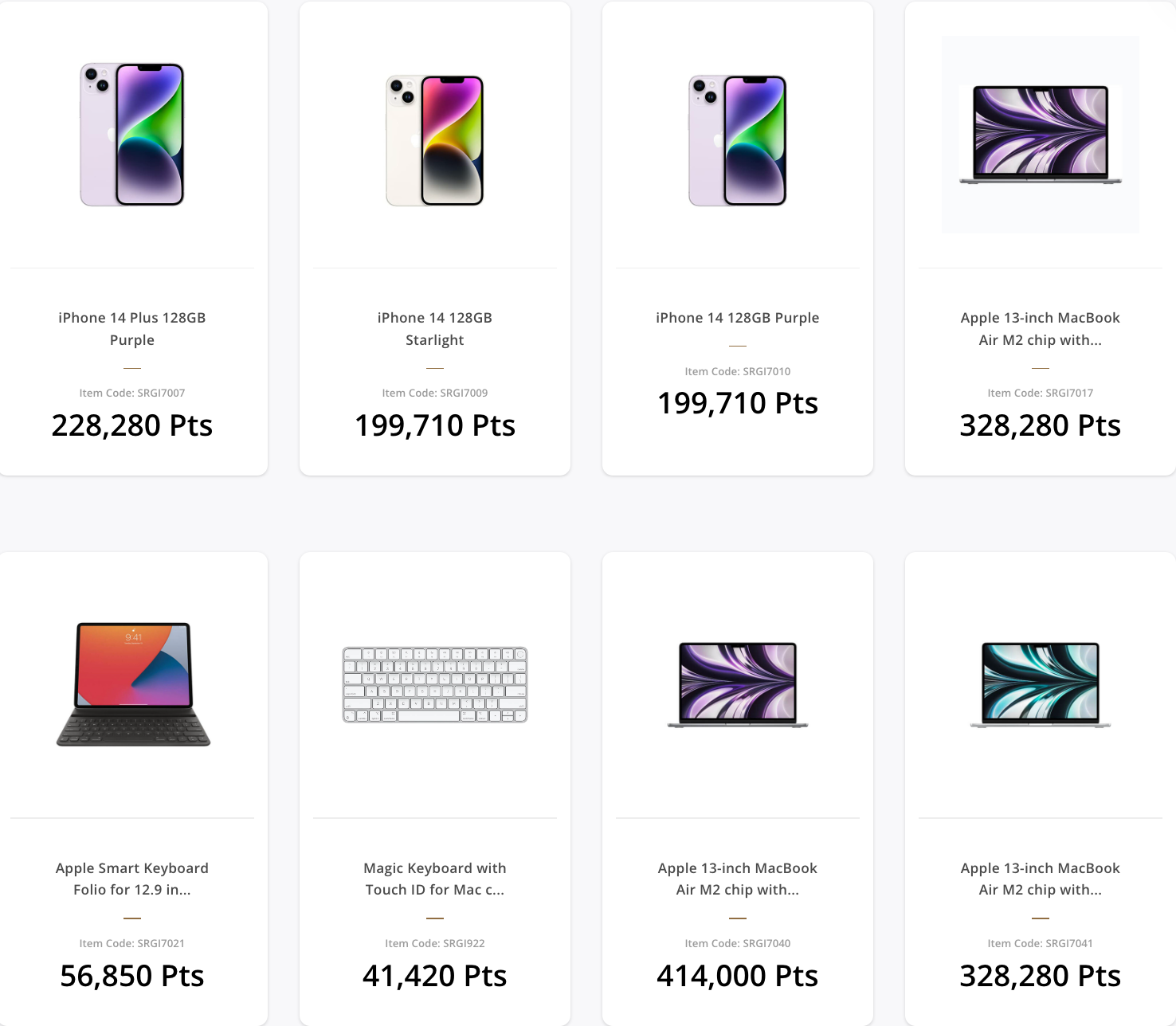

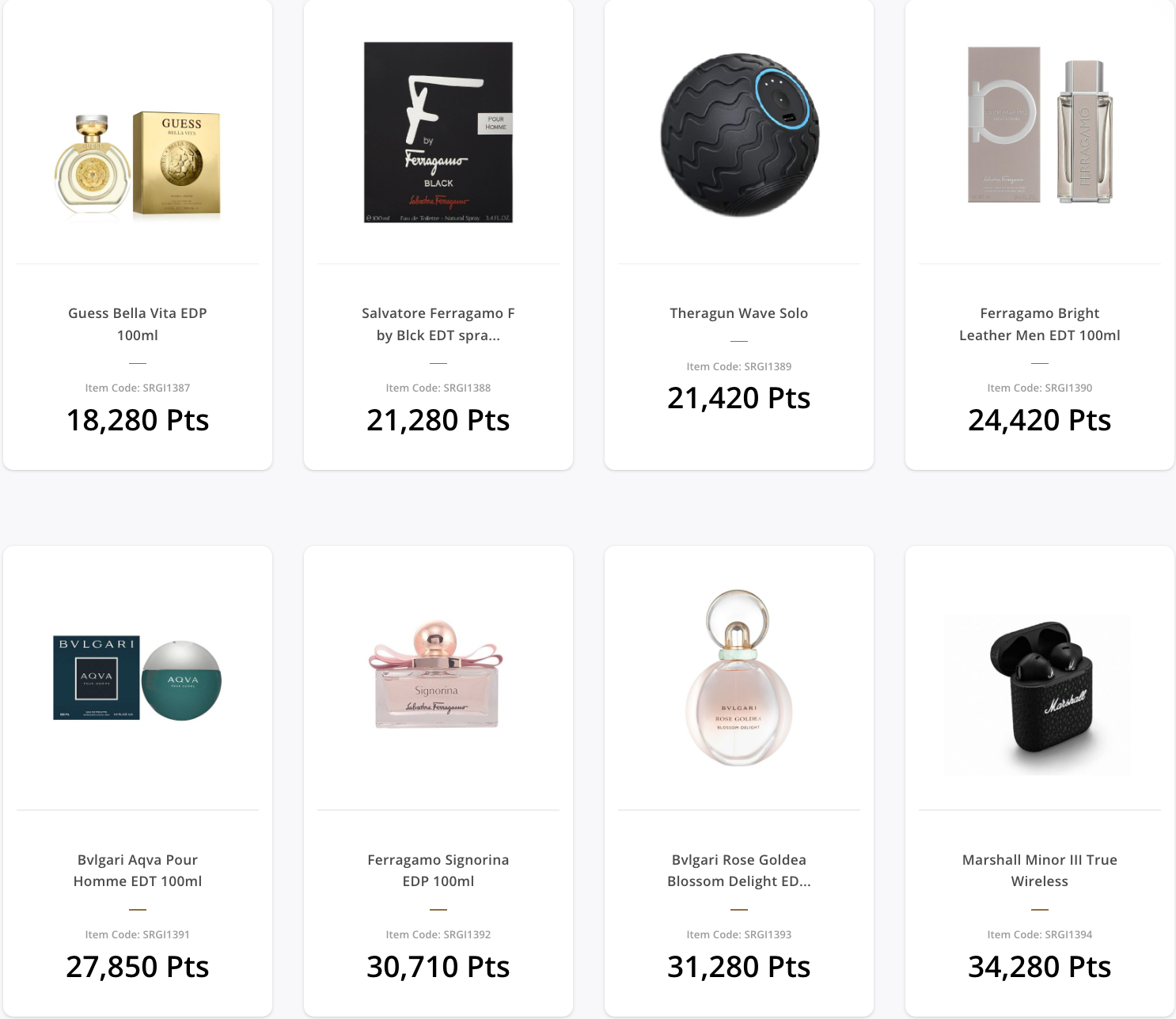

Products

There is a catalogue for all sorts of products (premium fragrances, electronics, appliances, etc.) that you can have a look at. You can also get Apple products from your points. For some of the products, redemption might be capped at 70% of the total value with rest 30% to be paid by card.

