Axis Bank and ICICI Bank have enabled a new feature through which their customers can get a comprehensive view of their transactions across all bank accounts through the new account aggregator ecosystem. This will be a game-changer as many of us struggle with mamaging multiple bank accounts and keeping tabs on our expenses.

- Benefits of using Account Aggregator

- How it works?

- What about data accuracy?

- Can accounts be removed later?

- What about data security?

Benefits of using Account Aggregator

If by chance you have multiple bank accounts, you would know how frustrating it can be to track and monitor the balances & transaction across them. Logging into multiple apps or portals can be painstaking as well.

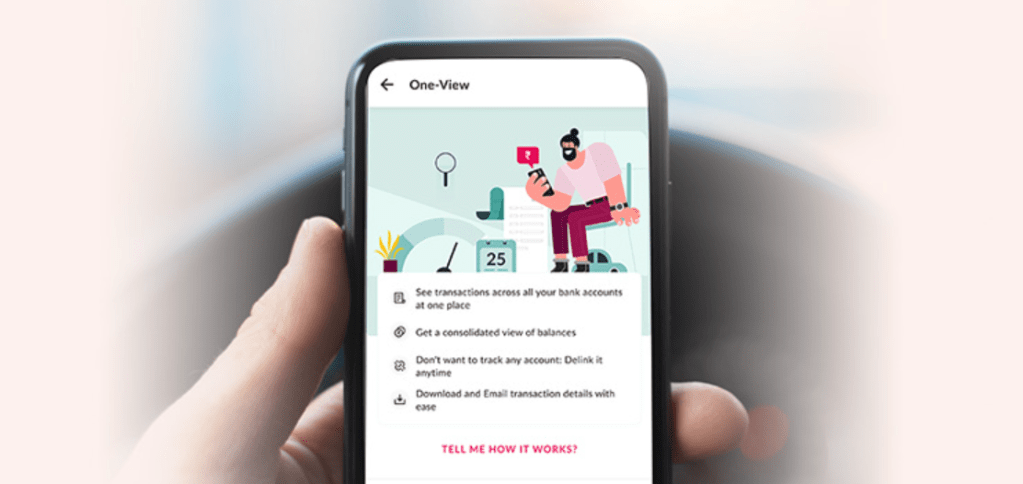

Using the single-view dashboards you can get single display account information across bank accounts, on their mobile apps and internet banking platforms. Axis Bank’s single-view dashboard is named one-view, while that of ICICI Bank is called iFinance.

From the single-view dashboard, you will be able to One can view bank balances, top spending and income categories, expense breakdowns, daily inflows, expenses, and balance analysis with this feature.

- Linking and viewing of all accounts: Users can securely link their savings and current accounts with all banks and view account balances at one place

- Summary of income and expenditure: The facility allows users to get insightful summary of their income and expenditure which helps them monitor their finances properly

- Track spending / payments: Users can track their spends and get category wise information of their expenses. This helps them in managing their expenses and overall financial health

- Complete user control: The facility also provides increased convenience as the users can link and de-link accounts on real-time basis

- Detailed statement(s): With this facility, you can also download consolidated account statement(s) of all linked Bank accounts

How it works?

All the data transfer is enabled by something called account aggregator ecosystem. It is a system of sharing financial data digitally in a secure manner. All the account aggregators need to be RBI approved so that they can facilitate the data sharing between financial service provides (Axis, ICICI, HDFC etc.) with the consent of the customer. You can enable the dashboard by following the process as mentioned below.

For ICICI

Existing customers of ICICI Bank have access to iFinance through its Internet banking portal and mobile applications. To initiate the process, log in to your ICICI Bank net banking or mobile application. Choose iFinance and do a mobile OTP verification. The OTP is sent by Setu, a Reserve Bank of India-regulated account aggregator.

Then choose the bank accounts you want to link. Verify the accounts via OTP and track your bank accounts using the iFinance feature.

For Axis

To link your accounts on Axis Bank’s mobile application with the one-view feature, the process remains the same. Here, the OTP for mobile verification is sent by Finvu, another RBI-regulated account aggregator.

If you are Axis bank customers do not have to pay a fee to use the account aggregator-enabled features.

What about data accuracy?

The accuracy of the data displayed depends on the accuracy of the information shared by other banks. The banks rely on the data provided by the financial information providers (FIPs) and do not alter or modify it in any way.

Can accounts be removed later?

Anyone can easily remove an account just by following the process laid out by Axis and ICICI on their app or net banking portal and revoke the consent using the link provided.

If you want to re-link the delinked accounts at any time, same process will have to be followed as mentioned above.

What about data security?

Data is received through RBI approved Account aggregator through a secured channel. All the Account Aggregators are data blind and cannot access the data. When the account owner provides the consent then only the respective bank can start sharing the data with the aggregator.

Also, the consent is time bound which means it is taken for a specific time period and has to be renewed post expiry.

All your data will be visible only after logging into the secure channels of Axis Bank and ICICI Bank or any such service provider.

Have you used this new feature? Feel free to share your views in the comment section below.