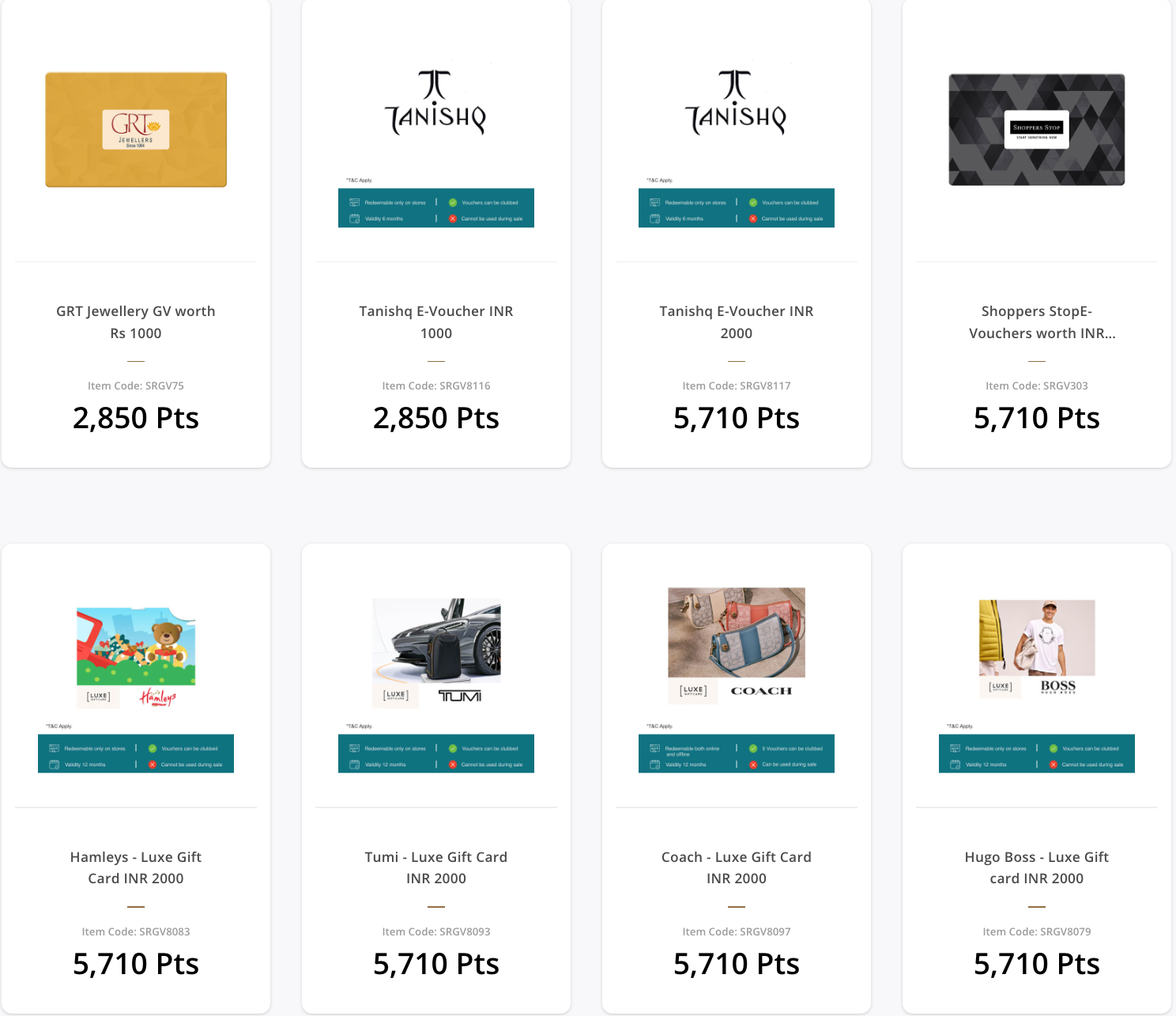

Instant Vouchers

Instead of products, what’s better is to simply redeem the points for vouchers. I always go for Amazon vouchers which is as good as cash but if you don’t want that for some reason, you can opt for Shoppers Stop, Tanishq, Reliance, Hamleys etc. or Luxury vouchers of brands like Coach, Steve Madden, Armani and more. You can get a value of 35p to 50p under this option. Voucher gets delivered within 5 business days.

Statement Balance Redemption

As you can redeem the points for Amazon vouchers which is as good as cash, you should avoid redeeming points for statement balance which gives you the least value from 20p to 30p.

Bottomline

SmartBuy portal is of great value to someone who has a super premium or premium credit card of HDFC bank. Even with semi-premium credit cards, you can get some benefit which will make you appreciate this option. You can read the detailed review of these credit cards from the link below-

- HDFC Regalia credit card

- HDFC Regalia Gold credit card

- HDFC Infinia Metal Edition credit card

- HDFC Diners Club Black Metal credit card

If you are in Amex world and then you can read about Amex Reward Multiplier Guide which is American Express version of SmartBuy. If you want an Amex card and take advantage of Reward Multiplier then you can opt for Amex Membership Rewards Credit Card which is being issued as Free for 1st year for a limited period OR if you need a card with more features like lounge access & travel benefits then try the Amex Platinum Travel credit card which you can get for free for first year by applying through this link. OR if you want to get 5X MR points you can opt for Amex Gold charge card (Apply now).

There is also Amex Plat charge card which is super-premium credit card and comes with several lifestyle benefits.

Have you used SmartBuy recently? Do you have any queries about SmartBuy? Feel free to share your views in the comment section below.